New Bitcoin Mining - Miner One ICO

In addition to Ice Rock Mining, there is another promising Mining ICO from Miner One . Miner One plans to build several mining facilities in Sweden near Luleå.

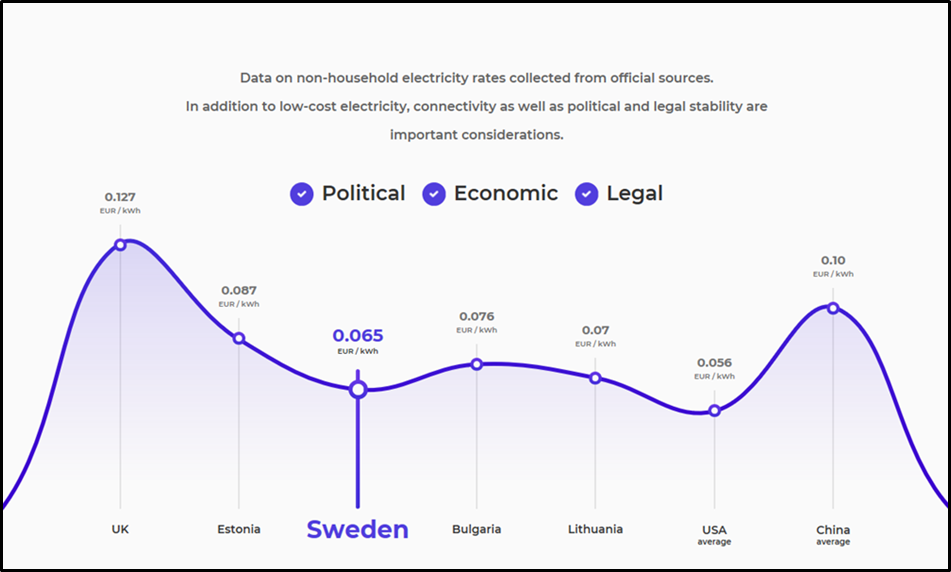

As important subject to survive in the competitive mining market, Miner One has selected the situation in northern Scandinavia based on the following factors:

- Low electricity costs with only 0.065 € / KWh. In european and international comparison, this price is almost at the top.

- Large amount of available energy and 100% renewable as Miner One uses hydropower for mining. This is especially necessary in order to expand in the future.

- The natural climate in northern Sweden is cool, which saves high cooling costs of the mininers.

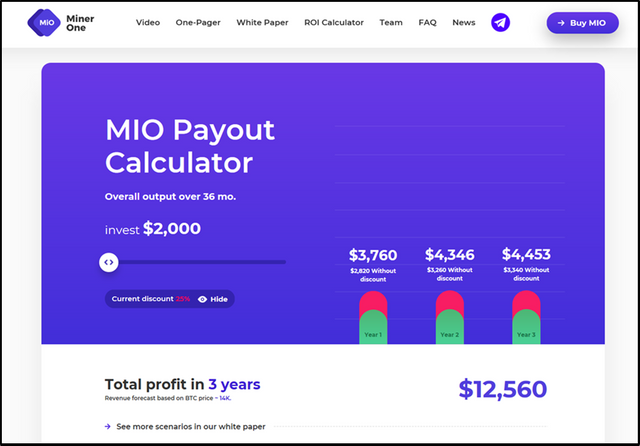

Official calculations for the annual profit were made by Miner One at a BTC price of $ 14,000 and difficulty in January 2018. According to these calculations, there would be a profit of 160% a year.

But since the price of Bitcoin has dropped and difficulty has risen, it would probably estimate a profit of 80% at current conditions - still very good.

According to Miner One, if the Bitcoin price drops to $ 1,500 - $ 2,000 profits still would reach 10% per year. At this value, Hashflare will have been shut down for a long time (Hashflare would not be profitable at a BTC price of $ 7,500).

In this ICO available Miner One MIO tokens, will work just like the Ice Rock Mining ROCK2 tokens:

If mining at Miner One begins at the end of Q2 2018, MIO tokens will be used to get mining returns:

The "Smart Contracts" developed by Miners One automatically detect how many MIO tokens are on your Ethereum address and then the mining revenue will be send to your address, depending on how many tokens you have at this address. It is paid in Ethereum.

By this percentage profits should be split from the current mining earnings:

Of all the Bitcoins mined, Miner One deducts 5% for equipment maintenance and repair. The remaining bitcoins are distributed as follows:

77% payout to customers

23% reinvestment in new miners

The further corporate financing is achieved by holding token in Miner One’s hands. 18% of all MIO token are hold by Miner One, so they will get profits from mining too. The remaining 82 percent will be offered for sale in the ICO.

Caused by its good conditions and size-based corporate structure, Miner One has a great potential to replace the established mining-companies, like Hashflare or Genesis Mining.

Miner One does not offer contracts like Hashflare, but tokens to participate in the mining, what is Miner One's special and decisive advantage compared to Hashflare.

At companies like Hashflare, you buy a contract (which is also limited to 1 (!!) year) and then it takes a few months to get your invested money back (ROI, return of invest). Only after this ROI you make profit at all. And since many providers (like Hashflare) limit their contracts in time, it could be, that you end up paying because the ROI was over the contract period. If the contract expires, you only have the mining revenue.

At Miner One you get a token to participate in the mining, mining profits are paid out to ETH addresses holding your own MIO tokens. You always own these tokens by yourself, which you can sell at any time and make a profit. It's like a mining contract that you can resell in future.

The reinvestment of 23% in new assets will also increase the revenue per MIO token over time, so that the value of these tokens should increase steadily - so you benefit twice.

Conclusion: Miner One has two components:

- MIO tokens having a rising value

- Mining revenues, which also tend to rise

At current cloud-miners you get finally nothing back from the initial investment in the contract and hold only the mining revenues.

At Miner One, the contracts are the tokens, which have an available value and can be resold.

If this system gets famous, the established contract cloudminers, which initially be paid for every contract and customers get no value, can soon shut down.

Above all, I see disadvantages, too: Miner One is still being a company set up, so they need an ICO, from which the project is financed. While there is much progress, mining is will start in June / July.

| Financials | Details |

|---|---|

| Token | MIO |

| Price | 1 MIO = 0.001 ETH (ca. 1 USD) |

| Bonus | Mar 01 – Mar 15: 25% Bonus |

| " | Mar 16 – Mar 31: 20% Bonus |

| " | April 01 – April 20: 15% Bonus |

| " | April 21 – May 05: 10% Bonus |

| " | May 06 – May 14: 5% Bonus |

| Payments | ETH, BTC, LTC |

| Soft cap | 3.000.000 USD |

| Hard cap | 200.000.000 USD |

| Website | Miner One |

| Whitelist/KYC | KYC |

Tokens not sold in the ICO will be burned.

The following link will give you a 4% Bonus.

By using the following link you can get a 4% Bonus on all your payments, if you want to invest in this project:

It is also important that your ETH address stored in your account at Miner One is ERC-20 compatible and you have access to your private keys, I would use MyEtherWallet.

This is very important, so do not use an address from an exchange, otherwise your MIO tokens will not arrive and be lost. This is very important.

What do you think of this project?

If you are interested in more Mining-ICOs: here is my review about Ice ROCK Mining on steemit:

)

Interesting post! Here’s my post with 6 free Airdrops going on now for free Crypto!

https://steemit.com/airdrop/@la2410/7te2eq-here-s-6-new-airdrops-get-your-free-cryptocurrency-today

Thanks for using please come back daily and tell your followers

For future viewers: price of bitcoin at the moment of posting is 8287.10USD

Coins mentioned in post: