These four factors will boost gold demand in 2018 — WGC ??

Gold demand is set to jump this year thanks to government policies targeted at transparency and economic growth, the World Gold Council said Tuesday in its annual outlook report.

In particular, the industry body believes that gold will maintain its relevance as a strategic asset in 2018 thanks to four key trends — synchronised global economic growth, shrinking central bank balance sheets, rising interest rates, insubstantial asset prices and market transparency.

"Our research shows that continued economic growth underpins gold demand,” the WGC said. “As incomes rise, demand for gold jewellery and gold-containing technology, such as smart phones and tablets rises.”

Income growth also spurs savings, helping increase demand for gold bars and coins.

Monetary policy tightening in the countries including the US and Britain pushed up short-term bond yields across the board last year and, logically, the group expects that trend to continue favouring gold.

“In our view, the potential headwinds to gold may not be as strong as some think. Gold can help investors manage financial market risks,” it said

The council also expects China's economy to continue expanding, but the nature of growth is changing from investment-driven growth to a consumption-led model.

"This could affect the economic growth rate, but even if the Chinese economy grows at a slower rate than in the past, we see a more balanced model, aided by further global integration through its One Belt One Road initiative supporting a sustainable growth trajectory," it added.

Demonetization and tax implementation that shocked the market last year are now expected to boost gold consumption in India, where mandatory jewellery hallmarking will put an end to under-carating, the WGC said.

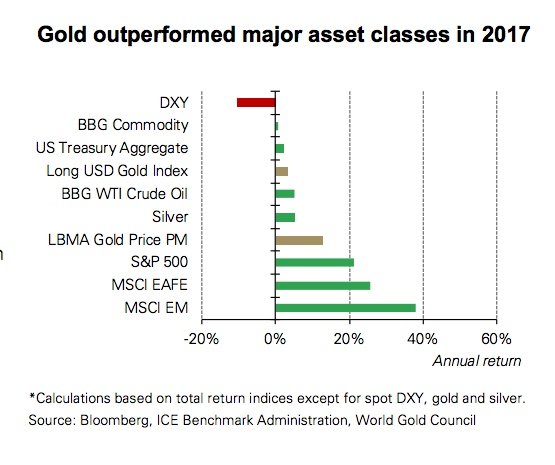

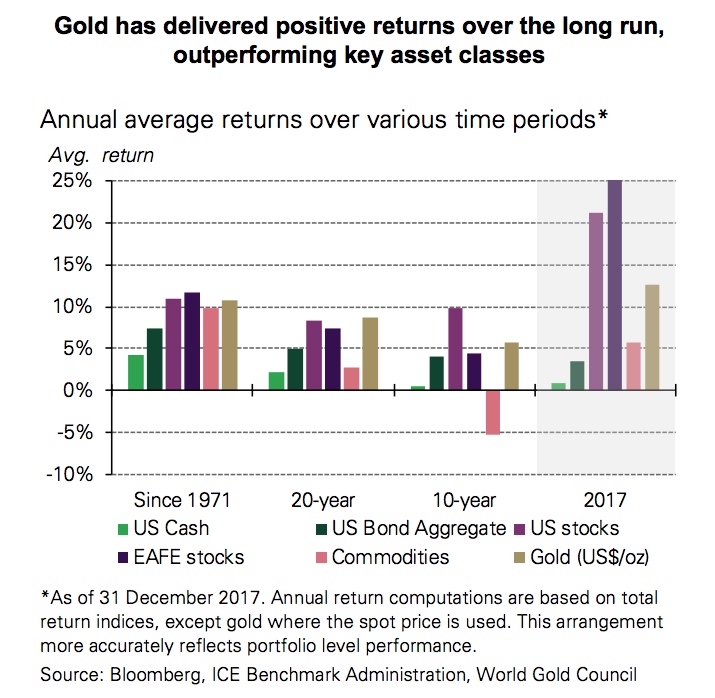

Finally, the report also spells out four reasons why investors should hold on to gold: “It has been a source of return for investors’ portfolios; its correlation to major asset classes has been low in both expansionary and recessionary periods; it is a mainstream asset that is as liquid as other financial securities; and it has historically improved portfolio risk-adjusted returns,” it concludes.

MINING.com