Increasing demand of Copper and perspective investment idea.

All major Mining companies, including copper producers, will continue to shape their investment decisions and production plans based on government regulations, which are increasingly becoming very focused on sustainability and community well-being, a study released Tuesday shows.

According to the report, commissioned by the International Copper Association (ICA), the increasing demand for efficient building systems and electrical equipment, electric vehicles and renewables generation, could add more than 4 million tones of annual copper use by 2030.

The study outlines five key regulatory trends copper miners should watch for in the next decade:

1.- The first tend is what MetalsPlus researcher Paul Dewison, who authored the study, qualifies as “resource conservation:”

Copper is fully recyclable and has a positive Life Cycle Analysis (LCA), which will make it fare better than competing materials in coming years, and will boost demand.

Governments have toughened up rules to ensure mining operations are environmentally and socially sustainable, the study says, citing as an example regulatory efforts in China, which led to a net increase in copper demand last year. “This was largely driven by efforts to lower the carbon footprint, which helps to create demand for efficient motors and transformers that use copper, as well as renewable technology and low carbon building components,” the study notes.

Resource conservation, says Dewison, will be shaped by sustainable resource policy and legislation, as reflected in the circular economy concept. This trend focuses on eliminating waste through better-designed and more efficient materials, products and systems.

“Regulations to date have largely focused on recycling at end of life through manufacturer obligations and disposal restrictions. Copper is fully recyclable and has a positive Life Cycle Analysis (LCA), which helps ensure that it will fare better than competing materials and see a positive impact on demand,” the report notes.

2.- Another trend to impact the copper market is what Dewison calls “carbon footprint/climate change:”

Global regulations have sought to tackle climate change by reducing energy use and carbon emissions, and by promoting clean electricity generation. According to the study this will positively impact copper due to its use in both efficient low emission equipment and renewables technology.

3.- The third regulatory trend involves the control of toxicity to human health and to the environment. This results in specific and constantly changing legislation regarding chemicals content in products and systems, in the supply chain and in the environment.

4.- The fourth issue, product integrity, refers to global and local standards that may boost copper demand as the metal ling lifecycle minimizes the need for replacements, reducing waste at the same time.

5.- Having a social license to operate (SOL) will perhaps become the most important aspect copper miners will have to pay attention to, as the concept goes beyond the scope of legal requirements and into acceptance by the wider community. “Industries can gain better access to key community resources like land, sales or capital. For copper, SLO management comes down to business integrity within social and environmental grounds, and the integrity of the entire supply chain from mining to recycling,” the report notes.

“We understand the importance that these regulations have on all industries, including copper,” said Colin Bennett, Market Analysis and Outreach, ICA. “In order to navigate the ever-changing relationship between government action and the marketplace, it is vital for us to understand how these trends will continue to evolve.”

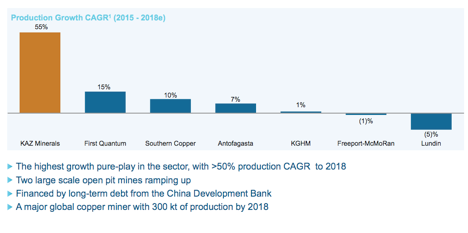

KAZ Minerals PLC stock is a great long term investment

KAZ Minerals PLC (“KAZ Minerals” or “the Group”) is a high growth copper company focused on

large scale, low cost, open pit mining in Kazakhstan. It operates three mines and three concentrators

in the East Region of Kazakhstan, the Bozymchak copper-gold mine in Kyrgyzstan, the Bozshakol

open pit copper mine in the Pavlodar region of Kazakhstan and the Aktogay open pit copper mine in

the East Region of Kazakhstan. In 2016, total copper cathode equivalent output was 140 kt with byproducts

of 75 kt of zinc in concentrate, 120 koz of gold bar equivalent and 3,103 koz of silver bar

equivalent.

The Group’s major growth projects at Bozshakol and Aktogay are expected to deliver one of the

highest growth rates in the industry and transform KAZ Minerals into a company dominated by world

class, open pit copper mines.

Bozshakol is a first quartile asset on the global cost curve and will have an annual ore processing

capacity of 30 million tonnes when fully ramped up, with a mine life of 40 years at a copper grade of

0.36%. The mine and processing facilities will produce 100 kt of copper cathode equivalent and 120

koz of gold in concentrate per year over the first 10 years of operations.

Aktogay is a large scale, open pit mine similar to Bozshakol, with a mine life of more than 50 years

and average copper grades of 0.37% (oxide) and 0.33% (sulphide). Aktogay commenced production

of copper cathode from oxide ore in December 2015 and copper in concentrate production from

sulphide ore commenced in February 2017. The sulphide concentrator will have an annual ore

processing capacity of 25 million tonnes when fully ramped up. Aktogay is competitively positioned

on the global cost curve and will produce an average of 90 kt of copper cathode equivalent from

sulphide ore and 15 kt of copper cathode from oxide ore per year over the first 10 years of operations.

KAZ Minerals is listed on the London Stock Exchange, the Kazakhstan Stock Exchange and the

Hong Kong Stock Exchange and employs around 13,000 people, principally in Kazakhstan.

Around half of global copper demand is from the electronics industry and roughly one quarter finds application in building and construction. The remainder find its way into industrial machinery, consumer products and – important in terms of growth potential – the vehicle market, specifically electric vehicles.

Vehicles with conventional internal combustion engines typically contain about 20 kilograms of copper. For electric vehicles, the copper load is up to 80 kilograms (and increased quantities of cobalt, nickel, manganese).

Bloomberg reports Ivan Glasenberg, CEO of Glencore, the world's third largest producer of copper, told investors at an industry meeting in Barcelona “the electric vehicle revolution is happening and its impact is likely to be felt faster than expected.”

Almost all carmakers are increasing investment in electric vehicles as governments adopt tighter emissions targets, he added.

In a recent report consultants McKinsey forecast that barring large-scale substitution by aluminum and other materials or a significant increase in recycling, primary copper demand could potentially grow to 31 million tones by 2035 as per capita usage rates in emerging markets, particularly in China, approach levels in developed economies. The prediction represents more than 40% growth from today's annual demand levels of around 22 million tones.

Congratulations @gold-rush! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!