One year of GST: Is Goods and Services Tax rollout successful? PM Modi explains in 5 points

One year of GST: India will celebrate the first anniversary of Goods and Services Tax rollout in the country on July 1.

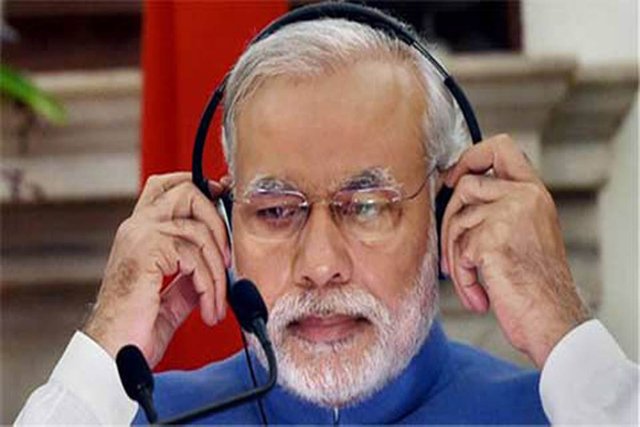

One year of GST: India will celebrate the first anniversary of Goods and Services Tax rollout in the country on July 1. As the historic, and one of the biggest, tax reform completes one year, Prime Minister Narendra Modi on Sunday talked about the reasons that led to the “success” of GST rollout and the changes that have been effected in the economy because of it. In his monthly radio address to the nation – Mann Ki Baat – on Sunday, PM Modi said, “My dear countrymen! It’s been an year when GST was implemented. ‘One Nation, One Tax’ was the dream of the people of this country that has become a reality today. If I’ve to give credit to anyone for successful implementation of ‘One Nation One Tax reform’, then I credit the states of our nation.”

Here are five points in which PM Modi explains the “success” of GST implementation in India:

- Great example of cooperative federalism

“GST is a great example of Cooperative federalism, where all the states decided to take a unanimous decision in the interest of the nation, and then such a huge tax reform could be implemented in the country. So far, there have been 27 meetings of the GST Council and we can all feel proud that people from different political ideologies have been involved in these meetings. These meetings involve representatives of different states; states which have different priorities, but in spite of all this, all the decisions that have been taken in the GST Council so far have been taken with absolute consensus. ”

- Celebration of honesty, victory of integrity

“Before the onset of GST scheme, there were 17 different types of taxes prevailing in the country, but now only one tax is applicable in the entire country. GST is not only the victory of integrity but it is also a celebration of honesty. Earlier, in the case of taxation and allied affairs in the country, there were rampant complaints of Inspector Raj.”

- “IT replaced the inspector”

“In the GST scheme,information technology has replaced the inspector. Everything from return to refund is done through online information technology.”

- Check posts gone, logistics benefit

“The check post has become extinct after the arrival of the GST scheme and the movement of goods has become faster, which not only saves time but is also accruing benefits in the area of logistics. GST is probably the biggest tax reform in the world.”

- Huge success result of enthusiasm of ‘honest’ people of the country

“The successful implementation of such a huge tax reform in India was successful only because the people of the country adopted it and through the power of the masses, fuelled the success of the GST scheme. It is generally believed that such a big tax reform, in a huge country like ours with such a large population takes 5 to 7 years for effective adoption. However within a year, the enthusiasm of the honest people of this nation, the celebration of integrity in the country and the participation of people resulted in this new tax system managing to create a space for itself, has achieved stability and according to the need, it will bring reform through its inbuilt arrangement. This is a huge success in itself which 125 crore Indians have earned for themselves.”

✅ @scorpianj50, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!