Leverage and margin trading

hello everyone

this is mehul today i would like to talk

about leverage and margin trading 2k18

before i start blog i would like to know you about

leverage and margin

what is leverage??

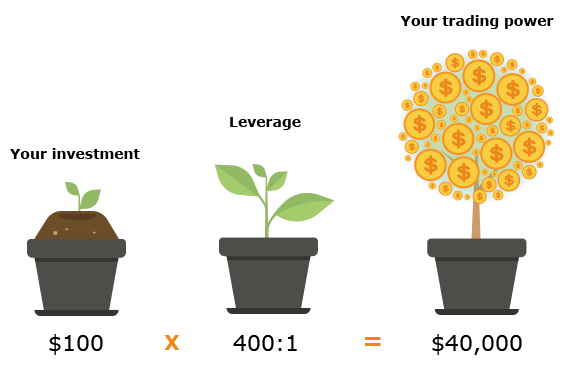

Leverage trading enables you to open large deals with a relatively small investment, thus maximizing your profit potential, but also your risk. Why? Because when you use high leverage, both successful and unsuccessful deals are, in simple terms, amplified.

what is margin??

Now that we understand leverage, let’s look at the other side of the equation: Margin, meaning the funds you need to have in your account in order to open a specific deal. Margin both enables you to open large deals with a small investment and acts as collateral to cover any potential losses. In the previous example, we can reverse the same statement: In order to open a $40,000 deal, you need a 0.25% margin, which is $100.

Different brokers require different margins for different instruments – depending on volatility, as well as other factors. Here is a simple chart that offers some popular examples for required margins - and what it means in terms of maximum leverage

Do You Have to Use Maximum Leverage?

Of course you don’t. Traders can choose to use leverage according to their own preferences and strategies, and some choose not to use it at all. As we said, leverage allows you to take advantage of even small market movements, but because it involves greater risk, you should manage it cautiously

nice post dear

thanku so much dear❤

Congratulations @mehultelaniya! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!