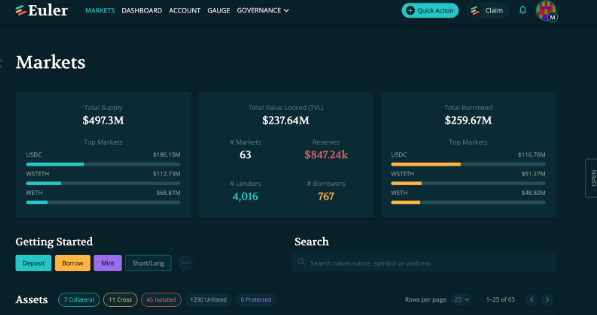

Ethereum Permisionless Lending Protocol Euler Finance (EUL) Market Analysis

1.Project Introduction

Euler Finance (Eul) is a permissionless lending protocol established by Michael Bentley, a researcher at Oxford University. Its R&D company is Euler XYZ.

The differences between Euler and traditional credit protocols (such as Compound and Aave) are as follows:

The development of a permissionless listing system, where users are entirely accountable for their own funds and Euler is completely non-custodial.

Reactive interest rate model: The purpose is to improve the sensitivity and accuracy of interest rate setting. Use the PID controller to increase or decrease the rate of change in interest rates when the capital occupancy rate is above or below the target occupancy rate.

3.In addition to easing the combined bid of the liquidators, Euler's Dutch auction liquidation method may help reduce clearing losses for the mortgagor. Trade EUL with mexc.com. In order to reduce the mortgagor's losses, Euler offers a discount acceleration mechanism for the borrower's collateral that enables them to self-liquidate before the liquidator holds a Dutch auction.Investment

Primary market: In August 2021, EulerFinance raised $8million in a funding round, led by paradise, lemniscap (leading investor of seed round financing), Anthony sassano and other institutions.

Beginning in June 2022, Euler Finance reported that it has successfully raised $32 million in a fundraising round that was headed by Haun Ventures and included variant, FTX Ventures, and Jump Crypto. On the other hand, the price of EUL in a private placement is not currently known to the general public.

Secondary Market: Eul is currently available on MEXC with a current price of 4.78 USDT and a maximum price of 9.8 USDT.