Gearbox (GEAR) Market Investment Research Analysis

Project Introduction

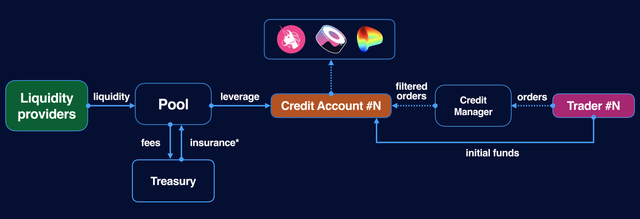

Gearbox Protocol (GEAR) is a decentralized leveraged lending protocol based on Ethereum. Enable leveraged lending and composability through credit accounts. It aims to reconstruct traditional financial margin lending and securities lending with cryptography, and finally realize that users with different needs can borrow on his Gearbox. There is no need to interact directly with another protocol's interface for trading, mining, arbitrage, etc.

A loan account is a separate smart contract that can be borrowed, designed to store the collateral originally submitted by the borrower and the debts borrowed. While you can't withdraw directly to wallets like MetaMask, you can use Gearbox Interaction to exchange funds in your balance account for Uniswap, Yearn, and other his supported DeFi protocols.

Project Analysis

Gearbox's core competitiveness lies in its leveraged lending and composability with credit accounts, allowing users to take advantage of supported DeFi protocols. The product was launched on his Ethereum mainnet with full functionality and a simple and easy-to-use interface. However, the currently supported asset types and other DeFi protocols are relatively limited. Additionally, the Gearbox contract has a very clear revenue model. As the arrangement matures and is able to generate a better market response, it is expected to generate good cash flow returns after good TVL.

Regarding the economic model, the GEAR token has not yet opened its transfer function and cannot be traded on the secondary market. When they come into circulation, the initial circulation is about 7%. The team allocated most of the tokens to community users when designing the token issuance plan, so there may be a small concentration of tokens in the early stages. Tokens are used in the protocol only as governance tokens, and user demand for holding tokens is relatively limited in the short term. According to the official disclosure, the community can then decide on other uses for the GEAR token by voting on governance proposals.

In terms of areas of focus, Gearbox focuses on leveraged lending, a sub-segment of the DeFi lending market. A core requirement is liquid mining that can be leveraged. Gearbox's main competitor is Alpha Finance. Alpha products launched earlier than Gearbox have accumulated a certain amount of user funds, giving them a first-mover advantage. However, Gearbox was founded only a year ago by him. The size of the market is unknown because it has just been released and the scale of the business is still underdeveloped.