Merlin Lab Vaults

Merlin Lab has made two sorts of systems inside its vaults, in view of the standard of self multiplying dividends so clients of the stage can have sufficient adaptability with which to choose how they will get their prizes. One of them is the promoter vault without $CAKE and the other is the supporter vault with $CAKE.

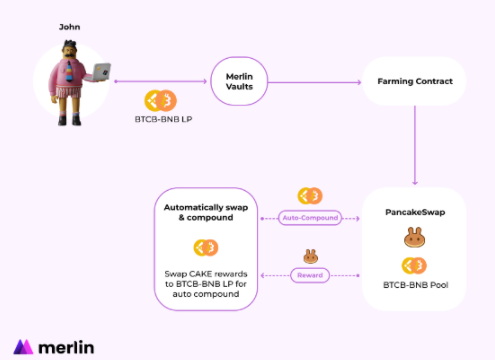

We should perceive how the mechanics of promoter cultivating conventions work without $CAKE. A client stores his liquidity LP BTCB-BNB tokens in the Merlin Lab vaults and the Merlin Lab brilliant agreement is responsible for making a definite and powerful component which is the accompanying: It puts the resources of that client in a marking convention In PancakeSwap, after this technique, it is accountable for gathering the compensations in $ CAKE to trade them ideally and in the right extent to apply the guideline of accruing funds and create more BTCB-BNB LP. Along these lines, clients advantage since their collected revenue on their underlying resources is reinvested and hence a higher level of revenue award will be gotten.

In the accompanying outline you can find in a graphical manner what is clarified in the past section, this is the functioning mechanics of the potentiator cultivating conventions without $CAKE.

Presently we will see the mechanics of how the $CAKE promoter cultivating conventions work. The $CAKE supporter cultivating conventions in Merlin Lab vaults were made to assist clients with amplifying benefits on the $CAKE token. In these vaults, Merlin takes the prizes produced from the first marked resource and spots them in a $CAKE marking convention under the mechanized accumulating funds standard, subsequently, this outcomes in higher APY esteems; But how about we investigate the mechanics of these $CAKE promoter vaults.

A client stores his liquidity LP tokens in the cultivating conventions of the Merlin Lab vaults, at that point the Merlin Lab keen agreement is responsible for playing out a progression of methods which are; places the resources in a PancakeSwap marking convention, at that point gathers the prizes in $ CAKE and applies the accumulated dividends rule in a robotized approach to auto compound these prizes straightforwardly into a $ CAKE resource pool at an ideal recurrence and ideal to guarantee most extreme yields. For this situation, this client, as well as having profits by the accumulated dividends standard, will get higher APY rates since the stage utilizes the most noteworthy APY of the $CAKE resource pool.

Kindly visit any of these links for more info about MerlinLab

Website: https://www.merlinlab.com/

Twitter: https://twitter.com/MerlinLab_

Medium: https://merlinlab.medium.com/

Telegram: https://t.me/merlinlab/

Telegram Announcement: https://t.me/merlinannouncements/

BSC Wallet: 0x9d09d934cF88694650dd335879a7E33114D78013