To Build Anew Or To Retrofit – Money Is Time

As a society we are going to face an extremely difficult task in the years to come. In my experience it is much like calculus coursework: some folks think they can simply stroll through the course because they have identified themselves as “strong in math”. While the coursework may begin simply, it grows exponentially in difficulty, and those stuck in the linear growth mindset are going to be left in the dust.

This non-linear difficulty adjustment is going to be the driving force for change in our society, and those who lack the foresight (or drive) to come to terms with this accelerating world of ours face the threat of being left in the proverbial dust; just as those who refused to adjust their work ethic in difficult coursework, like calculus.

As humans, we value one thing above all else: time. We know our time in this form is limited, and as a result, all living matter acknowledges the scarcity of time. Meaning, time is the hottest of commodities, the most highly valued asset of all.

The way our societies are structured correlate time with savings, particularly in our current capitalistic society. The amount of money we have accumulated is representative of the time we have “earned” to do as we please. Savings is a proxy for how much time you’ve accumulated, in essence.

Time for what you ask? At its most fundamental layer, time to survive. It’s a bit of an abstract thought I do not think is fully comprehended , so chew on that for a moment.

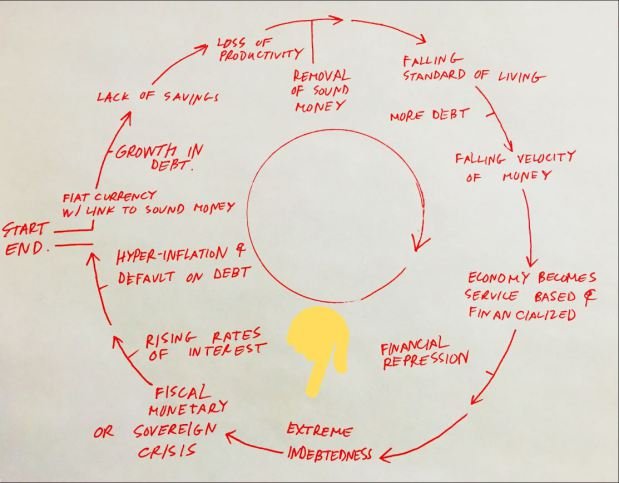

As our monetary system comes to face the ultimate test – one that all monetary systems must face – over the coming years, people will realize it is not just paper and digital account numbers they are losing, but really it is the savings of free time. Once the value proposition between a currency and its store of value for time breaks down, confidence in the currency as a time storage device is no longer.

This is why economics is so fascinating. It is not merely a study of statistics on GDP growth, unemployment rates, inflation targets, and other specific items. Rather, viewed holistically, it is the best system man has been able to generate to reflect how we value our limited time on this earth.

The relationship between time and money is really quite simple, however, much like the Apple Terms and Agreements the nuances are substantial in quantity, and convexly complex in nature.

The most common mistake I see today is people approaching our monetary system much like that of a calculus course. While things may appear sound and linear in relation to difficulty adjustment, the truth of the matter is that these are dangerous assumptions to make. It appears the majority believe our system is static, growing, and stable; at least that is the common perception.

The zeitgeist of populism, distrust in the media, the growing popularity of themes like zombies, corruption, lies, “winter is coming” say that this common perception is detached from reality, an indicator that is worth consideration. Actions speak louder than words.

Our economic and monetary system is highly complex (almost impossibly so), interrelated, and interdependent, which lends itself to instability. And when we humans reach a point of critical instability we always restructure that which is unstable, for better or for worse. Regardless, change is inevitable, and in this case the change appears to run very deep into the foundation of the structure.

I put this notion forward in an optimistic light, not a doomsday type prognostication.

This makes for exciting times because it is often said that such crucial structures in a society cannot be built using pieces from the previous system, but rather built anew from the foundation up. The debate between new construction versus retrofitting the existing structure is something we are currently witnessing, and the pace at which this debate continues will only accelerate moving forward.

It is very important that each and every one of us pursue learning about these areas because in the end, it is ultimately our personal free time that is being priced and re-priced in financial terms, and I do not know about you, but I intend to closely monitor and manage the construction of my new foundation just like that of a project manager overseeing a host of subcontractors with unknown motives and spotty performance track records.

“Crises and deadlocks, when they occur, have at least this advantage: they force us to think.” – Jawaharlal Nehru

DISCLAIMER : This content is for informational, educational and research purposes only. This post is not to be taken as personalized investment advice.

Congratulations @maven360! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes