A Grain Of Sand In A Pool – Investment Philosophy

Within my rolodex of reading material, Bill Bryson's A Short History of Nearly Everything has been a recent favorite.

One of the ideas that has really stuck with me is his exploration of subatomic particles. Bryson puts forth a number of analogies as a way to comprehend the scale of atoms; specifically, that of a fly within a cathedral. I liken this analogy to a grain of sand in an Olympic size swimming pool:

- the grain of sand representing the nucleus, full of protons and neutrons

- the remaining volume of the swimming pool representing the area in which electrons move about (in ways that are still unknown to man)

Many of us likely recall learning the various electron configurations (s, p, d, and f orbitals) in our chemistry coursework, yet, as Bryson points out this framework has been disproven. Science has gone back to the drawing board in trying to determine how our sporadic electron friends behave.

"Well, in the meantime, what do we teach our eager students about electrons until we discover another scientific theory? We surely cannot let them know that we do not know, what it is exactly, we do not know."

"Let's continue to have them memorize the disproven concept of organized, predictable electron orbitals. It's much easier to manage this way."

At the most fundamental level (subatomic/quarks), human understanding is equivalent to a grain of sand in an Olympic sized swimming pool. Think about that for a moment.

Quite a bit of room for opportunity, wouldn't you say? This is music to the ears of you entrepreneurial spirits who refuse to believe that anything worth inventing has already been invented!

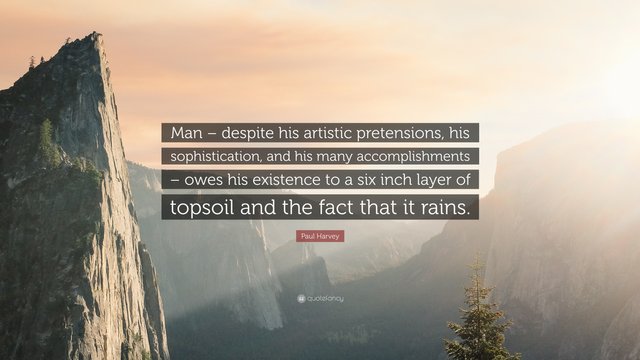

This evident lack of human understanding strikes at the very core of what I wish to explain in this post. Namely, that many overestimate the general body of knowledge that man has acquired. I do not wish to detract from our many achievements and innovations over the millennia (agriculture, flight, internet, dulce de leche Haagen Dazs – just to name a few).

Rather, I want to point out that we appear to be living in an era of hubris, especially as it relates to technology as a solution (TAAS?) and the talk of the technological singularity.

Armed with this analogy (grain of sand in large pool) as a proxy for human understanding, we can explore all sorts of interesting thoughts.

For starters, if we are not capable of understanding the building blocks of our existence, that means that everything beyond atomic level (molecules, cells, tissues, organs, and organ systems) is really just a derivative of our understanding of atoms, which again, is flawed and incomplete.

If we are to assume that compounding upon this incomplete, flawed knowledge base creates more unknowns, then is it within reason to assume that human understanding of a system as complex as financial markets is the equivalent of a stone within the Pacific Ocean?

This is why it’s so imperative that we do not rely solely on models, specific indicators, expert consensus, predictions from others, our own biases, opinions from loved ones, Wall Street algorithms, or anything really that might jeopardize our own objectivity. Surely, they can be helpful frameworks to acknowledge and pay attention to, but too often I sense that people are willing to pick and choose the models, indicators, predictions, and so on that match their preferred narrative.

It is essential that you always ask yourself why might any individual have a preferred narrative to promote. Does said individual earn commission from this narrative, are they employed in a company that benefits, is it a political motive, a religious one, or are they merely flying blind and have nothing better to do?

One of the things that constantly baffles me is back-testing and how prevalent it is within the financial system. Strategy A was back-tested to predict every major market move since 1913. Algorithm B was proven to accurately predict the price of commodity Z within 5% accuracy through our rigorous back tests. Through back testing, we've proven that following this simple strategy would allow you to compound your capital at an annualized rate of 18% since 1981.

You get it. You've heard and read these very claims, but hopefully you take them with a grain of salt sand because it's quite easy to look into the past and figure out how you could have predicted various outcomes.

We must be forward facing, and willing to chart our own course. Ultimately, there comes a time where your thoughts, ideas, preconceptions, and intuition must be applied to the physical world. For me, where this application and interface to the physical world is most evident is within the realm of finance, and more specifically, my own personal savings and capital.

Realizing that nobody has all of the answers leaves a lot open to interpretation, and when your interpretation is more closely aligned to the objective truth versus another’s (and you trade on this interpretation) then you stand to benefit via the wealth transfer mechanism of the markets.

The primary caution I like to throw out is how markets are forward looking – sometimes so much so that it surprises the inexperienced trader or investor. Whenever someone approaches me with a “stock tip” (which is generally a solicitation for my opinion), I ask them to immediately pull up the price chart.

9.9/10 times, my experience has been to find a chart that appears like a hockey stick. My response usually borders along the lines of:

“Looks like what you’ve just told me has been priced into the markets some time ago, and not only that, has reached a point where institutions will likely incorporate leverage (and inherently, hype) around this particular stock in order to drum up buying interest so they can reduce their risk exposure by taking profits (transferring their risk unto you - person asking me).

Then, they will roll a portion of these profits into options/derivatives so that when the narrative runs its full course (when the liquid pool of buyers dries up and the chart plateaus and begins its inevitable descent) and the volatility of the underlying begins to ramp up, the same institutions that sold you the underlying stock for a premium are there to capitalize on increasing volatility by selling puts or owning calls, along with a high probability of repurchasing their position from weak hands at a nice discount."

Of course, the person immediately begins to question their hot stock thesis. And while I come across as a know-it-all ass in this example (so far) I always make mention of the fact that what you’re asking with this type of chart is whether I have any interest in momentum trading. Truthfully, I do not.

Momentum trading is risky in my view; namely, because it appears to be everyone’s strategy these days and there is a very high likelihood that there are other folks out there who are much better than I am at momentum strategies. And when your playbook is the same playbook as that of everyone else’s, how do you expect to rise above the pack and win that championship? Playoffs?!?!

Sure, departing from the herd opens you up to underperforming the herd, something many claim they can handle, but fail to follow through with when presented with the proposition of being in last place. Contemporaries call this term, FOMO.

What a terrible emotion to bring into a world where emotion typically spells the downfall to an eclectic, diligently structured portfolio. Fear and greed are your worst friends in achieving alpha, or in limiting your risk exposure for you wealth preservers, you fortunate few.

My point being that while the large portion of our society has become a popularity contest (the reality tv effect), investment, personal capital management, and growing your portfolio ought not be one.

Really it’s much like those girls that you knew in your schooling days. You know, the ones that had braces, weird haircuts, low self esteem and seemingly disappeared from your life for a decade or two, only to pop back up on one of your social media feeds as a bombshell. Yeah, I think it’s healthy to approach investments much like these now beautiful women who were so unjustly underestimated in their primitive years - take the long game and do not worry about what others are saying or doing.

Rather than focusing on being popular, in the know, and up on all trends investment, come to value working behind the scenes, taking the road less travelled, and buckling up for longer term time horizons. These three things alone will increase your likelihood of growing your capital and leave you with the all-elusive peace of mind that long term investors come to appreciate.

Who knows? If you are successful, perhaps, that former unattractive-now-bombshell will want to re-connect.

As I said earlier, nobody can predict the future, so all we can do in this game is maximize our odds, position ourselves to get lucky, and have the mental fortitude to commit to the bigger picture on a longer time frame than that of our competitors.

DISCLAIMER : This content is for informational, educational and research purposes only. This post is not to be taken as personalized investment advice.