MenaPay: Crypto Made Easier Than Cash in The Middle East and Africa

MenaPay is the first, fully backed, Islamic compliant blockchain-based payment gateway in the Middle East and Africa. It’s goal is to create the most commonly used cryptocurrency of the MENA region and becoming the largest non-bank mobile payment solution on blockchain while generating significant returns for the investors. It replaces the traditional payment methods with blockchain-based fully backed cryptocurrency. More than 50% of online shoppers, in countries in the MENA (Middle East and North Africa) region, according to the report from yStats.com, prefer cash on delivery to other payment methods like credit cards. Using debit card is not usually the first option with them because it does not have the assets of credit cards which do not follow Islam.

A merchant service made available by an e-commerce application service provider that authorizes credit card or direct payments processing for e-businesses, online retailers or physical store is called a payment gateway. Payment gateways enables consumers to make payments easily to merchants or easily send money to their friends, family or any other associates. Keeping the data and reporting regularly, payment gateways also help merchants to grow their customer base and reach alike consumers as well.

The financial systems in MENA region is controlled and doinated by banks, that’s why cash is used as the main tool for transactions. However, according to the researches in 2014 86% of the MENA region doesn’t prefer to use bank cards due to Islamic compliance. Also, even though there are privatization, government ownership still takes a huge part in the sector. Blockchain system presents an option for those who avoid using bank cards and reduces the control of government on private sector as communication of data is done through cryptography.

How banking problems in MENA region would be solved by MenaPay and bring solutions to cash on delivery system

There is 86% of the population who do not use banks in MENA as a result of their religious beliefs. So many people in that region do not use banks because of their practice of Islam. MenaPay will solve banking problems and cash on delivery system in MENA region through the following:

- Islamic compliance: According to Sharia law in Islam, i cannot have any divident or interest. So, assuming i put 1 000 dollars in the bank, i must be certain of getting the same amount back. However, banks add interest or divident. On the other hand, MenaPay as its’ business model does not add any divident or interest while i hold my money in my MenaPay account. Also, 1 MenaCash (MenaPay currency, discussed later in this artcle) will always be equal to 1 USD which means that i will not ever face any sort of inflation risk. Also, every transaction has to be witnessed by someone to make sure the way of transacting the money and how much money you transact. MenaPay, by using blockchain technology, solves this issue by making every node a witness.

- Simple & Easy transactions: By using a simple QR code, one can make any sort of payments in ones daily life. MenaPay deals with every aspect of life from shopping to booking a flight. By using MenaPay, you can easily make any transactions in online and offline.

- Secure accounts: By using KYC (Know-Your-Customer) and 2FA (Two-Factor Authentication), your account will be secure and will always belong to you that will be kept in blockchain. In case of losing your mobile phone, a 16-digit passcode will be needed for anyone to unlock which is quite impossible to come by. By using MenaPay, you can get rid of carrying a lot of cash with you and safely keep your money in MenaPay.

- Payments made through MenaPay will be 100% Islamic compliant. MenaCash is 100% backed by USDs, meaning there is going to be a single currency in the region which was fragmented with multiple currencies before. Desktop and mobile wallets will make feel the buyers like they have a solid wallet which they can use easily. An advantage for merchants is that transactions will take place in a faster pace.

MenaCash

The stable cryptocurrency “MenaCash” will work as a private blockchain solution to eliminate volatility and to ensure transactions are faster than old-fashioned financial tools like credit and debit cards. The tradeable MenaPay token will utilize ERC20 and will be used to distribute most of the revenue and profit of the MenaPay platform and will be available for crowd sale. Generating revenue from the fees from P2P (peer to peer) and P2M (peer to merchant) transactions and cash-out fees from M2F (Merchant to Foundation).

Green Mining: Every MenaCash transaction between Peer to Merchant may be awarded by a MenaPay token. MenaPay tokens will be distributed from mining reserve. A certain percentage of the transaction fees will be used to fill the mining reserve with MenaPay tokens.

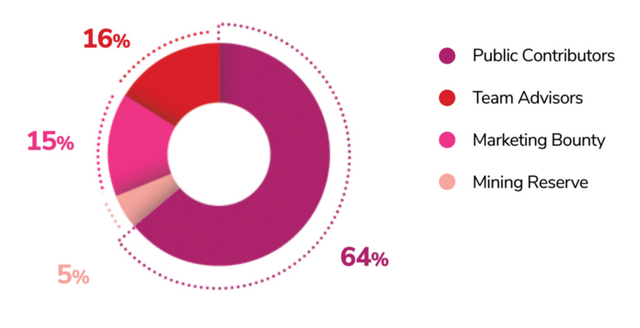

Token Distribution

Tokens To Issue: 400M Mpay

Tokens For Sale: 256M Mpay

Estimated ICO Price: $0,165

Target Soft Cap: $5M

Target Hard Cap: $25M

Token Standard: ERC-20

Unsold tokens will be burned

Roadmap

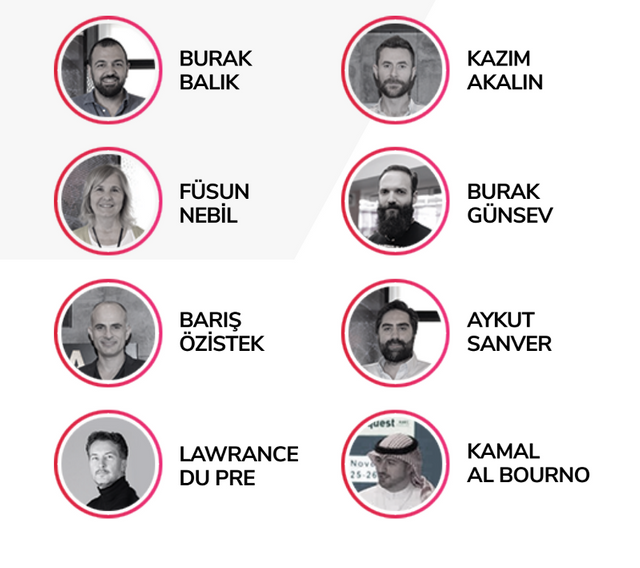

Founders & Advisors

Team

For more details about MenaPay, check their Website and Onepager

BountyOx username: ifeakinola