Metavault.Trade: A Decentralized Exchange Platform With Leverage Up To 30x

Project overview

The decentralized finance (DeFi) industry continues to hit all-time highs, with daily transaction volumes steadily increasing. Unfortunately, even though billions of funds are currently being switched back and forth, decentralized exchanges (DEXs) are fraught with obvious and invisible costs that hinder the functioning of the market.

Therefore, the future of DeFi requires eliminating the high transaction costs and limited functionality typically associated with traditional DEXs. Among them is slippage, the difference between the quoted price of the cryptocurrency and the trader’s actual price. This is due to limited liquidity, expensive gas costs, lack of control over strike prices and the risk encountered, as malicious traders execute trades ahead of knowledge-based traders. their consciousness. insider knowledge of their futures trading. Addressing these concerns means that DeFi can achieve parity with centralized exchanges (CEXs), while eliminating the need for middlemen. On the other hand, decentralized cryptocurrency exchanges (DEXs) are blockchain-based applications that coordinate the large-scale trading of crypto assets between many users. They do it entirely through automated algorithms, rather than the conventional approach of acting as a financial intermediary between buyers and sellers. These are crypto assets that sit below the surface of an exchange, awaiting the completion of any incoming buy or sell orders. pool. This is the Metavault Trade .

Metavault Trade Is A Decentralised Spot And Perpetual Exchange With Low Swap Fees And Zero Price Impact Trades. Trading Is Backed By A Multi-Asset Pool Which Is In Turn Supported By Liquidity Providers.

Trading Is Backed By A Multi-Asset Pool Which Is In Turn Supported By Liquidity Providers. Liquidity Providers Receive Rewards From Swap Fees, Market Making, Rebalancing And Leverage Trading. MVX Uses Chainlink Oracles And TWAP Pricing From Large-Volume Decentralized Exchanges For Dynamic Pricing.

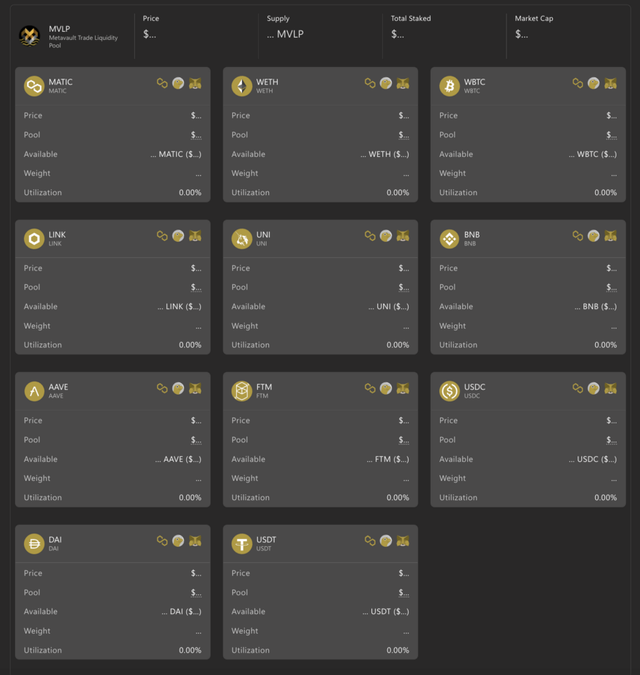

The Multi-Asset pool

The great innovation at the heart of GMX, and now of Metavault.Trade, is the Multi-Asset pool. All the assets supported by the platform are pooled together and a token called MVLP represents the index of these tokens. The price of MVLP will fluctuate with the prices of the underlying assets in the basket and the Profit and Loss (PnL) of the traders — when they loose on a trade, their losses flow into MVLP.

How does this shared liquidity lead to a reduced price impact swap solution? Let’s say for example that the pool is made up of five assets (BTC, ETH, MATIC, USDC and DAI) in equal proportions in terms of dollar value: 20% of each. If a trader wants to buy 50% of the BTC supply with USDC, they can do so instantly, without any price impact. After the order goes through, the state of the pool will simply become BTC: 10%, USDC: 30% and the rest unchanged. To understand how unique this feature is, I encourage you to check how much price impact you get for a very large order on a CEX with an order book or on a DEX like Uniswap!

At launch, the assets supported on Polygon will be six large caps and three stablecoins:

BTC, ETH, MATIC, LINK, UNI, AAVE USDC, DAI, USDT

Now let’s get back to the pool in the example above. Post-swap, it is unbalanced compared to its initial state. The liquidity providers will be incentivized to deposit BTC and disincentivized to deposit USDC, which will lead to a rebalancing of the pool.

Metavault.Trade will also allow traders to go long or short with up to 30x leverage against any of these assets. The main innovation here is the way the price is set: the platform aggregates Chainlink and Time-Weighted Average Price (TWAP) pricing from major DEXes and CEXes. This greatly reduces the risk of liquidation from the temporary wicks you find on some exchanges.

There are two ways to get involved with Metavault.Trade: the simplest one is to be a liquidity provider and to mint MVLP by providing one of the asset listed on the platform. MVLP holders get a 70% share of platform fees.

One can also choose to hold MVX, the utility and governance platform token of the platform detailed in the last section.

$MVX token

Metavault.Trade will issue a utility and governance token for the platform, ticker $MVX.

The MVX token is particularly well designed in terms of rewards for the stakers. The rewards are simply piled one on top of the other.

MATIC rewards from platform fees

MVX stakers will get 30% of the fees collected from across the platform in the form of MATIC (on Polygon network).

Escrowed MVX

MVX stakers will get Escrowed MVX, esMVX, that can be used in two ways:

esMVX can be staked, and so earn the holder the same rewards as staked MVX: MATIC rewards from platform fees, more esMVX and multiplier points.

esMVX can be unstaked and vested to be converted and distributed as MVX. In that case, they stop earning the staking rewards though. Vesting esMVX then unlocks linearly over one year with MVX being distributed to you with each unlocking.

Vesting your esMVX also requires you to lock the average MVX/MVLP that earned you that esMVX in a vault. The MVX/MVLP in this vault cannot be sold, but does still accrue rewards.

The locked MVX/MVLP in the vault can always be withdrawn but this will stop any further vesting of esMVX.

Multiplier points

Staked MVX receives multiplier points that allow the holder to accrue protocol fee rewards: each multiplier point earns the same amount of MATIC as a MVX token.

But unstaking MVX or esMVX will incur a burning of multiplier points. This is a gamified system that rewards you points for staying staked for longer as the only way to acquire multiplier points is through staying for the long haul.

Public sale and IDO Data

Public sale

The public sale IDO of MVX will happen on the 1st of May on Uniswap (v3).

IDO data

IDO Price: $1

Total Supply: 10,000,000 MVX

Initial Market Cap: $1,500,000

Blockchain Technology: Polygon

References

Social medias

Website: https://metavault.trade

Telegram: https://t.me/MetavaultTrade

Twitter: https://twitter.com/MetavaultDAO

Medium: https://metavault.medium.com

Discord: https://discord.com/invite/b2fPrbmPza

#PROOF OF REGISTRATION

Forum Username: Snapexti

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=2785638

Telegram Username: @Ramutmen

Participated Campaigns: blog , video

Matic Wallet Address: 0x85BCF13A1B784f0668Eb7DCC00a16dd1374b6eF2