Exponential Functions Are Dangerous - The Economy

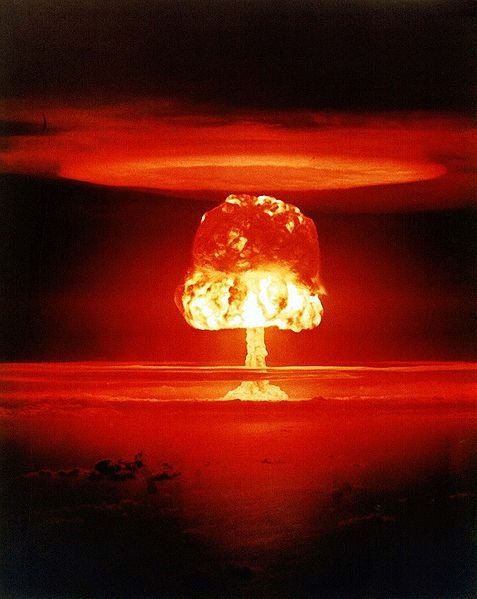

There are many types of functions in mathematics but none is so dangerous as the exponential function. If you have watched a video of an atomic explosion then you are familiar with the effects of an exponential function.

Exponential growth can wreck an ecosystem, blow up a city and destroy an economy. This post is about the influence and danger of out of control exponential functions on the economic system.

EXPONENTIAL GROWTH

The financial news talks endlessly about growth in the economy. It talks about how much the GDP grew last year and how much the GDP is expected to grow next year. It talks about how much a corporation is expected to grow and it punishes companies that fail to meet those expectations.

The news also talks about debt and how it grows each year. It rarely talks about debt payments and how much they are expected to grow from year-to-year because that is an uncomfortable topic.

Exponential growth can sometimes be a good thing. Put a $1000 into a bank account when you are 18 years old at 5% interest and it will turn into $9900 dollars by the time you are 65 years old. If you contribute an additional $1000 dollars into that account and do that every year it will turn into $188,000 by the time you are 65.

Who doesn't like that?

Well economic stability that's who.

POORLY GOVERNED DEVICES

Let's go back to the physical world for a second. Have you ever heard a lawn mower engine that it revving up and then down and revving up and then back down over and over again? That is an example of a poorly governed engine.

A better example is a nuclear bomb. Take a certain mass of fissile material, say plutonium isotope Pu-239 and then assemble it into a critical mass. The few stray neutrons in that mass will trigger some nuclei to fission and release 2.88 neutrons on average. This is generation 1. Those neutrons from generation 1 will trigger 2.88 fissions on average and release 2.882 = 8.3 neutrons. This is generation 2. Those 8.3 neutrons from generation 2 will trigger 8.3 fissions on average and release 23.9 neutrons and you get generation 3.

You see where this is going. By generation 20 there will be about 1.5 billion fissions happening and by generation 40 there will be 2 billion billion fissions happening.

Each generation lasts only a few nanoseconds so the energy buildup is incredibly fast. The end result is the bomb 'disassembling' itself and terminating the fission chain event. Too late, all that heat and energy needs to go somewhere and it is usually an innocent Pacific island that ends up being the victim.

BUSINESS CYCLES - BOOM AND BUST

The business cycle is a well known effect of economic expansion, heavy borrowing, over extension and high debt payments and then the inevitable downturn. If a country is lucky it is just a recession but if things go bad then it can turn into a full blown depression.

The effect of an entire country, governments, businesses and millions of private individuals engaging in excessive borrowing can be detrimental because it is feeding an exponential function.

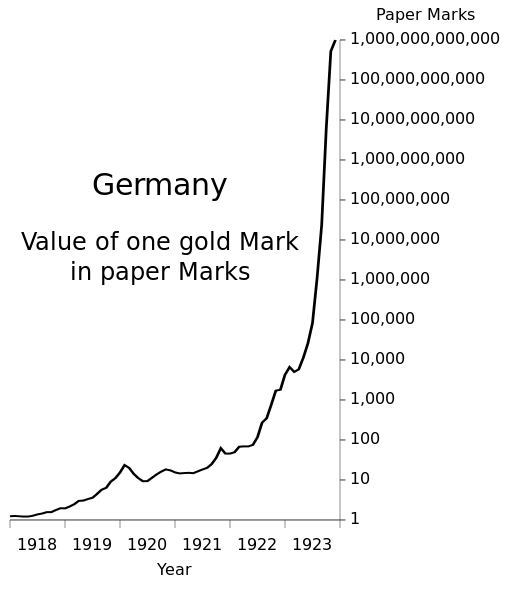

Over-borrowing leads high debt payments and then to less spending by individuals and corporations which leads to lower quarterly profits and stock market crashes. Governments can legally print money so they (usually) don't go bankrupt but printing money too fast can also make a currency worthless (i.e. Wiemar Germany circa 1924, Zimbabwe circa 2009 and Venezuela circa just about now).

PROPERLY GOVERNED DEVICES

Let's go back to the physical world again. That lawnmower that was running poorly in the example is rare because most lawnmowers have properly working governors (as they should if they are maintained properly).

The atomic bomb example is an case of run-away fission reactions but it too can be properly governed and these devices are called nuclear reactors.

Nuclear reactors are actually very good examples of controlling the exponential function. The best internal control mechanism for a nuclear reactor is the temperature of the fuel itself. When the power goes up the fuel heats up and it expands. This lowers the density of the fissile material and makes it easier for the neutrons to miss the fissile nuclei and escape the reactor. This means the power goes back down and things return to normal.

The power is naturally controlled and stable. Of course it is more complicated than that and there are control rods and shut down rods but the basic idea is that an exponential function can be controlled if you are clever and careful about it.

PROPERLY GOVERNED ECONOMIES

The holy grail of economists is ending the business cycle and bringing about a stable economic system for all time.

I don't think this has been figured out yet as the crashes of 1987, 2000 and 2008 have shown.

World debt currently stands at about 73 trillion dollars for governments alone. If you include corporations and individual debt it stands at about 233 trillion dollars.

This may be why central banks are so very very reluctant to raise interest rates and it feels like a ticking time bomb.

CLOSING WORDS

Trying to control an exponential function is a tricky business. It can be done successfully for nuclear reactors because you only have to worry about one thing: neutrons.

In a real economy however you have to worry about many things, money supply, debt, interest rates, tax burdens, tariffs, energy costs, commodity costs and so on.

The crash of 2008 provided us with a valuable lesson but did the economies of the world learn it? We'll see.

Thank you for reading my post.

POST SOURCES

https://en.wikipedia.org/wiki/Business_cycle

https://en.wikipedia.org/wiki/Hyperinflation_in_the_Weimar_Republic

https://en.wikipedia.org/wiki/Hyperinflation_in_Zimbabwe

https://www.nationaldebtclocks.org/

https://www.businessinsider.com/global-debt-his-record-233-trillion-debt-to-gdp-falling-2018-1?op=1

Interesting post. I have always loved exponents, though I do see the dangers you present. Should be interesting to see how the cryptocurrency world plays out.

This is indeed an interesting and thoughtful write up...

Controlling inflation and debts accumulation for example, as demerits of exponential is not at all an easy task. Governments may make just one mistake and to rectify it becomes a heck of trouble. Take for example, the Zimbabwe case of hyperinflation which I believed arose from the decision to reshape ethnic balance in land ownership. That was a good idea they thought, only for them to find out otherwise. The country at a point had to switch almost completely to the use of US dollars as her day to day trading currency.I agree with your views. If exponential growth/action is properly managed the possible downsides won't be a problem to think about.

However, just like you mentioned here that

My first read this morning, and I must say I enjoyed it.. Thanks @procrastilearner

This post has been voted on by the steemstem curation team and voting trail.

There is more to SteemSTEM than just writing posts, check here for some more tips on being a community member. You can also join our discord here to get to know the rest of the community!

Hi @procrastilearner!

Your post was upvoted by utopian.io in cooperation with steemstem - supporting knowledge, innovation and technological advancement on the Steem Blockchain.

Contribute to Open Source with utopian.io

Learn how to contribute on our website and join the new open source economy.

Want to chat? Join the Utopian Community on Discord https://discord.gg/h52nFrV

@procrastilearner You can read ....