Are we in the "Bubble of Everything"?

Market watchers love to toss around the word "bubble". This is a curious creature since they are easy to spot in hindsight but difficult when we are in them. The definition of the term is rather simple yet the applicatoin of it is an individually slanted. There never is consensus of a bubble until after the fact.

Often, money flow pushes one particular asset class up. In the late 1990s, it was the equities markets, specifically the tech/internet related stocks. A little less than a decade later, it was real estate that was bubbling. Each of these ended with the proverbial crash.

This is the danger of boom/bust cycles, you cannot have one without the other.

So where does this put us today?

Over the last decade, central banks around the world got very aggressive with their easing. Tens of trillions of dollars was issued in all different kinds of currencies around the world. Whatever form the easing took, this meant that a ton of liquidity entered the markets.

Globally, we saw different markets appreciate over time. In the United States, both equities and real estate experienced sustained runs. Both are still in long-term bull markets that are providing a huge "wealth effect" among the participants.

But are we in a bubble? And where are these located?

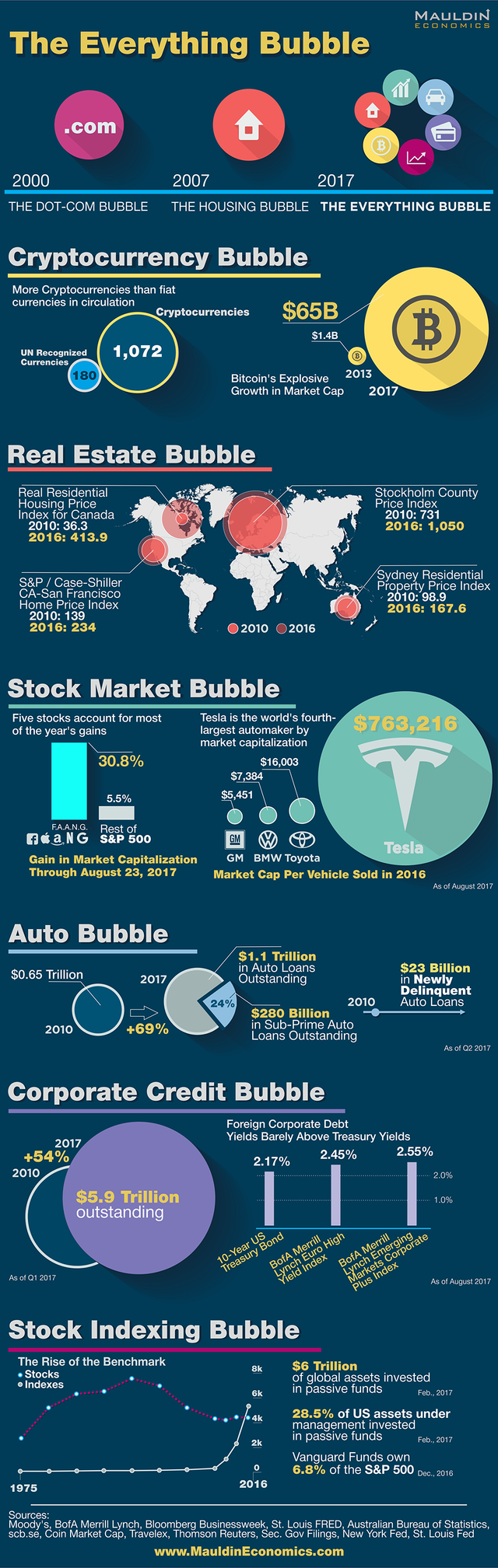

According to an infograph put together by Mauldin Economics, it seems that everything is bubbling. So, according to them, we are in multiple bubbles and they are located everywhere.

Infograph from here

This chart is about a year old. What is interesting is, for the most part, each market mention has only appreciated more.

Bitcoin, for example, was only worth $65 billion when the data was taken. Today, it is $110 billion. Couple that with the fact that there are closer to 2,000 cryptocurrencies as opposed to the 1,000 listed and you can see, in spite of the enormous pullback, cryptocurrency is still much higher today than it was when this infograph was created.

The only market that appears to have a pullback is the auto sector. 2018 was a rough year for that industry. Car sales are down again while defaults are rising. The bull run for autos stopped a while back.

What will happen if everything starts plummeting? We never witnessed this much money being doled out through the easing program. Markets could well be addicted to the cheap and easy money. The U.S. Fed started tightening a year ago yet rates are still at the lower end of the spectrum compared to historical norms. Money is still cheap.

The equities markets used this inexpensive cash to do a record number of stock buybacks. This was only aided by the Trump tax cut which provided more liqudity for companies to repurchase their stock. What will these companies do to sustain these valuations? Will they be able to product enough to keep the train rolling?

Housing is already starting to show some signs of cracking. It might be a temporary situation but it bears watching. We might well see a number of markets turn over in rapid succession.

Bubbles always end up popping. If we are in a "Bubble of Everything", the pop will be felt across multiple markets at the same time.

We could be in for something never seen before.

Richard Heinberg said it himself in his book, Peak Everything. Of course we are a bubble, everything is. If there is one thing Nature was brilliant at, was building a machine the size of a planet and keep it balanced at the same time. We came along and looked at everything both in ecology and geology as a resource to be exploited with no regard to the cost. We know that every time we double we use as much resource as all the previous growth all added up, and now we are at 7.6 billion people, racing to 8B, we will not double again. In every way the geology and the ecology which remains, which is the entire foundation of our economy has been hollowed out and is ready for collapse. The numbers are a horror story, yet we seem only to care about the greed of the day. When this bubble pops, nobody will be able to hide from it, and all the time in the world to ponder how did it come to this...

It seems we are goldfish and our children will have to pay for our sins...

Awesome infographic. The bubbles are the result of super low interest rates for many years.

The underlying problem is that there is a major focus on "growth" over everything else. Our society has gotten better at promoting growth while keeping inflation down.

Part of this is the natural growth that comes from increases in productivity and technology, but this is amplified by financial and legal policies to amplify the effect.

This is problematic because it ignores or discounts other goals, like ecological stability, supporting the middle class, or basic sustainability.

This last item is the concerning one. We burn through a years worth of global resources in shorter and shorter amounts of time each year.

If we are lucky, then one or more bubbles will burst and we will have economic difficulty. If we are NOT lucky, then we will continue to optimize growth until we have drained the resources from the planet. The result of that outcome is dire.

Isn't an "everything bubble" just called inflation? What else would you expect the consequences of years of unlimited quantitative easing and zero percent interest rate policy to be? The question we should all be asking ourselves is what will blow up first and what the chain reaction will be? What assets will people flee to? Also, where the hell is the 1.5T student loan bubble that can only be discharged through death?

and we're still encouraged to take out $120,000 loan for a Philosophy major

Hi @finprep .. Good article... but every industry goes through a phase where the price reaches unsustainable levels due to more investments coming from people. If you want to see a live example then study share price fluctuations of good companies. You will see the bubbles popping in and out of existence at regular intervals on a micro level. This kind of corrections or bubbles are always healthy for the long run.

I particularly appreciated the stats about the 5 stocks that accounted for most of the S&P appreciation. I didn't know that one.

I googled it and there have been a couple of articles posted on this very subject just recently.

I don't think Bitcoin is in a bubble. I think it will continue to out-perform all stocks in the next 12 months.

Can you see any opportunities arising from this "bubble of everything?" or would that be guesswork at best?

yes we are....looks like recession on our head..starting of 2019 will be critical

Dear author, I really like your content! You’re writing in a very interesting manner!

I think my last post will also be interesting for you:

https://steemit.com/cryptocurrency/@cryptofrau/buddy-platforma-dlya-avtomatizacii-razrabotki

Please, upvote it! I’ve upvoted your in advance.

Seems like a bubble trouble problem to me :S

haha its not bubbel bro:D we will be fine:d

If it is not a bubble ... We will be rocking ;)

yeh indeed bro haha