US Dollar On The Edge – How Will It Affect Gold Prices?

Interesting article by Christopher Aaron. Check out more of his content at igoldadvisor.com

The US dollar is on the edge of a decline that may take many by surprise throughout 2018 and 2019. Conversely, gold, the euro and many non-dollar assets stand to benefit. Certain segments of the US stock market may hold up in a falling dollar environment, especially those which can raise prices to compensate. Yet to use the skydiving analogy: the time to buy a parachute for protection is before the falling begins. As usual, we will focus here primarily on technical analysis, and endeavor to avoid the fundamental-only rhetoric that is so often misleading at exactly the most crucial turning points.

Over a year ago, amidst intense and misplaced fundamental fears that the euro would break up due to the British withdrawal from the EU (“Brexit”) and the resignation of David Cameron, we proposed – in contrast – that the Euro was in fact forming a long-term bottom, and that conversely, the US dollar was forming a long-term top. Fundamentally, the perspective seemed absurd at the time. After all, the news was euro-negative. Yet just when things seem the worst is exactly when a market is poised to rebound, and this is where technical analysis can serve a critical role.

The perspective was updated in May 2017 after France elected Macron, and we concluded that this vote represented the final turning point for a new euro bull market. The euro was trading at 1.09 to the dollar at the time. As of the end of this week, the euro has risen to just under 1.19.

Now closing in on the end of 2017, it is time for a proper update on the US dollar, the euro, and how this should impact the precious metals market into the coming year.

Why Follow The US Dollar?

First, why should we care what happens to the value of the dollar?

The reason is that several markets move generally opposite to the value of the dollar; the most important ones being gold, oil, and the euro.

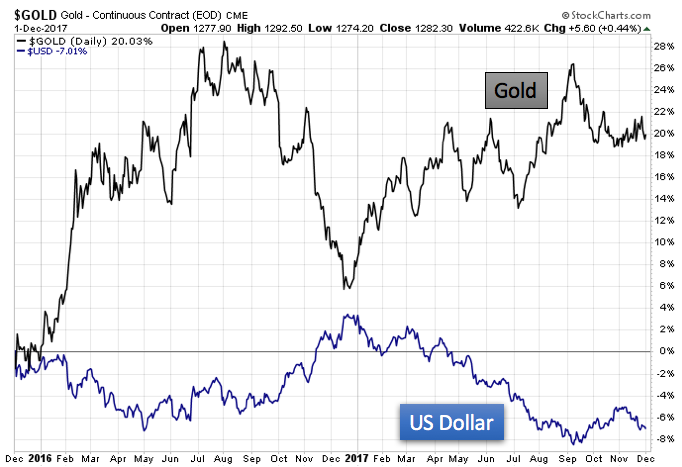

Although the inverse correlation between the US dollar and gold has actually been weaker over the past few months than is typical, we can see that this relationship still exists with some clarity by a simple examination of two year chart below:

Backdrop: Long-Term Technical Analysis

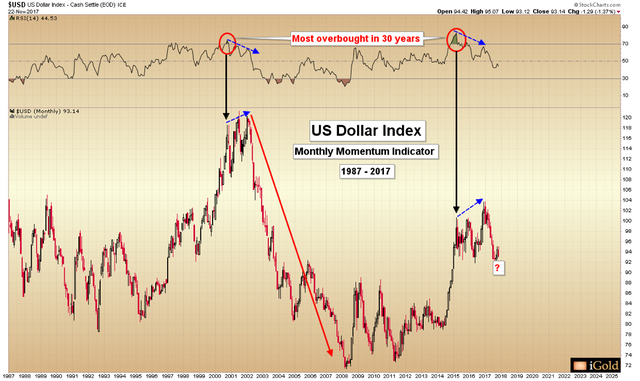

The backdrop for this analysis shows that through early 2017 the dollar had been in a rising trend for nearly nine years, since March 2008. We can observe this time period on the 30-year chart below:

On the top of the main chart we show the monthly RSI (relative strength) indicator for the dollar. RSI is a study of momentum, which can give hints of potential tops or bottoms. In general, momentum that is too strong in either direction tends to be a precursor of an unsustainable trend, and hence sets the stage for a reversal in the opposite direction.

In this case, in early 2015 momentum reached unsustainable levels to the upside for the dollar.

Indeed, by 2015 the dollar showed its most extreme momentum reading in 30 years of record keeping (red callout, upper right). This surpassed even the reading from the year 2000, which preceded the top and subsequent seven-year decline in the dollar through 2008. This period conversely coincided with the strong gains seen in gold in the mid 2000’s:

Again, the major backdrop here is that the dollar has just registered an overbought momentum reading beyond that which was seen in the year 2000.

This is an important signal to monitor.

Back To The Present

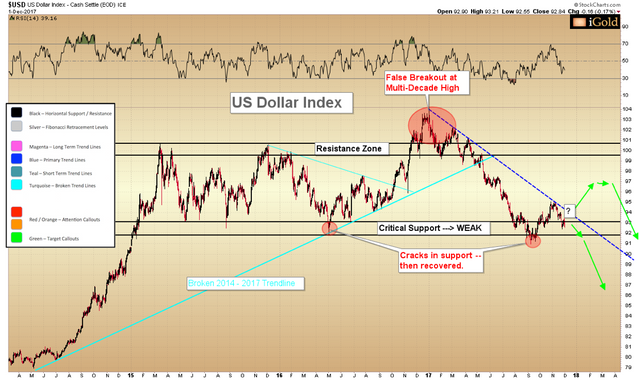

Having observed the overbought momentum reading in early 2015 as a leading signal, we were waiting for a confirming technical indication for the US dollar which would give a more precise idea as to when the major reversal would begin. That signal came in early 2017, as the dollar formed a false-breakout at the end of its nine-year advance above the 100 level on the dollar index.

A false breakout occurs when a market consolidates for a lengthy period of time, and then finally exceeds its upper resistance, only to reverse quickly back below the resistance and thus negate the breakout. A false breakout, when it is seen after the end of a protracted advance, is the most ominous of all reversal signals for major international markets. False breakouts tend to represent long-term tops after which years of declines may be forthcoming.

In the case of the false-breakout for the dollar, it came after over two years of consolidation between the 92 and 100 level on the index, labeled Resistance Zone and Critical Support, respectively (black).

Note how after the false-breakout, the dollar quickly fell all the way to its Critical Support zone. Here we see the power of a false-break reversal.

While certain analysts in the foreign exchange market are calling for a recovery in the dollar or a reversion to mean levels, we suspect they are failing to grasp the significance of a false-breakout that occurs after nine years of prior advance.

To be clear, the combination of the most overbought reading in a generation along with a false-break to mark the 2017 top is a confluence of technical signals that indicate the dollar should be headed not just for lows near the present region of 93 on the index, but for new lows never before seen on the long-term chart. If the percentage drop from the 2001 – 2008 decline is met, the dollar would be headed for 62 on the dollar index… off the Y axis of the long-term chart.

This decline is expected to occur through 2024 – certainly not overnight. Yet the initial seeds are being sown presently.

When Will The Dollar Break Critical Support?

Return back to the recent dollar index chart above.

We see a clear primary downtrend which has formed from the false-break top through the most recent lower peak in November (royal blue dashed line).

The critical confirming breakdown will occur when the dollar falls decisively through Critical Support (black) labeled between 92 – 93 above. Having closed this week at 92.8, this could happen any day.

Note that the successive lows seen throughout 2016 – 2017 that have tested this region continue to see buyers fail to show up until lower and lower levels are reached. This is not the sign of a healthy market – it is a sign that buyers are not resolute.

The question mark to the far right of the dollar chart exists because we cannot be certain of the exact timing that the dollar will take to crack this Critical Support zone. The protracted scenario would be that the dollar breaks its primary downtrend and forms a final counter-cyclical bounce in early 2018 before it begins to decline in earnest. The more accelerated scenario will be if the dollar breaks its Critical Support zone by February, as its downtrend suggests.

Takeaway On The Dollar

Yet these are short-term considerations. The larger picture must be reiterated: the dollar has registered its most overbought reading in 30 years, followed by a false-breakout to mark the absolute top. This is a rare confluence of technical reversal signals that suggest a protracted multi-year decline is just beginning. Counter-trend bounces will occur, but the major trend will be lower for several years.

What will occur fundamentally to cause this loss of value for the US currency? It could be a weakening of the US economy, it could be protracted war in Korea or the Middle East, or it could be the emergence of inflation that exceeds the Fed’s expectations. We cannot know for certain what fundamental triggers are in store, but we can observe the language of the charts which are giving hints ahead of time.

Expect mainstream media attention to begin to focus on the weakness in the US dollar once the support zone at 92 is broken. It is suggested that investors begin to take some protective action before this time arrives, as the initial decline could be as quick and sharp as that which has been seen in 2017 thus far.