THIS TASTES DELICIOUS: Flood of Cash Enter CRYPTOS!

Big Changes are under way in cryptocurrency. The Crypto Winter of 2018 has caused a large amount of people call this period the end of a fad, including some early adopters, but skepticism is precisely what creates bottoms for prices.

It’s not that everything needs to change; in fact, cryptocurrency core investors want some things to stay the same. For example, we all like the fact that Bitcoin and other coins are immutable, inflation-resistant, difficult to counterfeit, and allow self-custody of the assets, which is our ability to hold our tokens in our personal wallets, instead of at a bank.

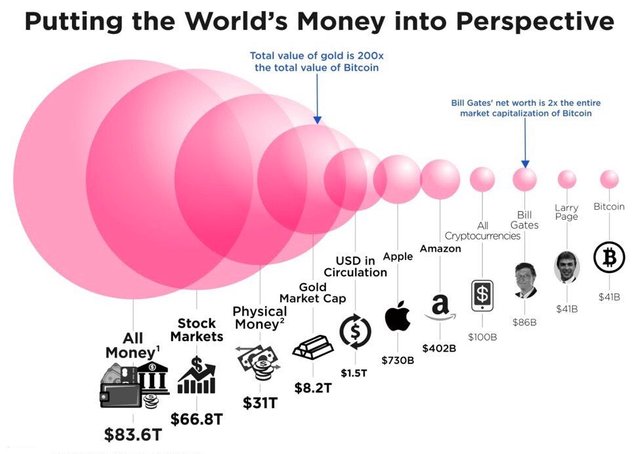

One thing that will change this year, however, is the magnitude of capital bidding on crypto. Right now, the entire cryptocurrency market cap is about $125 billion. To put that in perspective, Jeff Bezos is worth more. Or, compare it to the value of the global stock market, which is over $60 trillion. All told, the crypto market is just 0.3% of the world’s money supply.

This is a tiny industry, absolutely tiny.

Courtesy: howmuch.net

What will change all of that in 2019 is the entrance of Wall Street – and the massive amount capital it brings – into the cryptocurrency space, which Pure Blockchain Wealth is dubbing the “End of Innocence.” Fidelity Investments, the world’s 5th largest asset managers with $2.5 trillion in AUM, is leading the charge with plans to launch a Bitcoin custodial product aimed at institutional investors.

The launch is scheduled for March, and it will be a game changer. The fact is, the impact of institutional money flow is greater than that of small-time retail investors, no matter how many of us are out there. Wall Street’s entrance into the crypto space is about to have a tremendous impact on the price of Bitcoin and other well-known digital assets, effective immediately.

Fidelity is one of the most trusted names on Wall Street, so when it takes a sizable stake in the future of cryptocurrency, you can bet your bottom fiat dollars that other big players like Citigroup and Goldman Sachs will follow suit. In fact, many crypto insiders that we’re in contact with are saying that this massive influx of Wall Street money is what will not only put an end to the Crypto Winter once and for all, but will even spark an extended Bitcoin bull run.

Additionally, traditional financial firms are making it easier to buy, sell, and hold cryptocurrencies. We can view Wall Street’s entrance into crypto as a positive development because it could potentially make cryptocurrency available to over half a billion new investors – that’s 15 times the current number of users (35 million).

As always, there are two sides to every crypto coin: not everyone shares the enthusiasm for Wall Street whales getting into crypto. I can relate, since there’s a bad vibe around the community in the world of crypto. Many early investors and new ones as well, identify this as a grassroots movement that isn’t entirely comfortable with the idea of traditional financial institutions getting involved.

I don’t blame them. Satoshi’s vision was to compete with the current banking system, not to invite them into the lion’s den. After all, Wall Street whales are manipulating the stock market. The whole point of the cryptocurrency movement is to avoid the heavy hand of traditional financial institutions. We want the power to be in the hands of the community, not the elite bankers, who have created this mess.

The fear of Fidelity and other banks exerting too much control over cryptocurrency is overstated, as we see it. The big banks can buy up Bitcoin while creating ways to buy, sell, and store it, but that’s not the same as literally CONTROLLING Bitcoin.

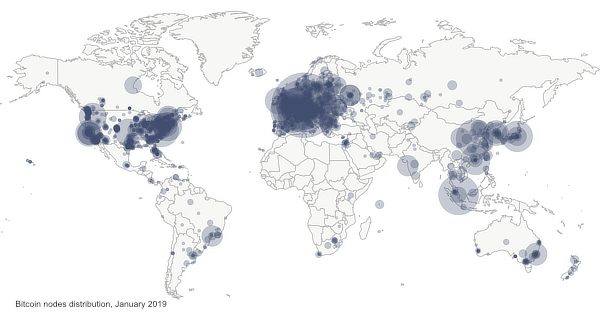

No one in his right mind can fear that banks will control the blockchain because that would be impossible. By its very nature, no one can control it. There are 10,266 Bitcoin nodes and 10,078 Ethereum nodes, and they’re scattered throughout the globe.

Courtesy: bitnewsbot.com

The crypto innovators made sure of it many years ago. The cryptocurrency ecosystem simply isn’t controllable by a cartel of banks or whales.

To make any changes to the Bitcoin blockchain, they would have to commandeer over ten thousand nodes and countless miners – no amount of Wall Street influence can make that happen. Besides, the Wall Street fat cats can’t control crypto self-custody, which is your ability to hold Bitcoin in your own personal wallet – out of the reach of big banks and exchanges. The self-custody aspect of cryptocurrency is something that will never change!

In the end, what Wall Street does best is create avenues for retail investors to trade a currency, which is precisely what currencies are designed to do. Personally, I’ll hold mine in the way I always did, but millions of investors will opt for the easy route, via their brokerage account.

All I care about, in the bottom line, is that the value is there, when I need it to be.

Best Regards,

Brad Robbins

President, PureBlockchainWealth.com

Legal Notice:

This work is based on SEC filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought.Please read our full disclaimer at PureBlockchainWealth.com/disclaimer

Original Article Available HERE