State of the markets - divergence between US, Europe and EM

So we indeed had a rebound this week as expected, but Europe and especially China and EM (Emerging Markets), which also started the rebound 2 days later¹, remain in a downtrend whereas for the US indices it rather looks like a continuation of the uptrend.

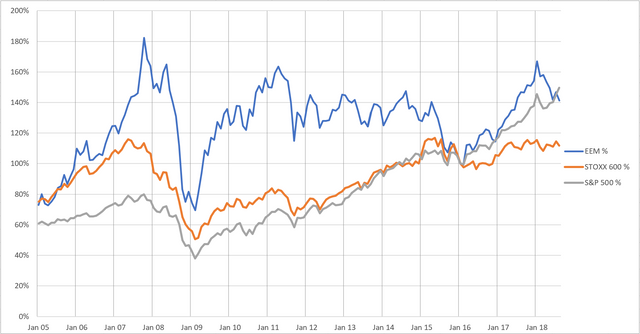

So let's look at the relation/correlation of these different indices on a longer time period.

For Europe I took the EUROSTOXX 600 Index, for the US obviously the S&P 500 and for the Emerging Markets the iShares MSCI Emerging Markets ETF (EMM).

The chart is aligned in such a way that 100% represents the Feb 2009 lows. You can see that at the beginning there is a fairly good correlation but first EM begin to stall in 2011 and later in 2015 Europe. In fact, since 2011 Europe can't catch up to the S&P 500 and since 2017, when EM is actually in an upwards rally together with the US, Europe completely starts to move sideways only. This you can see even better on the next chart, which is basically the same chart again but with 100% being set to Jan 2016.

By the way: If you look at the last part of the chart you see that after the peak and "crash" from January and February this year the US market regained it's strength while EM just goes down...

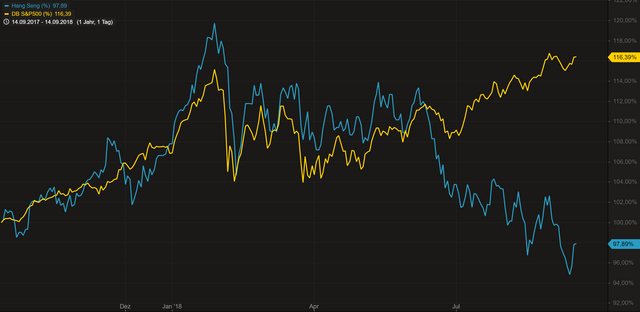

Here is a picture of S&P 500 vs Hang Seng Index:

This is super fascinating because (as you will be able to see in one of my future posts 😉) US stocks are already overpriced if you look at fundamental ratios but China's are not. They are priced very fair and compared with others actually pretty cheap. The reasons probably most people think about here are the trade war or the strength of the dollar, which started in April. Probably it is more complex than this though.

For now however let us go back to our first chart and add Japan to it. The Nikkei surprised me this week because it broke it's old and strong resistance line on Friday. Japan is a country that geographically is very close and does lot's of trade with emerging markets but is a developed country itself. From 2009 until 2013 and 2015/16 the moves of the Nikkei look very similar to those of the European market for me. But basically from December 2012 with the start of Shinzō Abe's new economic policies the Nikkei starts to catch up to the S&P 500.

Let's summarize all we see: From the end of 2011 until January 2018 we have been in a bull market, except for the 2015/16 part. This bull market got very strong in 2017 but now some of the markets, namely China and other EMs, are in bear mode. It remains to be seen if the other markets follow them. (Right now this seems to be the case for Europe.) It is very crazy that the American market has such a bull power. Maybe one year it the future EMs are back up to their highs and we can forget about this or maybe we have the next big crisis and what goes up comes back all the way down again.

Let me know what you think!

Also if you have any questions or suggestions write them in the comments.

Footnotes:

¹: Europe, US and Japan started showing some green numbers on Monday whereas e.g. the Hang Seng Index continued lower until going back up on Wednesday

Congratulations @pfeifferresearch! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP