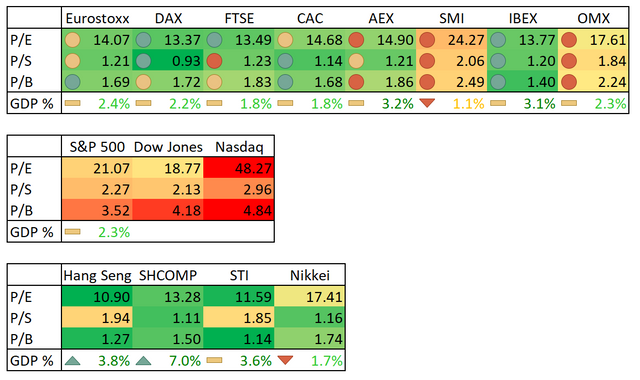

Over and undervalued indices

Hallo. I've had two busy weeks so it's been a while since my last post. Well, now let's give you what I promised in my last post first. An overview about how over or undervalued certain markets are.

For this I put the three well known value ratios Price to Earnings, Price to Sales and Price to Book from the Indices in one table. The data comes from Bloomberg (the numbers for Hang Seng index are a little outdated). I also put the GDP growth for each country in there (data from Worldbank).

The background color shows how good each number is in global comparison; for GDP the arrows do that. For the European indices I also added markers that show how each index performs compared to the other European ones.

What you can clearly see is that US equities especially Tech are extremely overvalued while Asian stocks are actually cheap. However remember that you should always take other thoughts into account when investing. E.g. the American market ist still the most bullish one although equities are so overvalued there. The funny thing actually is even if you only compare European indices, the ones that are overvalued seem a little more bullish/less bearish than the ones that are already undervalued.