The Deceptive Nature of Market Capitalization

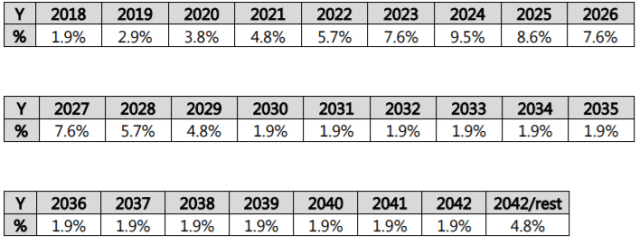

Market capitalization, for both new and old investors, is a deceptively complex figure. While many believe that market capitalization is the right way to determine the total value of a coin, the value displayed by the market capitalization of a coin is a number that can easily be manipulated by savvy and often unethical development teams. When inexperienced investors misjudge the value of coins for a unit, most investors advise them instead to check their market capitalization, which is the price per unit multiplied by its turnover. Although this is a much more accurate approach, it is important to recognize that market capitalization is still an imperfect measurement, as it completely ignores liquidity and non-trade supply of coins. A major criminal, when it comes to "manipulating the lid," is Dentacoin. Dentacoin (DCN) maintains a market capitalization of just over $ 545 million. In the rating of 57 on CoinMarketCap this is not an unreasonable number for a project of its size and ambitions. However, DCN's market capitalization does not reflect the fact that there are only 4.5% of all tokens in circulation. Of the 8 trillion DCN tokens that exist, only 325 billion are currently in circulation. Moreover, more than 90% of supplies are locked in smart contracts, which will be sold in the future selling tokens or rewarded to the founders. The remaining tokens emerging from circulation are mainly owned by the founders. These tokens are not frozen, but they can not be moved yet. Each year from 2018 to 2044, the share of almost 80% of the total supply volume will be unfrozen and sold by the development team. This year, 1.9% of the offer will be thawed and sold, increasing the total supply by 152 billion dollars. This increase of more than 30% will require 152 million dollars. US for new purchases only to maintain the current value of the tokens. Another disadvantage of market capitalization is that it does not take into account illiquidity in the markets. In smaller, less traded currencies, this oversight has enormous consequences. For example, there are more than 100 currencies listed on the CoinMarketCap, which can see their market capitalization doubled with market purchases of $ 1,000 or less. In the overwhelming majority of cases, when coins rise by thousands or even tens of thousands of percentage points per day, this is due to the relatively small number of purchases on the market, which have a huge impact on the market capitalization of the coin. Illiquidity also has serious consequences in the opposite direction. For holders, again, mostly small coins, market caps can deceive the owners, believing that their coin is worth more than it is. Despite the fact that the bag can grow strongly, as on the coins depicted above, this does not mean that you can sell any significant part of your stocks for this value. It is possible that a market that sells a small amount can lead to similar sharp losses of 80 or even 90% per day. Fortunately, most coins do not abuse the faith introduced into market capitalization by investors and speculators. In addition, information on common supplies can be easily found in project documents, and understanding liquidity is simply a matter of checking books on buying and selling books along with the volume of coins. Market capitalization, when fully understood, still provides valuable information to traders. Source: themerkle.com

I thought about this trick earlier but never looked for a concrete example where got abused. Nice post and research!

thanks you