U.S. Debt Is Heading Toward $21 Trillion

The fact that the U.S. national debt has surpassed $21 trillion raises a number of important concerns. What are the consequences of amassing such a large public debt? How will it affect the future of our children and grandchildren? Will the government increase our tax burden? Is this just a house of cards waiting to collapse? These are only a few of the questions on the minds of Americans as we face the largest debt in our nation’s 240-year history.

It seems politicians like to make relatively simple issues appear complex. Why? Perhaps it is because they need us to need them. In truth, the real reason America is in such dire financial straits is not at all complicated. Between 1900 and 2015, the federal government’s budget had a deficit in 89 out of 116 years or 77% of the time. When you continually overspend, there is only one possible result: greater debt.

Sometimes there are legitimate reasons for overspending. For example, during a severe economic crisis, government may need to step in and provide assistance to those adversely affected. In addition, during a time of war, whether officially declared or not, government may need to spend more than it collects in order to properly defend our way of life. These types of situations are temporary. Afterward, the government should reduce its spending to bring the budget under control. Unfortunately, once the government creates a new program, even if it is to meet a temporary need, it rarely eliminates it when the need no longer exists. Instead, politicians have mastered the art of using money to retain power. By expanding the number of individuals on welfare, they have created a burgeoning dependent class who rely on government subsidies to survive. This is a key reason there are fewer people willing to work hard to achieve the American Dream. But I digress.

The key factors that set America on its present course, which is toward an expanded-Socialistic government, are as follows:

FDR’s New Deal of the 1930s

L.B.J.’s War on Poverty of the 1960s

Nixon’s removal of the gold standard in 1971

A successful campaign to divide Americans into the “haves” and the “have-nots” (class warfare)

There are other reasons, but the result is a growing entitlement mentality. I detailed FDR’s New Deal in my previous article. The War on Poverty was an attempt by President Johnson and Congress to eradicate poverty through expansion of the welfare system. The role of welfare (in many cases) was to provide temporary assistance until the individual could get back on their feet. However today, it has become a way of life. For example, welfare payments increase when a recipient has another child. Should the government reward someone for having a baby? There is also corporate welfare. Why should we pay farmers not to grow a certain crop? Should the government be in the business of setting commodity prices? Again, these are foundational questions regarding the role of the government.

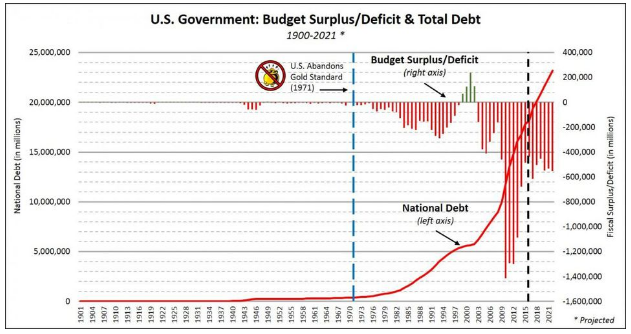

The action that opened Pandora’s Box for good was President Nixon’s final removal of the gold standard in 1971, dubbed, “the Nixon Shock.” Prior to this, one could redeem U.S. currency for gold. In 1966, the U.S. held about $13.2 billion in gold reserve. While this was sufficient to back the dollars held in America, it was not enough to cover the dollars held outside our borders. With the Vietnam War becoming more expensive, Nixon’s removal of the gold standard opened the door for Congressional overspending. The following chart illustrates this paradigm shift very well. It contains the fiscal-year budget surplus/deficit and the total national debt from 1901 to 2015 (black-dotted vertical line) with a projection through 2021.

The blue-dotted line marks the year the U.S. abandoned the gold standard for good. Even though there were deficits prior to this, they began to increase greatly after this event. With the exception of four years during President Clinton’s second term (with a newly elected Republican majority in Congress), there was a deficit every year since the removal of the gold standard. Below are the numbers and percentage of years that the federal budget had a deficit. For example, during the entire period, the federal budget had a deficit 77% of the time (89 out of 116 years).

• All Years: 1900 to 2015……….77% (89/116)

• Before 1971: 1900 to 1970……68% (48/71)

• After 1970: 1971 to 2015……….91% (41/45)

In place of a gold standard, we now have a debt ceiling, which is another name for “credit limit.” Imagine you were a banker in charge of all lending for your bank. If an entity applied to increase its credit limit, stating they would not be able to pay their bills without it, how would you respond? Would you continue to grant their request? This is precisely what is occurring today and has led to the largest government debt in human history!

It'll be okay, I just heard president Trump say he was going to fix the deficit and end extra spending.

You're right, it is simple. Although I disagree with some of your assessments, we shouldn't be spending more than we bring in. That's economics 101.

Although from another perspective, U.S. citizens are generally living better than they ever have in history, so do we really want to rock the boat?

Can not be fixed even with cuts in expenses, I believe that they will blow a bubble in gold, but the US also has no gold