- Bitfinex.com

Bitfinex.com may be a controversial choice for the #1 place to take out a margin BTC loan, but regardless of the bad press and banking issues. Bitfinex has been a rock solid cryptocurrency exchange for the last couple years. Funds have remained secures, trading engines haven’t stalled, deposits and withdrawals haven’t been closed and overall the exchange has functioned well. Until proven otherwise the negative press and FUD around bitfinex seems to be unsubstantiated.

Registration and Verification

Bitfinex is one of the few remaining cryptocurrency exchanges that does not have a mandatory KYC policy or deposit/withdraw limits. It does require KYC for USDT deposits and withdrawals and states that it doesn’t accept US customers. However, many users get around this ban with VPN’s.

Borrowing Process

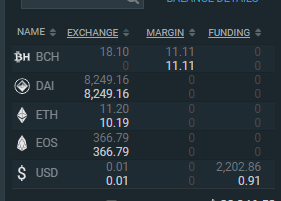

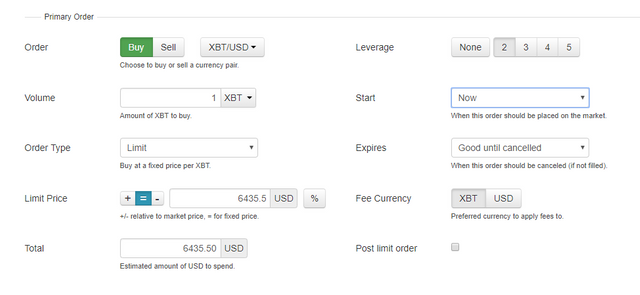

The borrowing process on Bitfinex is very straightforward. Deposit funds and then transfer them to your “margin account” where you can then trade on leverage. The margin limit is described well in Bitfinex’s resources or this video tutorial does an ok job explaining.

Bob would just have to deposit his 10 BTC, move it over to his margin account, and then buy 1 BTC on leverage and withdraw. His account will automatically be charged interest until he repays that 1 BTC by selling 1 BTC. Bob would have to keep an eye on the borrowing rate of his margin trade though as if the market goes wild his borrowing cost could skyrocket.

Margin Fees

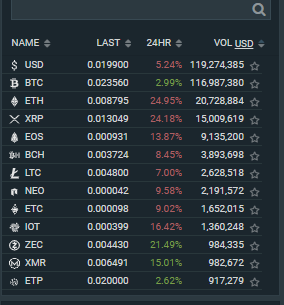

Bitfinex hosts a lending market. Which means that interest on margin loans is determined completely by the market and other counterparties on Bitfinex lending out their BTC.

Interest is calculated in %/24 hours. Because this is a market driven operation fees can range from very high to very low depending on volatility and a host of other factors. As you can see in the snapshot above the current cost to borrow BTC is .023%/day or roughly 10% APR. This market ensures you are getting the best interest rate possible for your loan, the bad part is that this rate can skyrocket as well during high volatility events. Margin rates range anywhere from 3%-350%+ APR.

Pros

- No verification or limits

- Lending market and market interest rate

- High liquidity

Cons

- Bad press and exchange trust of Bitfinex

- Unregulated and not available for US customers

Summary

Bitfinex remains a trustworthy high liquidity site for trading and margin lending. Though they have been hacked in the past, the site has a solid history of performance regardless of bad press. And with market driven interest on margin loans, it is most times the cheapest place to borrow on leverage.

One of the oldest and most established cryptocurrency exchanges Kraken.com is our top pick for Bitcoin margin lending. Kraken has established banking partnerships, long history of security and performance, and a liquid market for margin lending. While it is not necessarily a high volume cryptocurrency exchange, it has enough liquidity and benefits to make up for its lower volume.

Registration and verification

As a exchange based in the USA Kraken is quite regulated and has a strict KYC policy. In order to borrow/withdraw 1 BTC you will need to verify to teir 2 which requires. A valid name and address. However, to be able to withdraw the full BTC in one day teir 3 would be required which requires uploaded ID and proof of residence.

Borrowing process

The borrowing process for Kraken is not the easiest to figure out. This video does a good job at explaining the process. If you take your time and go through their resources it doesn’t take too long to learn.

For Bob the process would be pretty simple, he would just need to deposit his BTC, then make a leveraged buy of 1 BTC with a safe 2:1 leverage ratio. He can then withdraw that BTC to sell to sam and would be charged .01% interest every 4 hours until he repays the margin loan by selling 1 BTC on kraken using margin.

Margin Fees

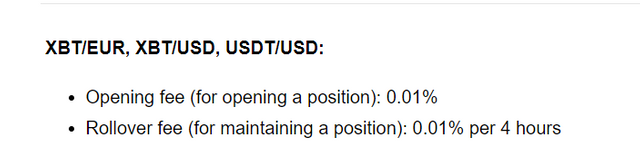

Kraken does not have a lending market for margin loans and instead has a set fees.

So the interest rate is set at .06%/day the APR on a margin loan at Kraken quickly shoots up over 22% with compounding factored in.

Pros:

- Established, regulated, and secure exchange

- Trade with real Fiat money not stablecoins like USDT

- Stable lending fees

Cons:

- Strict verification + based in US (likely need to be reported for taxes)

- High APR

- Limited flexibility

Summary

Kraken is the safe bet if your fine with verifying don’t want to take on any additional risk like exchange failure. As the exchange is based in the US and heavily regulated it would be wise to report everything on taxes, so when you repay the Bitcoin capital gains will be due on the sale. With the relatively high APR rate Kraken is best for short term margin lending loans.

Other Margin lending sites

An early cryptocurrency exchange based in US. Due to bad support and recently holding users funds hostage for verification we cannot recommend their service. They are also closing margin trading services to US customers.

Bitmex is the highest volume cryptocurrency exchange. However, Bitmex trades contracts not cryptocurrencies directly and has a negative history of performance during highly volatile markets. So we cannot recommend them.

I agree with the author, @bitcoinlending!

Thanks

Congratulations @bitcoinlending! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Congratulations @bitcoinlending! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: