Tidal shift in monetary policy

Ben Hunt appeared on the Macro Voices this weekend and was as eloquent as ever. You should definitely read his blog which is a piece of art in itself. Trying to very compactly interpret the theme, there is major shift occurring in monetary policy which he likened to a cumbersome barge very slowly changing direction.

https://www.macrovoices.com/286-dr-ben-hunt-the-federal-reserve-is-no-longer-your-friend

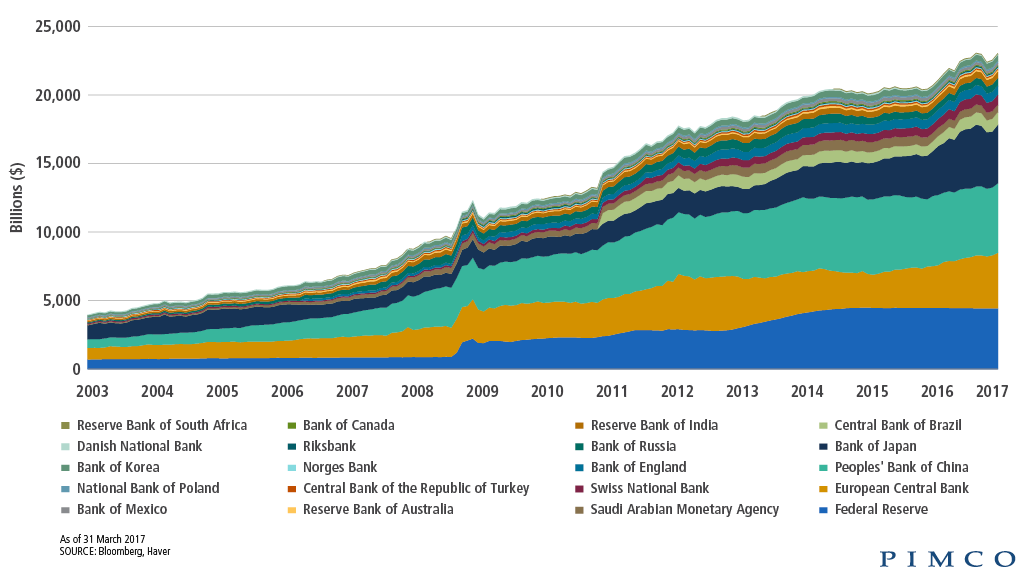

The FED “story” is changing from one of loosening to tightening and there is talk of shrinking their balance sheet. The important part is that when we now parse their output for signals about the distant future, we ask by how much and by when will they be shrinking their balance sheet.

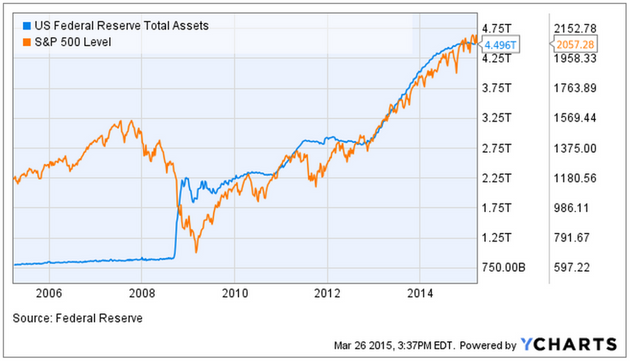

We know what happened after the 2008 crisis hit and they began growing their balance sheet, $4.7 trillion was pumped into the US financial system causing asset prices to inflate. The financial tide came in lifting all boats and we are now preparing for that tide to roll out. Any fool can therefore guess what might likely happen when they start rolling things in the opposite direction.

It might not happen today or tomorrow but there is a fundamental driver which could pull prices lower.

Just another signal that the time to prepare for great change is upon us. Build your future strategy to take this into account and have shorting candidates ready for any shocks. Maybe have downside protection or an exit strategy if you are going to ride this final up spike higher in stocks. The FEDs pump and dump fuel is no longer feeding the fire and the time for insurance is now.

But what to go short and how to insure? To be honest that is what I am still trying to work out. The first to cut are the FED the furthest down the trail are Japan. But what about the Swiss? Japan are buying their own their stocks and bonds but the Swiss have also begun a crazy policy of buying US stocks including APPL! So the Swiss and their currency seem to be a good starting point to at least keep an eye on. Liquid and easily accessible to everyone.

Long or short and against which currency? Wait for the shock and follow the trend may be the no brainer solution. Macro analysts and gurus have been arguing about the US dollar for years, they are all smarter than me and they all have competing thesis on what will happen in the coming crisis. As no one knows, wait and let the market tell you?

Good long carry on a USDCHF position (5.5%) but price is not moving that direction for now. People must be dead keen to be short USD right now as they are paying a high price to be short (6%) against CHF. What does that say about the US dollar?

Not much carry being paid on a long EURCHF position for a retail trader (0.1%) but it IS at least positive carry.

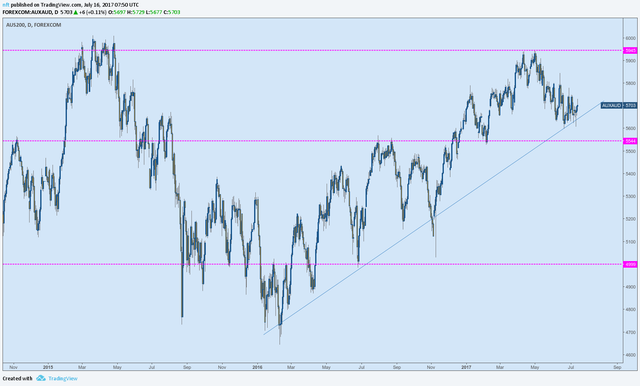

In terms of Australia and our ongoing housing bubble he made the great point when asked about ways to short it. The lack of good shorting targets has played a large role in allowing the bubble to go on for so long. One to think more about, someone will have to feel the pain. Probably the tax payer when the government absorbs the debt.

Congratulations @fxequity! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

Congratulations @fxequity! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!