Planning for Long-Term Care: The Most Overlooked Retirement Expense

The majority of Americans think that they’ll cruise through retirement as long as they have savings and investments. Sorry to burst everyone’s bubbles but saving money is just a part of retirement planning.

So, what else should be considered?

Long-term care.

What is long-term care?

Long-term care is defined as the support and services a person might need to maintain the quality of life due to injuries, disabilities or illnesses. Ltc covers assistance in carrying out six Activities of Daily Living or ADLs and they are as follows:

- Eating

- Bathing

- Dressing

- Toileting

- Continence

- Transferring

Around 70% of Americans 65 and up will need long-term care, which means that there is a high chance we might need any form of long-term care during our golden years.

Unfortunately, Americans overlook their potential long-term care needs. What’s more alarming is that many underestimate the cost of long-term care and mistakenly think that Medicare, Medicaid and health insurance can help fund it.

In fact, a poll conducted by Associated Press-NORC revealed that two-thirds of Americans age 40 and up have done little planning or no planning at all for their long-term care needs.

To address these ltc issues, ALTCP came up with easy steps on how Americans can plan for long-term care.

1. Get Educated

You may have already heard things about long-term care. But, it doesn’t mean that everything you hear is true. You should do your homework by doing research and getting familiar with different long-term care options such as nursing homes, adult day care, assisted living facilities and more. In doing so, you’ll have an easier time determining the appropriate ltc service or facility for you.

2. Find out the Real Cost of Long-Term Care

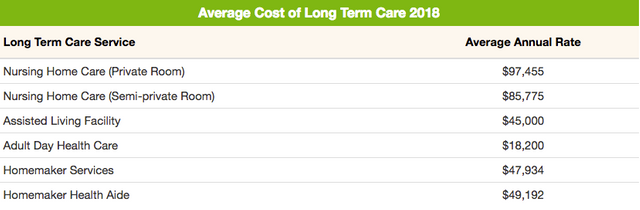

It’s easy to get a realistic picture of long term care cost today. ALTCP has a long-term care cost interactive map that allows people to check the median cost of different long-term care facilities and services by state.

A private room in a nursing home is the most expensive today, which has an average annual cost of $100,379 followed by a semi-private room that has an average annual cost of $88,348. Here are the rest of the long-term care options and their average costs.

3. Find the Truth Behind Long Term Care Payment Options

A lot of Americans think that Medicare pays for long-term care. But, it’s just a myth because Medicare doesn’t pay for non-skilled living assistance or extended nursing home stays, which make up the majority of care needs today.

Medicaid, on the other hand, pays for long-term care. However, only those with low-income are eligible for Medicaid benefits. It’s best to research on Medicaid eligibility rules since U.S states have their own set of rules and also to find out if you can qualify.

Due to misconceptions and lack of information on financing options, more than 50% of Americans end up paying out-of-the-pocket according to Bipartisan Policy Center report.

4. Buy Long-Term Care Insurance

Long-term care insurance is defined as a product that helps Americans fund long-term care services and facilities that they might need due to old age, illness, injury or disability.

You have the option to buy group long-term care insurance through your employer or an individual insurance from companies that sell individual policy like Genworth, Transamerica and Mutual of Omaha.

Sad to say, only 7.2 million Americans have long-term care insurance out of around 47 million Americans who are at risk of requiring ltc.

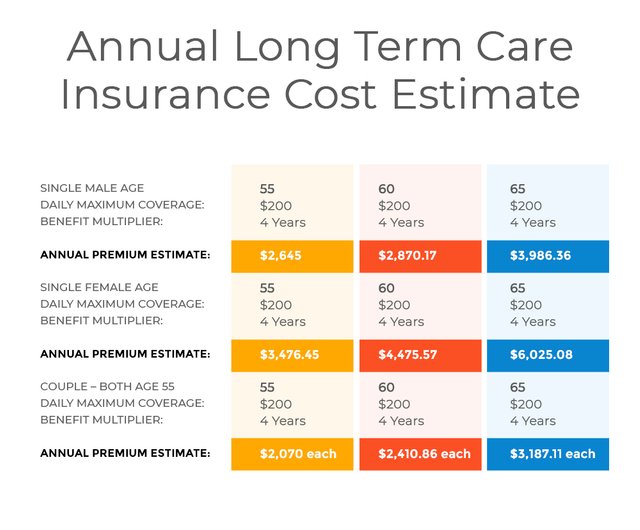

One reason behind this alarming attitude is that people find long-term care insurance costs expensive. But the good news is that if you start doing your research and planning for long-term care early, your premiums will be lower.

Take a look at the annual average cost of long-term care insurance by age below.

You can save on the price of long-term care insurance when you buy early since insurers consider you as low-risk. The younger and healthier you are, the lower your premiums will be.

To help you come up with a well-informed decision, here are 5 reasons you should buy long-term care insurance now.

Is Long Term Care Insurance Worth It?: 5 Reasons You Should Buy Now

5. Include your Family When Planning

Most often than not, family members get involved when it’s time for you to receive long-term care. So, it’s highly recommended to discuss your plan and wishes to your loved ones before a crisis happens.

Sometimes, a family member needs to take care of aging parents at home first before moving them to a nursing home or assisted living facility. You need to introduce these possible situations to your loved ones first to make sure that they are on the same page with you and they are ready when it’s time for you to receive ltc.