5 Reasons I Became an E-Resident of Estonia

E-Resident of Where?

For those who are unfamiliar with Estonia's recent history, the small nation has built itself into one of the most tech progressive countries in the region, if not the entire world. Among other claims to fame, Estonia is

- the birthplace of Skype

- the most wired country in Europe

- home to the most startups per capita in the world

- ahead of the curve in considering internet access a basic human right

- an early adopter of digital signatures and identity cards

- first in the world to institute online voting

- the first country to be targeted by- and survive- a national scale cyberattack on both public and private sectors (Russia 2007 attack)

The future is already here — it's just not very evenly distributed.

- William Gibson

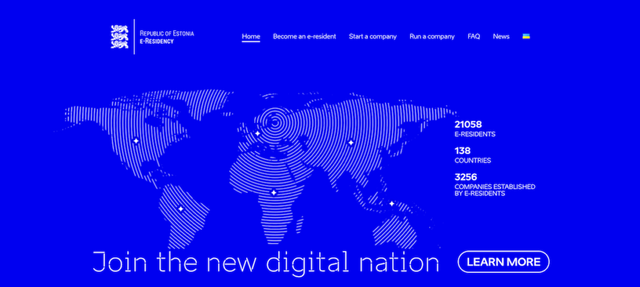

Don't let their small size or history fool you- Estonia plans to build a 'New Digital Nation,' and they mean business. Digital nations are the future, and an Estonian e-residency is a chance to be amongst the first in the world to take part.

Estonian E-Residency Is...

- A smart identity card used to authenticate digital signatures and verify you are who you say you are online

- A formal relationship with Estonia (an EU member) which grants access to financial and legal resources available to EU residents, such as banking

- A general method to securely sign, authenticate, encrypt, and send electronic documents

Estonian E-Residency Is Not...

- Citizenship in Estonian or the EU

- A travel visa or right to physically visit or establish residence in Estonia or the EU

- A picture ID for verifying your identity in offline transactions

- An easy means for tax evasion (more on that later)

Not everyone will have an immediate need for e-residency, but here are 5 compelling reasons that convinced me to apply.

5 Reasons I Became an E-Resident of Estonia

1. Start a Business or Open a Bank Account in the EU (as a non-EU citizen)

As an entrepreneur, business owner, and founder, the prospect of being able to start a company in the EU is of immediate interest. For founders of companies which operate independent of a physical location or which need an EU presence, this is an extremely attractive feature of e-residency.

Yet e-residency also benefits anyone who can make use of EU banking, from independent freelancers and digital nomads with EU customers to individuals who would like to easily transfer and store money in the EU.

I've faced the difficulty of incorporating and opening a bank account in various nations first hand, and know what a massive time waste and headache this process typically poses. Instead of a maze of red tape and paperwork, e-residency's digital signing makes it possible to open a company and bank in an EU member with relative ease, at ow cost, and with no physical presence required- solving all the usual pain points for digital economy businesses.

2. Bank with Cryptocurrencies

Estonia is leading the way in real-world applications for digital signatures, including online voting, which offers something cryptocurrencies are in dire need of: an environment and partner capable and willing to apply revolutionary blockchain technologies to real-world situations.

Whether you are a supporter of the blockchain, already invest in or own some cryptocurrencies, or just want to diversify assets, banking with cryptocurrency represents a major step forward. Several crypto banking providers have sprung up recently, offering services such as debit cards which allow spending crypto holdings at any vendor which accept debit cards (whether they accept cryptos or not). This possibility alone allows for a level of mass adoption that has previously been impossible for cryptos to achieve.

Consistent with their forward thinking approach, Estonia's e-residency program has already partnered with one of these crypto banking providers, Change Bank:

With this partnership Estonian e-residents can expect to be the first in the world to reap the benefits of lower banking fees, quicker transfer times, more secure transactions, and an ability to fully integrate crypto holdings into their day to day lives. Yet most importantly, even if Change Bank is not a success, the very fact that Estonia's e-residency program is partnering with such a project is indicative of the crypto banking benefits e-residency will inevitably offer.

Full disclosure: in addition to being an e-resident supporter, I am also a big fan of Change Bank's mission and execution, and for those interested you can learn more or participate in their ongoing ICO below. NOTE: My personal support of e-residency and Change Bank is not investment advice. If however you do look into Change Bank and decide for yourself to participate, please consider using the below affiliate link to participate, which would grant me some CAG at no cost to you.

https://change-bank.com/?aff_id=6d6174742e6f636f6e6e6f7232313740676d61696c2e636f6d

3. A More Secure, More Convenient Method to Verifying your Online Identity

Existing methods for verifying identity were not designed for online transactions. Passports, driver licenses, social security numbers, the list goes on. None are as secure or convenient as the digital signature process of e-residency.

All it takes is having your passport, credit card, or traditional ID card stolen and thieves have everything they need to pose as you online. Even 2FA text message verifications are still exposed to a wide variety of vulnerabilities, including the obvious situation in which both your wallet and phone stolen at the same time.

As the recent Equifax hacks have demonstrated traditional identification methods options are in dire need of an upgrade. The technology used in Estonia' e-residency cards could very well be the solution.

E-residency offers a secure combination of the smart identity card and a unique digital signature PIN, meaning it is impossible to steal your identity with just a lost or stolen ID card. And while more traditional programs could consider adding some additional verification technology, Estonia's programs are already well ahead of the game- it is entirely possible they continue to improve and tie PIN validation to biometric security measures such as fingerprints.

The bottom line is e-residency offers a uniquely convenient and secure method to verify your online identity- for all kinds of transactions. And this trend is only set to continue, as the platform is improved and adoption grows, in fact by 2018 Estonia's e-residency cards will be accepted as online identification throughout the entire EU.

4. E-residency is the Future, and Early Adopters Stand to Gain

4 years ago e-residency was nothing but an idea

3 years ago e-residency had less than 10,000 applicants and few practical benefits

2 years ago e-residency was insufficient to remotely open an EU bank account

Today e-residency enables opening and operating an EU business and bank account- 100% remotely.

Notice a trend?

How long until 'digital nations' become the norm? Until online identity matters as much, if not more, than offline?

Today e-residency doesn't offer many offline benefits- no travel rights, visa status benefits, physical residency, citizenship fast tracks etc.

Yet as the dominance shifts from offline to online, it's difficult to imagine these limitations remaining the same, especially for earlier, more well established e-residents who have long histories with EU governments and companies.

The concept of e-residency will continue to grow and evolve, and as it does, it's only natural its uses grow as well. While not a clear benefit at the present moment, the risk/reward ratio is overwhelmingly positive. For an application fee of 99 Euros, I not only get something with immediate benefits, I get to be part of the future, part of something that will only continue to become more and more useful.

5. Potential Tax Benefits

As mentioned earlier, e-residency is not a way to avoid or skirt tax liabilities. Having said that, Estonia's tax plan does have one feature that can be very beneficial in particular situations.

While Estonia's tax rate is a flat 20%, corporate taxes are only charged on distributed profits. For young companies and startups which are reinvesting profits into growing the business, this effectively means no corporate tax.

Personal income is not applicable for this exemption, and when profits are eventually distributed to shareholders they are taxed at 20%, but for companies which care much more about cash flow and rapid growth, operating in Estonia can be highly favorable.

Learn More

Ultimately the decision to apply for e-residency is a personal one. For me however the choice was clear, not only for the above 5 reasons, but also because the very idea of e-residency and being among the first 'cyber citizens' in the world is just plain cool. I hope to see you all soon as e-neighbors.

To learn more and/or apply, visit the official site:

wow nice post dude!

Thanks. You know any other e-residents?

I am interested, both on ico and e-residency. Thanks for letting us know! Looking forward your next posts :)

very interesting. Too bad they've missed the wordplay with e-stonia;-)

Haha a missed opportunity for sure

This post received a 1.6% upvote from @randowhale thanks to @mattroconnor! To learn more, check out @randowhale 101 - Everything You Need to Know!

Very interesting. I will be doing research on e-estonia and the banks named. Thanks for the info. It sounds good. I will follow you now.

Resteemed to over 4900 followers and 100% upvoted. Thank you for using my service!

Read here how the new bot from Berlin works.

@resteem.bot

I like your post. @mattroconnor I have followed you

This post has received a 30.00 % upvote from @lovejuice thanks to: @mattroconnor, @mattroconnor. They love you, so does Aggroed. Please be sure to vote for Witnesses at https://steemit.com/~witnesses.

This post has received a 0.59 % upvote from @booster thanks to: @mattroconnor.

@royrodgers has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond. To be Resteemed to 4k+ followers and upvoted heavier send 0.25SBD to @minnowpond with your posts url as the memo