The Five Talents Series: Talent 2b Your Cash Flow is King

Flow is Key

In this installment of our Five Talents Series we will go over the Cash Flow Statement Template and provide the community with an example of a completed cash flow statement. For a quick introduction into the Series Click HERE and you may want to skim through Talent One Your Mental State Does Matter. As mentioned above the Cash Flow Statement Template is a resource available to the entire community which aims to help individuals and families organize a realistic picture of their fiscal health. When looking into the mirror we must not always focus on our defect of which we all have many, but rather accept our circumstances and move forward with a clearer understanding of how to achieve our goal considering our the many obstacles we face.

Cash Flow Statement Explored

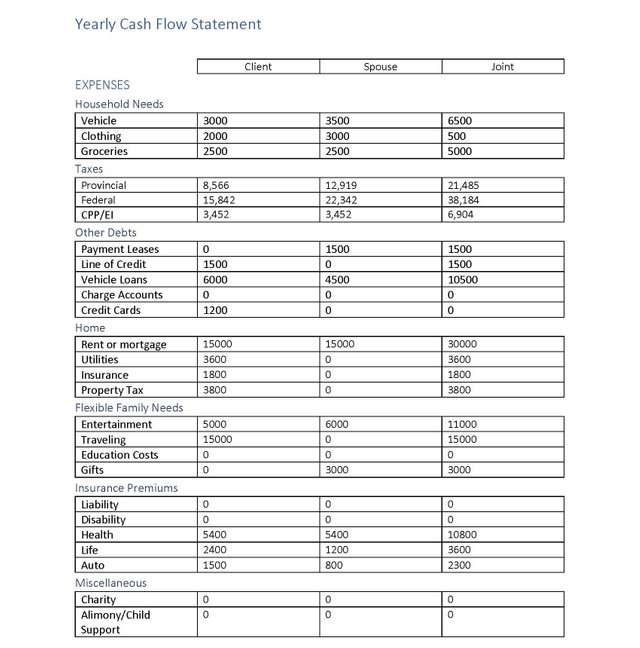

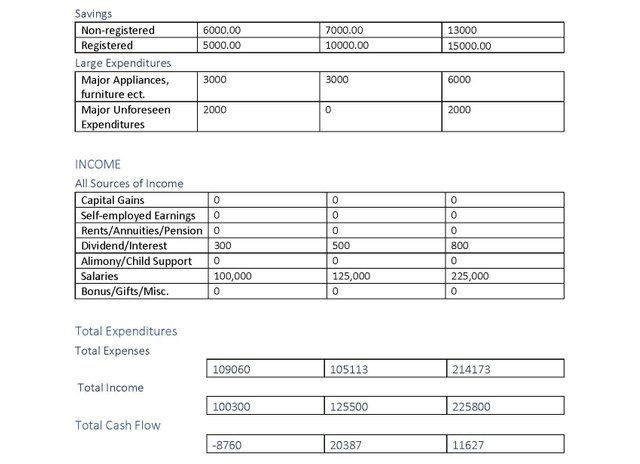

As we covered in the last post Cash Management if we have negative cash flow this is akin to driving a car on an empty tank and eventually the fumes will run out and you will be stuck in tough spot. I hope that before your budget comes to a crashing halt that you would see the additional risk you are putting yourself in and take the first steps in resolving your situation. Let us take a quick look at an example cash flow statement which can also be accessed via PDF Here if that is your preference.

Cash Flow is a Statement of Fact

When reviewing your cash flow statement, you must start by scrutinizing all non-discretionary (fixed expenses) and discretionary spending (i.e. flexible expenses) to figure out how you can reverse your current financial trajectory. At quick glace this example budget look very sensible as the household is composed of two professionals making 6 figure incomes and their expense do not seem extravagant compared to their take home pay. When we dive a little deeper we see that they have very little dividend and interest income which generally means the couple does not have a substantial amount of assets and saving earning interest returns. It is common place for families making larger incomes to be less concerned with savings as nothing could possibly happen to change their budgetary situation. I would like to mention that when murphy comes and moves into your house he tends to bring his broke cousin debt with him. The main question you should be asking yourself when reviewing the cash flow statement is “where did all my money go?”. There are a few places that this cash flow statement seem out of balance upon further investigation. This couple is overspending on travelling and entertainment as $260000.00 of their net income a year which is over 10% of their gross income is being spent on dining and scuba diving trips. This is a lot by any standard and although we must enjoy our lives while we are with the living this must be tempered with a long-term approach to managing wealth. This large expense is putting a lot of pressure on the rest of their budget, and although they have mentioned they would like to contribute monthly to a charity they feel like they can’t afford it. If you look at the rest of the budget it is boring, and this is a good thing. If there is no obvious overspending, you will be need to go into more detail to find what is putting you in the red.

If you Fall Off Get Right Back On

After you work on the initial cash flow statement you should ask yourself how much you have saved over the period covered by the statement. A great deal of money can be wasted on miscellaneous items, and this usually the easiest place to cut and provides the greatest cash flow increase. Keep in mind that old habits die hard, so you will need a certain level of self-discipline. Those miscellaneous habit like your $5.00 soy latté from Starbucks may need to be cut out which can be challenging if this has become part of your routine. The idea is to string as many near perfect spending days together as possible, but you may end up going two steps forward and one step back so don’t be discouraged. In the next post we will look at systematic savings and how this all becomes possible due to an honest cash flow analysis and some hard self-work. Your Mental State Does Matter as most individual will resist change so honest self-assessment is more valuable than any specific financial advice and forms the foundation of financial success.

Woooow nice post

Thanks martin2 the series is just stated so I will be posting more shortly so please follow.

what a good post i like to read it

thank you angel48, In my next post I will talk about savings planing and how you can better achieve your long term objectives. thanks

hopefully be a lucky person in following the flow, hopefully we can take advantage of all this

Thanks for your feedback takin. I like to think of it rather as fortune favors the bold. Do not hesitate or be fearful in the face of actual or potential danger or rebuke. It takes courage to recognize and change our behavior so be courageous and dare to dream.

This post has received votes totaling more than $50.00 from the following pay for vote services:

rocky1 upvote in the amount of $50.37 STU, $68.08 USD.

upme upvote in the amount of $45.12 STU, $60.98 USD.

therising upvote in the amount of $26.85 STU, $36.29 USD.

For a total calculated value of $122 STU, $165 USD before curation, with a calculated curation of $31 USD.

This information is being presented in the interest of transparency on our platform and is by no means a judgement as to the quality of this post.

hey, this post resteemed by @manikchandsk to over 7400 followers and voted. good luck

thanks for using our service.

send 0.200 sbd or steem to @manikchandsk and keep post link in memo that you want resteem + 40 upvote +@manikchandsk 100%upvote.

click for details..https://steemit.com/manikchandsk/@manikchandsk/post-resteem-upvote-service