Why I Love Credit Card Rewards!

Credit cards that pay rewards? Sign me up! Thanks to rewards accumulating automatically from daily expenses, I can reward myself with a fairly large ticket item once a year. Such as the iPhone X I am currently using was purchased mostly with credit card rewards! Using the right set of cards and following the reward schedule for each card set every quarter, you may be surprised at how fast these rewards can be accumulated over the months.

When I use to operate a business, my rewards grew much faster than it does today. Being able to charge large amounts of business expenses on cash back credit cards allowed my rewards to grow in the range of $200-$400 every month! Most of the rewards generated from business credit cards were mostly spent on business expenses or buying employees lunch. If you currently run a business and have the option to charge expenses on your credit card, you should definitely do so! Just make sure your vendors or suppliers don’t charge a transaction fee for credit card payments which may eat into your rewards. Luckily, some of my suppliers never charged such fees. It was a nice extra bonus to have every month.

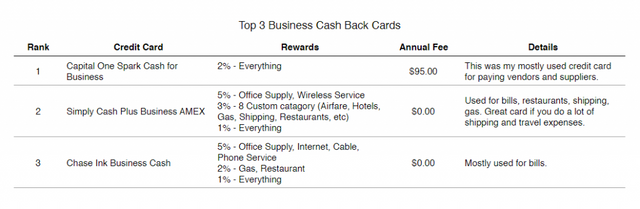

Top 3 business credit cards I enjoyed the most:

My favorite was the Capital One Spark Cash card even with the annual fee of $95. The 2% cash back really adds up quickly making up for the annual fee. If your business can charge $5,000 a month on the card, that will result in a $100 reward. There goes your annual fee! All rewards afterwards are yours to keep. Of course, If you are not able to charge over $5,000 in a year this card will not work for you.

Today, my rewards don’t grow nearly as fast anymore but they grow enough in one year to use towards a nice purchase or add to a vacation.

Every few months I take the time to tally the points and often catch myself surprised at how much they have grown! During the tally, I also evaluate which cards I haven’t used for a while and make sure I make a small purchase to keep the cards active.

This will only work for those who are able to pay off the balances in FULL every month. If you carry balances on your accounts, the interest fees your paying on the revolving debt will likely be much higher than any rewards that may be earned. So, make sure you pay off all your debts prior to saving rewards.

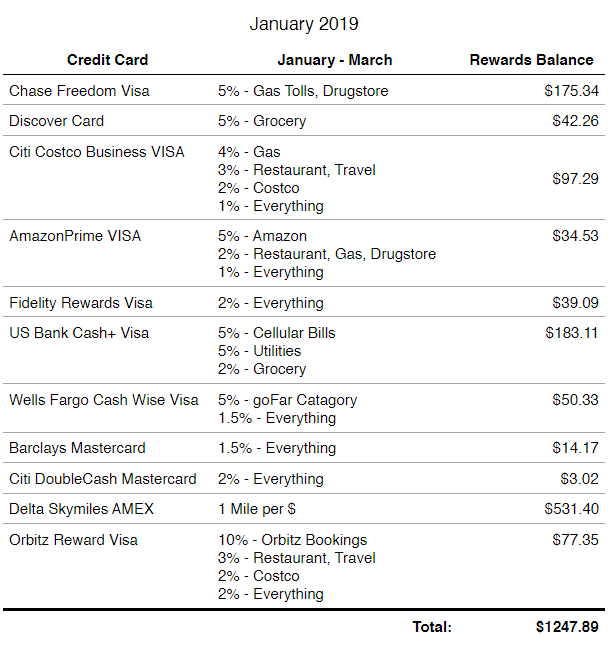

Here is the list of cards I use, along with the reward schedule and the rewards earned as of today:

My favorite cards used mostly are the following:

1. Fidelity Rewards Visa: This is the card I use when I'm not sure which card to use for the maximum rewards. There are many times where I simply don’t wish to hassle over which card to use. That's when I pull this card out. I guess you can say this is my default card. This is just a simple 2% cash back card for all the transactions that don’t fit any rewards schedule. For the full cash value of your points to be realized you must transfer them into your fidelity brokerage account. Some may see this as a drawback but personally I like it. You do have the option to transfer the cash back into your checking account once the rewards settle but often, I catch myself using the rewards to contribute to my cash holdings. Helps my savings! Alternative 2% Cash Back Card: For those who don’t have a Fidelity account, Citi Double Cash Mastercard is a great alternative with the same 2% cash back.

2. Citi Costco Business Visa: Costco always seem to have the best prices for gasoline by far. To top that off with a 4% return using this card is pretty hard to beat. Rewards for this card build up pretty fast every year being a fan of Costco. Great card for restaurant charges and travel expenses as well. The only catch is, the cash back is released once a year.

3. US Bank CASH+ Visa: This card is great for paying bills such as your cellphone, gas, and electric bills. You have the option to choose from a list of categories which I always choose cellular and utilities. I can’t think of any other credit card that gives you 5% off on such utilities every month of the year!

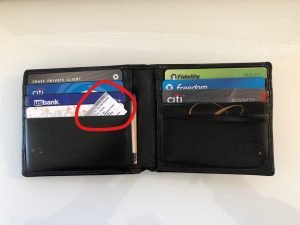

Every 3 months when the reward categories change, I update my list and print a small version for my wallet as a cheat sheet. It helps guide me to the right cards for the maximum rewards when I'm outside. The print is kept in my wallet as shown in the photo.

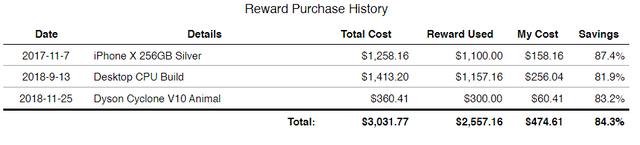

How I spent my rewards in the last 2 years.

There were many things I purchased with rewards which I can't remember. In fact, I decided to start tracking my reward purchase savings just to see how much savings are realized over a longer stretch of time.

In September of 2018, I spent $1157.16 in rewards upgrading my computer! It’s been almost 7 years since I upgraded my desktop, so it was about time. Using my rewards, I was able to save 81.9% on the upgrade.

NEW PC BUILD (2018-9-13) SPECS:

| CPU | Intel i& 8700K 3.7Ghz 6-Core LGA 1151 | $369.89 |

| Motherboard | Asus ROG Strix Z370-E Gaming LGA1151 ATX | $184.99 |

| CPU Cooler | NZXT Kraken X62 280MM | $156.29 |

| Ram | Corsair Vengeance LPX 16GB (2X8GB) DDR4 DRAM 3000Mhz C15 | $152.99 |

| Ram | Corsair Vengeance LPX 16GB (2X8GB) DDR4 DRAM 3000Mhz C15 | $128.00 |

| Primary SSD | Samsung 970 EVO 500GB NVME M.2 2280 | $165.00 |

| Power Supply | EVGA Supernova 80+ Platinum 650W P2 Full Modular PS | $95.88 |

| Case | NZXT H500 | $52.64 |

| OS | Windows 10 Pro | $30.37 |

| Monitor | Samsung LS34E790CNS/ZA 34" WQHD Ultrawide Curved 31:9 | |

| Hard Drive | Seagate Barracuda ST2000DM0001 2TB 7200RPM, 64MB SATA 6GB | |

| Hard Drive | Seagate ST4000DM000 SATA 6GB 4TB 5900RPM, 64MB Cache | |

| Network Card | Asus Dual Band Wireless AC1900 PCI-E (PCE-AC68) | $77.15 |

| Total: | $1413.20 | |

| Credit Card Rewards: | $1157.16 | |

| My Cost: | $256.04 | |

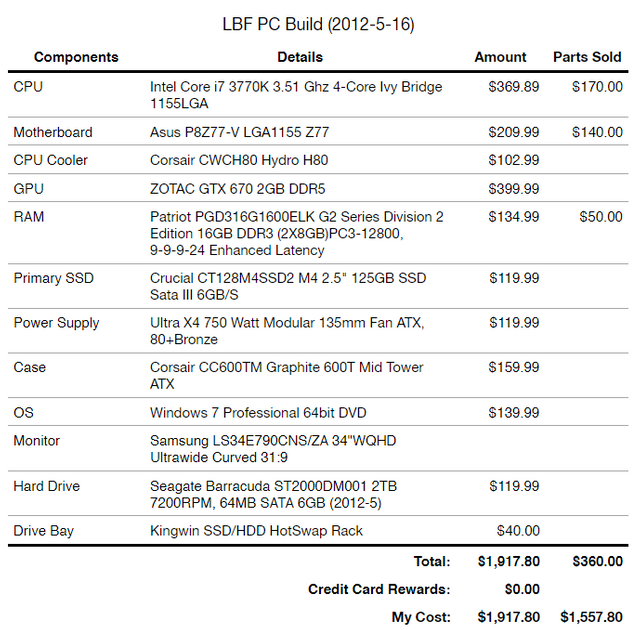

My previous build:

Using sites like eBay and OfferUp, I was able to sell some older components and recovered $360. If you include the money from the sold parts, the new build can be seen costing me nothing! The only component I still haven’t purchased is the graphic card. The old graphic card seems to run quite well and I didn’t feel the need to upgrade since I don't do heavy gaming or rendering. Yet, I do plan to upgrade which will probably cost me around $350 to $500. Perhaps I will use rewards for that as well! We shall see.

Everyone’s spending habits are different, so the cards being carried may differ and be tailored to the individuals spending habits. So, what’s in your wallet? What cards do you use often and why? How do you spend your rewards? Thank you for reading!

Follow me at my website: www.LifeBeyondFIRE.com