January 2019 - Expense Update

In my earlier years, it was a constant struggle trying to pay off debt. I could barely keep my balances above water. Overdraft charges were often too common during those days. I learned at an early age to be frugal due to the limited amount of resources. Only if someone taught me the importance of an emergency fund, I may have not made as nearly as many mistakes with money. With absolutely no financial education, armed with my first credit card at the age of 18, I racked up debt quickly. The hard lessons of life followed right after providing the opportunity to learn from my mistakes.

I learned to be frugal at an early age. Today, I still carry many of the frugal habits from my past. It's seared into my collection of habits. However, extreme frugality is not what I wish to practice in life. My goal is to get to a point where I have no financial restraints on anything I wish to do in life.

An End to Wasteful Consumption

Ever since I went FIRE(Financial Independence Retire Early), I noticed how much useless things I have accumulated over the years. A whole garage full of material things I no longer have use for just sits there. Many items I may never use again. I decided to set myself some disciplinary guidelines for making any further material purchases. Such as the “buy 1 get rid of 3” rule. I’ve been making some progress by selling things on eBay and to locals but I may have to run a yard sale one day.

I was only able to notice how much junk I have once I went FIRE. This really made me realize how inefficient I was with the way I utilized my resources. So lately, I have really been cutting down on my spending in the shopping category. In 2018, I spent in total $6,955.84 in shopping. My plan is to see if I can cut that in half in 2019.

Every product I purchase is now met with the following set of questions:

Will it simplify my life?

How often will I utilize the product.

Can I live without?

Will it bring lasting joy to my life?

Surprisingly, when you think through such questions, you would be surprised how often you decide not to make the purchase. Having more doesn't always equal happiness. It's not about how much you own, it's about why you own it.

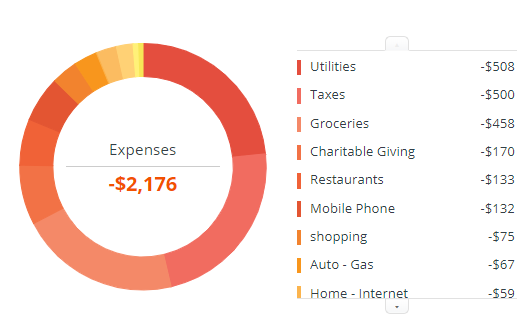

Expenses

Here is a snapshot of my expenses for the month of January 2019.

Utilities (Water, Gas, Electric): $508 - The weather in Southern California has been quite chilly lately. Heating costs can really add up during this time of month.

Taxes: $500 - This tax payment is for a repayment for first time home buyer credit. When purchasing my first property, the government had a program for first time home buyers where it provides an interest free loan. As of this payment, I have a remaining balance of $3,000. My plans are to pay at least $500 - $1000 every January of each year.

Groceries: $458 - This is fairly typical amount I spend per month on groceries.

Charitable Giving: $190 (Correction) - I try to begin the year with giving away some money to charities. My hopes are one day I can give away much more.

Restaurants: $133 - I usually eat very well at home and prefer it rather than eating out. The food at restaurants contain so much sugar it's almost impossible to avoid. I am currently trying to cut sugar out of my diets so my restaurant expense should be reduced further going forward.

Mobile Phone: $132 - I made some changes to my data plan which reduced my monthly obligation down by around $30.

Shopping: $75 - Bought few random small things. I hope to keep this part of my expense low this year.

Auto – Gas: $67 - It was common to spend over $200 in this category when running a business before FIRE. It still amazes me how little this part of my expense has become.

Internet: $59 - This has been slowly creeping upwards. If they raise this one more time, I may do some shopping for better rates.

Fees: $48 - This is from eBay related sales fees and shipping fees.

Subscriptions: $20 - TV Media and WSJ subscription fees.

Auto – Maintenance: $12 - I usually wash my own car but got lazy this time and took it for a wash at a local car wash.

Mortgage Debt Free

As you can see I don't have any mortgage. My house has been completely paid off. No longer do I own the house with a co-owner (bank). It felt amazing and somewhat unreal paying off the house at the age of 36. What a huge excitement that was removing the financial shackles around my ankles.

Not having a mortgage payment helps dramatically with your cash flow but living in California there are still costs to owning a house such as property taxes and insurance! It's important to understand such expenses have an inflationary aspect to them. They almost always go up every year! So the game is to continuously grow your cash flow to cover the rising costs. I'll share more on the details of the rising costs later in a separate post.

All my expenses are all covered by passive investment income from stock dividends and real estate rental income as of today. After all expenses, I am still able to continuously save and invest every month.

I really enjoy my new-found hobby of writing and sharing my journey with the world. I hope to travel more in the future and share my thoughts on that part of my experience. The ability to move and live in different parts of the world for months or even years sound exciting, but I probably need to create a much firmer foundation before I make such a large move in life.

Conclusion

Overall, my expenses were kept well in control for this month. I do have some large expenses coming up in March and May, so I should prepare for those months. Property taxes and insurance expenses are ridiculously high in Southern California. No wonder so many people in California are moving to Texas and Nevada. Moving to those states would improve my cash flow but property appreciation in California is a factor I can’t ignore. We will have to see what decisions I may make in the future. Knowing the fact that I have the freedom to move anywhere I wish without the worries of finding a job is something I still can't believe myself. I may play with some numbers and see if there are any interesting options for the future in a separate post.

How do you guys manage your expenses? I track mines through Personal Capital. It’s a great site to keep track of your cash flow and all of your accounts. Give them a try! It's free to sign up with Personal Capital. Thank you for reading.

Follow me at my website: www.LifeBeyondFIRE.com