Is My Portfolio Allocation Too Risky?

My broker states that my allocation resembles an aggressive growth portfolio. My holdings move similarly to the S&P index mostly deviating away from the index on occasion by upwards of 2% a day, although rare.

I sleep well at night with the risk exposure I have today. However, investing with the focus of dividends has been bringing down my beta in my portfolio. Many quality dividend stocks tend to be lower beta value stocks compared to most of my holdings which are in growth stocks. Growth stocks are much more volatile. I feel the timing is just about right to bring down my overall risk in my portfolio by shifting it towards lower beta dividend stocks rather than holding cash. I am one of many who believe we are in the later cycles of the long bull market. If cash begins to pay 3% and above, I may reconsider and hold some more cash. We will see.

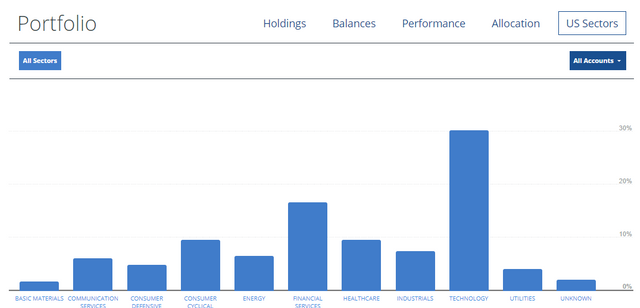

Allocation

My current investment portfolio consists largely of US growth stocks. The LBF dividend portfolio probably will quickly become a larger portion of that allocation over the years. However, my plans are to maintain overweight on growth.

Sector Weight

As far as I can remember, my largest sector holding was technology for well over 10 years. Today, it looks no different just slightly more diversified but with an emphasis in companies leading in research and development related to artificial intelligence. I remain confident more than ever that the technology sector will provide consistent continuous growth going forward.

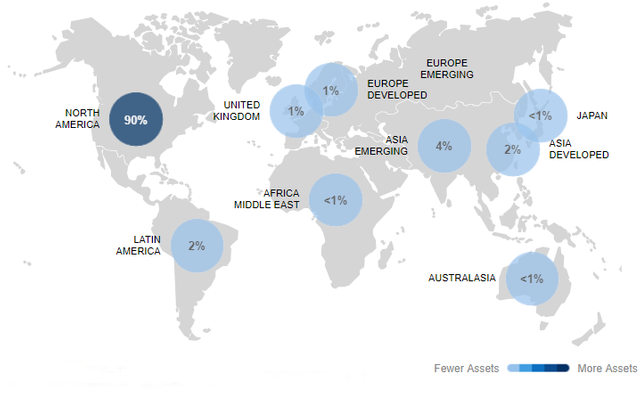

Geographic Distribution

Most of my investments are in US companies, but I do own companies with large revenue growth coming from overseas. My exposure to emerging markets is through US companies. I do have some individual international holdings such as Alibaba (BABA) but not much. Emerging market stocks are still pretty cheap so I may do some shopping or just use an index fund to get some more exposure. India has always been a place of interest for me but have not yet pulled the trigger. We shall see.

Better Understanding of Risk Brings Peace of Mind.

Everyone’s risk appetite will be different. For the last 2 decades of investing, I realized markets generally come back over time. Sometimes it may take longer but sure enough with time, they recover. My earlier years of trading made me realize how pointless it was to jump in and out of markets. After realization, the only times I sold my stocks were to prepare for real estate acquisitions.

I still make mistakes. In 2015 and 2017, I made some sales to increase my cash holdings because I felt we were due for a correction. We did have a 10% correction followed quickly by another long rally and I was slow to deploy my cash. I was trying to time the market which led me to underperform the S&P by few percentage points.

If you have a long investment time horizon, great companies rarely give a reason to sell. My investment time horizon is forever so I don’t plan to do much selling.

After having been through a few large market corrections, I have learned quite a lot about myself. Today I feel more confident about my ability to weather these corrections better. Your ability to navigate big financial storms will require some fundamental things.

The 4 Basics To Weather Financial Storms.

1. Emergency fund of at least 3-6 months of expenses. (More months if you run a business or own investment properties): This is to prevent you from selling your investments due to some unexpected expense such as your car breaking down or a roof leak. Emergency funds act as a buffer between your investments and day to day expenses.

2. Investing time horizon of at least 2 years. Anything less puts you at risk of losing money. This should be your absolute minimum holding period.

3. Stabilized Income. If you don’t have a stable income, it’s more likely you will result to dipping into your investments when times get rough. Make sure you have your income stabilized before you invest.

4. Stabilized lifestyle. You must have complete understanding and control of your cost of living. Anticipating all major life changes such as a new baby, family relocation, or even vacations should be met with planning ahead and saving for such occurrences.

I’m sure many people begin investing with the intention to do so for the long term but fail mostly due to life’s curve balls. As basic and fundamental as these things may seem, it was quite a challenge for me in the past.

The amount of risk I take shifts depending on market conditions. The larger and deeper the market correction, generally is followed by more risk on trades. I love bargains on stocks just as much as I do when shopping for material things.

How are you allocated and are you comfortable with the risk your taking in the markets? Thank you for reading.

Follow me at my website: www.LifeBeyondFIRE.com