February 2019 Dividend Portfolio Update

It has been a long tradition for me to review my finances every month. I enjoy the process of reviewing and documenting my progress. It helps me to look back and help learn from my mistakes.

"What gets measured, gets improved." -Peter Drucker

I began this FIRE dividend portfolio to diversify my portfolio of passive income to provide a better balance of risk to fortify my FIRE lifestyle. Currently, most of my income is coming from real estate rental income but the plan is to diversify my income over 10 different sources of income.

The LBF portfolio will consist mostly of long term holdings. My plans are to accumulate great companies that pay and grow dividends and hold them as long as the fundamental reasons for the viability of the business stays in tack.

It’s been 3 years since I went F.I.R.E. (Financial Independence Retire Early), and noticed my enjoyment in building wealth grows on a daily basis. Reaching FIRE has been an amazing liberating achievement and I feel thankful everyday of the life I have today. Learning about companies and the economy has grown to be a very enjoyable hobby.

The focus of this portfolio is to grow the dividend income. My plan is to create a portfolio that provides income growth that will expand my FIRE lifestyle where one day I may travel anywhere in the world without the financial restrictions as well as better provide for my loved ones.

Quick Market Update

Market recovery after the December correction had an amazing run. Trade discussions with China is hitting a positive note with investors. Federal reserve chairman’s dovish tone and earnings overall helped the markets move forward. Many experts believe most of the year’s gains are already booked for the year. It seems the market has already pricing in a positive outcome to the US China trade dispute.

Markets are up because investors have better clarity on some of these uncertainties that lingered the past 6 months. I miss the lower stock prices! It’s becoming more difficult finding good deals in stocks again.

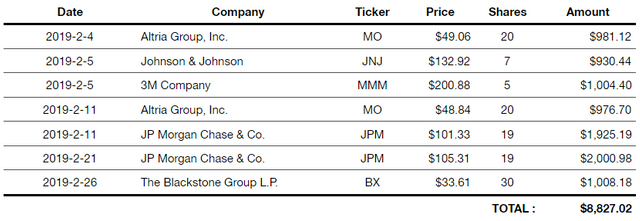

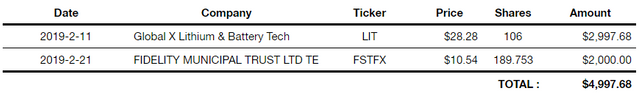

Here are the buys and sells for the month.

Buy Orders

Sell Orders

I have sold some LIT due to the once a year dividend payout and allocated the money towards other stocks. Looking forward, I am growing more cautiously bullish on stocks therefore selling some of my bonds to buy stocks.

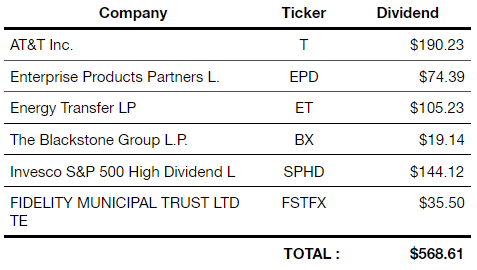

Dividends

This month the LBF portfolio paid out dividends in total of $568.61. That amount of money can cover a month of groceries! Fortunately, I do not have to tap into this income today so I will be reinvesting right back into stocks.

Starting next month, I will be removing my holdings FSTFX from the LBF portfolio. This fund is part of my cash holdings, so I decided to clean out bond holdings from this portfolio to focus mainly on stocks.

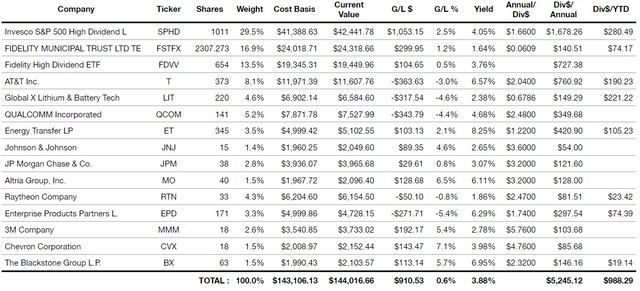

LBF Dividend Portfolio Summary

This month the portfolio ended at $144,016.66 which is 5.2% higher than the previous month. This month continued the rally after the recent market correction. For those who sold during December and missed out on the last two months of gains may have felt some pain. The Portfolio has grown YTD by 18.4%.

Currently, the portfolio is expected to generate around $5,245.12 in annual dividends. That is a -6.6% drop then the previous month which was at $5621. The drop was due to some modifications in my calculations to simplify the estimated annual dividends. The average yield is currently 3.88%. This puts me roughly halfway to my goal of $10,000 in annual dividends.

Conclusion

This month has been amazing as markets continue to climb. Markets bounced back aggressively and the portfolio has recouped all losses from the recent market correction. Dividend increases have been modest, but my focus remains to consistently seek opportunities and purchasing stocks to build this fund into a strong dividend income portfolio that will far outlast me.

I have some large taxes coming due on March and April that may reduce my stock purchases, but we will see.

Overall, I am satisfied with the month and looking forward to the next. It excites me to think about what this fund may become in the future. I look forward to sharing this journey and would love to take your feedback's as well. Thank you for reading.

Note: I recently created a separate page with all the recommended sites and services that helped me reach FIRE in my life. Feel free to check them out if your interested in reaching FIRE.

Follow me at my website: www.LifeBeyondFIRE.com

Congratulations @insidelook! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness and get one more award and increased upvotes!