Saving is Fun When You Understand Compounding Interest!

I'm fairly convinced that more people would save and invest if they simply understood compounding interest. According to this article in the Washington Post, 71% of Americans are not saving enough for retirement. That is just nuts. In this post I would like to provide a down-to-earth, practical explanation of how the rich get richer. Rich people teach their kids how money works, and how to use money to make more money, but a lot of people are just lost on the basics, and that can keep them from ever really getting ahead financially. I will begin with a story about my own upbringing, and how it led to being fairly clueless well into my 30s. I get annoyed by blogs that always have to start with a story, so feel free to skip right to the 2nd heading!

The Obligatory Personal Story

I grew up in a very middle class family. My father was born at the tail end of The Great Depression (1937) to parents who worked hard to live comfortably in a small row home in Northeast Philadelphia. My grandfather worked many different jobs, from a janitor at Pennsylvania Hospital, to running a printing press out of his basement (which apparently, and to my grandmother's chagrin, made him the neighborhood "pornographer." (Think: old timey pin-up girl pictures.) He also sold loose diamonds. You get the picture.

My grandfather's industriousness allowed my dad to spend his teenage years putting every cent he earned into a 1949 Mercury that allowed him and his buddies to cruise 5-points on Friday and Saturday nights, exactly as depicted in the film, American Graffiti. When he graduated from high school he enlisted in the Army, and after that he went into the apprentice program at The Budd Tool and Die Copmany, where he worked for the next 40 years. So, all that meant I grew up extremely lucky. I was never once hungry. I never once worried about having a roof over my head. And I attended good public schools in the suburb that my parents moved to after they were married. My dad made his annual raises like clockwork, and ended up making a decent salary for the time, but the best thing that happened to him financially was the fact that my mom, once my sister and I were in middle school, went back to work as a secretary at a boutique investment firm.

When my mom began the job, she knew absolutely nothing about investing, other than what a typical person learns when they sit on a savings account from a conventional bank. But she was sharp, and her bosses quickly began giving her more and more responsibility. She figured out fairly quickly that those bosses were basically giving her an education in How the Rich Get Richer, in exchange for the deflated salary they were able to pay her in lieu of a college degree. Over the next fifteen years she took my dad's salary, along with her's, and they made enough money to retire in ways that they had never dreamed of.

When my mom first started learning about money, like, for real, she would call me on the phone and tell me to start saving, even if it was just a little bit every month. I was so bad at managing my own finances, and not on any sort of high-paying career track, so saving was just an absurd pipe dream. At least that is what I would tell my mom, and she would inevitably respond with something like, "You're not listening to me." Because, well, I wasn't. Poverty mindset. I am poor, and there is nothing I can do about it, so I may as well just keep spending everything I have, and rack up credit card debt while I am at it. I actually still remember my dad, around that time, telling me that I would probably always spend everything I made and that was just how it goes. His opinion seemed so much easier so that's the one I embraced, and I rolled with it for another 15 years.

It wasn't until I met my wife and we plotted buying a home and starting a family that I really began to appreciate why I might not want to work until the day I die. But even then, it didn't seem to be in my nature to save. This might sound absurd, but things really changed when I downloaded Mint and loaded up all of our accounts. Over the following year I became obsessed with checking our money on a daily basis, and that made me become hyper aware of where every cent was going. Once I got on top of spending, I kicked my saving into high gear, and I was shocked to realize how much fun it was to watch our money grow. It did help that I had a very stable job at this point (not very high paying, mind you, but very predictable).

Today, I find that I get just as much of a rush from socking $1000 into an ETF as I do dropping the same amount on a something fun, like a new bike. I still like to spend money now and then, but I am much more deliberate about it, and do it way less often.

I share this story because I am sure it is very common. In general, people do not think intelligently about money until they have money. This is one factor that keeps people from getting ahead. I somehow managed to become a full-time working adult before I ever heard one thing about financial management. Maybe it was taught in school, but I certainly wasn't paying attention if it was. I don't think it was.

Here are my conclusions based on my early lack of education, and how I came to become more informed and proactive:

- Parents have to come up with creative ways to teach their kids about money and investing

- Young people must do everything they possibly can to struggle through any low-wage, early phases of their careers to prevent from accumulating debt.

- If you accumulate debt you must pay it off as fast as you possibly can. Print pornography in your basement if you have to! (Kidding.)

- Start paying yourself with monthly savings deposits as soon as you possibly can, no matter how little.

- Tap into the power of compounding interest as early in life as you can.

- Use a financial program like Mint to track all of your money in one convenient location.

- Use a fun app like Acorns to learn about saving and compounding interest in a concrete way. (I am not affiliated with Mint or Acorns, but I do provide a sign up link to Acorns at the end of this post that can earn both us $5.)

With that out of the way, let's look more closely at compounding interest.

If More People Understood Compounding Interest More People Would Be Saving!

Since there is a tendency for people who don't understand finance in the way I didn't to put their heads in the sand, let's keep this as simple as possible.

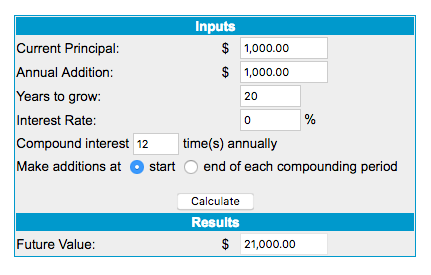

Here is a calculator that I found on MoneyChimp.com:

The first screenshot shows what would happen if you put $1000 under your mattress, and then added $1000 more every year for 20 years. Pretty basic math here. In 20 years you would obviously have $21,000.

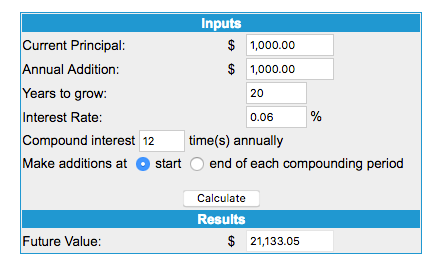

This next shot adds the super incredible amazing (yawn) interest rate provided by a conventional savings account at a bank. According to ValuePenguin.com the average interest rate on savings accounts in 2018 is 0.06%. As you can see, this rate will increase your savings by $133.05 over that same 20 years.

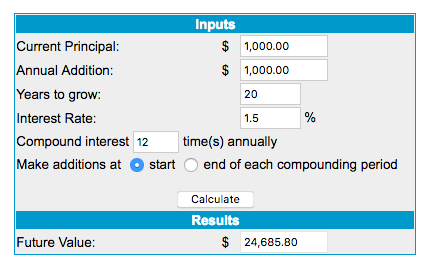

But you can probably find a better interest rate than that. Let's say you find one that pays 1.5%. That adds $685.80. Not bad, considering the money is just sitting there doing nothing. That gives you a small idea of what compounding interest does. I have the calculator set to pay interest every month, which will always lead to a higher annual return than an account that pays the interest once per year. The reason that $685 reflects what is called compounding interest is because each month, the next interest payment is calculated on the new, slightly higher balance than the last interest payment. (If you withdraw your interest each month you would eliminate this powerful concept.)

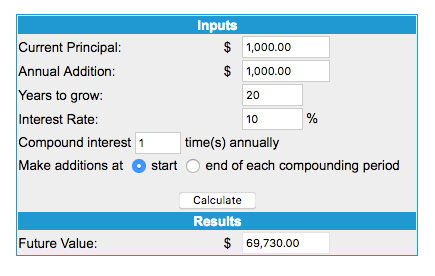

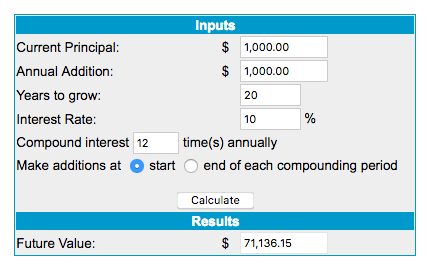

This next shot is where we introduce a higher interest rate, more along the lines of what you might make from a 401K during a good year. Bear in mind, if you put money into a managed portfolio, your money gets spread out over many different investments. From there, you can choose to invest in a higher or lower risk portfolio, depending on your goals. In general, if you are not planning to need the money for a long time, you go with a higher risk/higher return portfolio, but if you know you will need the money sooner, you go low risk/lower return. For this example I plugged 10% into the calculator.

As you can see by the above screenshot, you went from $21,000 with the mattress savings account, to now having an additional $48,730 in 20 years. That is $24,045 more than you would have with the 1.5% interest of a higher than average savings account at a bank. Notice I changed the frequency of interest disbursements to 1, and now you can see the additional amount earned below when I change it back to 12 ($1,406.15).

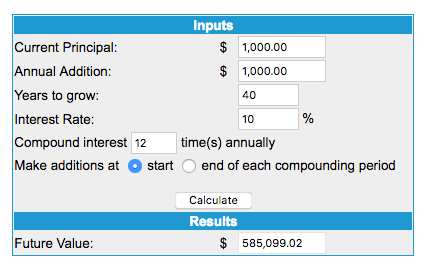

Now comes the real kicker. You are trying to hang on here, and its a little bit of a stretch to understand, I know, but hang on for one more change to the calculation. Are you ready? If you keep up the good work for another 30 years . . .

Yup. after 40 years of $1000 per year at 10% interest you will have a whopping $585,099.02.

Usung Acorns to Save and Learn

Below I show a screenshot from one of my favorite apps, Acorns, to see what compounding interest looks like in a graph. I have been using Acorns for a few years, and I currently have a little over $400 in the account. The graph is a little complicated, but it basically shows that I am currently on track to save $100,602. Now, this is based on the rate at which I have been making little micro deposits into my Acorns account for the last few years, and I have this chart set to age 88. I am likely not going to live that long, but this is just to show compounding interest over the next 20 years, since I am currently 48. I currently automatically invest $20 per month, plus my "Round-Ups" which I will explain after the chart. The higher line in the chart is what I might achieve if I increase my monthly contribution to $110. If I decrease the age at which I plan to withdraw my finds the projected amount will travel down the arc, and if I increase my age it will travel up, and you can see the exponential nature of the difference.

The unique feature of Acorns is what they call "Round-ups." You can link any number of debit and credit cards to your account, and every time you make a purchase, Acorns rounds up the amount to the next dollar. When you accumulate $5 in roundups, it is automatically transferred from your regular bank account to your Acorns account. This is a really effective, pain-free way to make regular contributions to a savings/investment account. You can also set additional details like 2x, 3x, or 10x the amount of your round-ups, and as I wrote above, you can also set a specific amount to be invested automatically every month.

I highly recommend Acorns as a learning tool, and as a way to begin setting aside very small amounts of money if you don't have much left over each month at this phase of your life. As I wrote, I have been using it for a few years, and it is quite slick, and works without any glitches. I am honestly sharing my thoughts on Acorns because I believe it is a very valuable learning tool, and not to make money. But if you use the link below we both get a $5 credit. Its up to you and I will not be the slightest bit offended if you just go find the app on your own :).

Start investing with Acorns today! Get $5 when you use my invite link: https://acorns.com/invite/T6VFTW

I hope you have fond this post helpful. Please feel free to ask me any questions. I am not a financial advisor, and all of this is obviously just based on my own experience, and struggles. Please do not make any financial decisions based on anything I have written, and be sure to consult a professional financial advisor before putting any of your hard-earned money into any type of investment.

Resteemed your article. This article was resteemed because you are part of the New Steemians project. You can learn more about it here: https://steemit.com/introduceyourself/@gaman/new-steemians-project-launch

Yeah it's really good to save

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by cstrimel from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.