CRISE ÉCONOMIQUE EN 2018, QUE FAIRE MAINTENANT?

I want to make it clear to begin with: An economic crisis, a stock market crash is normal!

THIS IS A PURGE

A cyclic purge!

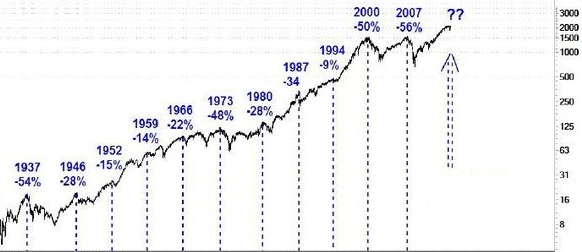

Evolution of the S & P 500 index, representative of the various stock market crashes in history

I do not have a crystal ball, so I do not think I can predict what will happen tomorrow in the markets, especially given that today, given the current elements , We can justify everything and its opposite.

In my opinion, inflation will accelerate, and we are coming to the end of a period when the economy is turning around.

The economy is currently overheating.

First observation:

If you think about the future and the date of the next economic crisis, do not invest on the stock market.

So far from me this idea of dictating what to do according to this assumption and do not make this mistake of wanting to anticipate the markets ...

... but it is better to prevent than to cure!

That said, here are some important points:

The indebtedness of the private sector is increasing (especially in china aïe ...)

Even the banks are worried about Trump's program. And historically, if US rates rise, European rates rise.

China's investment bubble can be disastrous.

Finally, in short, what happens in the United States and China hangs in our face!

Many assets will be depreciated and we will begin to witness bank failures worldwide and no longer only in the United States.

As the Russians say, the economic situation will be so degraded that women will marry for love.

Take the case of the stock market.

Do not play the game waiting for an event to invest though it is wise to take advantage of an economic crisis. This is where the best deals are made.

For example, make sure that your stock portfolio does not suffer.

Readers of the newsletter know how my stock portfolio is constituted, both to get a very good return and not stress in such a situation.

The market is very high (bull market since 2009 exceeding the pre-crisis valuations and setting historical records), so does not fit now if you do not master this kind of notions.

A TREE DOES NOT RISE UP TO THE HEAVEN!

I insist that this article is not an encouragement to intelligent procrastination but we must have a plan of action and know what we do of course!

To go back to the details of my example, we must not forget that there are plenty of actions that are doing very well in times of economic crisis.

You just have to choose them well.

I think for example of Hermes (years I have in portfolio), it is one of the companies that has the best commercial profitability in French quotation while having no debt. Hermes has been doing very well for many years!

Not an enormous yield that makes the novices fly away ... 🙂 but an action that connoisseurs know how to understand!

Short,

Here is another advice in times of economic crisis.

Finally, not "in times of crisis" but "before crisis" precisely to overfly.

An emerging investor will always keep an identical proportion for his assets: 20% real estate, 20% gold, 20% share, 20% bond and 20% cash (for the latter, do not hesitate To go franco obtaining dollars, euros, pound sterling, Swiss franc, crowns ...).

This type of weighting allows us to deal with all market cycles by limiting the volatility of the portfolio and by generating regular returns.

In addition to this diversification of levers, uses the method of Benjamin Graham (mentor of Warren Buffet;)) who advanced the concept of "dollar-cost averaging" which is a sort of diversification in time.

The idea is to add a monthly sum in its investment portfolio, regardless of the market situation. This avoids the emotional biases that push us to buy at the top and sell at the lowest.

"We are convinced that if the smart investor strives to make market timing, he will end up in the shoes of a speculator and will have speculative results. "

It's very powerful!

Thank you Benjamin.

If Graham was still there, he would tell us that the best time to go public is "a little bit all the time".

Diversifying is what has worked best in history.

Let's go to my (crazy?) Post economic crisis theories ... say for 2021!

1 - Cryptomonics will revolutionize the internet and the economy.

Do not chase the peaks and do not be obsessed with the bitcoin (the dominance of the BTC is already much less strong than before), plenty of other corners are just waiting to explode !!

Attention, the BTC, for me is a bit like a short-lived cat, between the problems of governments and the technological backwardness, we must bet on the altcoins (competitors) if you want to win big.

At the moment, it is at a summit, we bring the public and BIM the big go the shorts and the news will do everything for the dumper to death. The BTC will become cumbersome to handle, and mining too. There will be more and more fees on BTC transactions. Clearly the BTC will not lose its value, quite the opposite, but will be led to take a place that will take it out of the crypto monetary system to become a benchmark, a gold standard.

From the point of view of money, for trading of commercial transactions there will be a place on the market. We will soon declare it obsolete to sell altcoins (for me, the LTC is designated).

So be careful in the short term, rather expect "balances" in September / October when the hype will be down, this will be the time to take a max of altcoins and BTC if actually it goes down.

-> The method #jyconnaisrienmaisjeveuxfairedubiff for the years to come: You take the top 10 cryptomonnaies and you do not touch anything for months. RDV in 2021 to make the accounts.

And yes, when you do not know how to trade, you have to be patient.

As long as we are in Blockchain technology, I continue on ...

2 - investment in big data, it will explode! Digitalisation of our world obliges ...

One can look at the GAFA (Google, Apple, Facebook, Amazon) as investing live in Big Data startups, especially via crowdfunding platforms or participatory financing.

3 - investment in Biotech, will be very popular; Great scientific advances, great innovations are going to do a great deal. The share of subscriptions from individual investors (individual shareholders) is particularly important, much more so than in other sectors. To invest in the sector, you only need to have a PEA. These companies may be subscribed to at the time of the IPO or on the secondary market but there are also specialized funds in this sector.

4 - my prediction for gold in the years to come is at least $ 10,000 per ounce in current currency (currently $ 1,250)

In case of hyperinflation, it could be much higher.

If you understand history and economy, you understand gold my dear friend!

Gold, in the short term, is under pressure, and it could drop a little bit.

But well, few people are realizing the opportunities ahead in asset markets like gold in the next five years.

Hard work pays off.

In the end an economic crisis is more an opportunity than a disaster.

But hey, it's all about a state of mind in life. People will suffer ...

Never fall into the trap of anticipation but place your marbles well!

At your disposal to discuss it. 😉 Give your opinion in the comments and share it with your friends.