Briggsy's Quotes to Keep You Grounded #22

Buy when there's blood in the streets, even if the blood is your own

-Baron Rothschild

While many still believe the false tales surrounding Nathan Rothschild and the Battle of Waterloo that took two centuries to properly debunk, this quote would still be worth as much coming from any person besides a Rothschild; and that's because every person who has ever speculated in any market soon finds out that you make your money when you buy in.

When it comes to speculative markets, you can always spot the new people. They will often ask things like:

"why is the price of Bitcoin falling? will it go back up again?"

These are valid questions, and many answers can be given, but in the end there is only one answer that is always correct: Emotions.

This is the "secret" to successful market speculation.

When you realize that every person invested in a market is driven by emotion, you have to find a way to overcome your own.

In the case of cryptocurrency you should buy a hardware wallet, and don't carry the hardware wallet around with you. Also don't leave coins on an exchange, and most importantly you should never buy something you don't understand. Otherwise, you are left with uncertainty in the value, and uncertainty leads to a loss of emotional control when the price of what you are holding goes up or down in ways you don't understand. Part of understanding is continuing to research and dig up information on what you are holding, to have an idea when the price might rise or fall next.

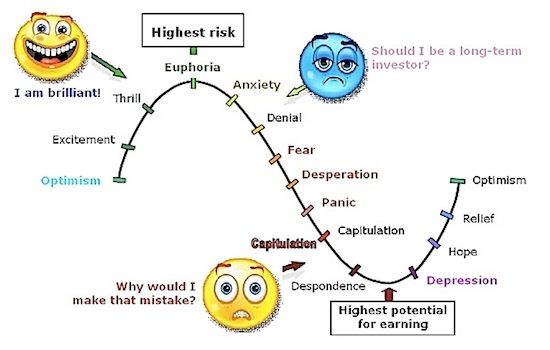

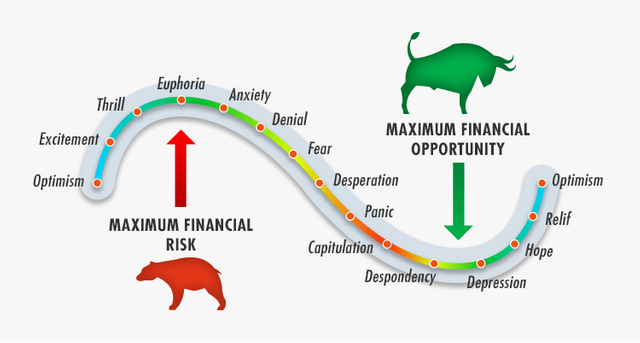

Every single person who has ever invested into a speculative market has fallen into the ditch more than once. Our emotions are our worse enemy with investing, at least when we are first starting out.

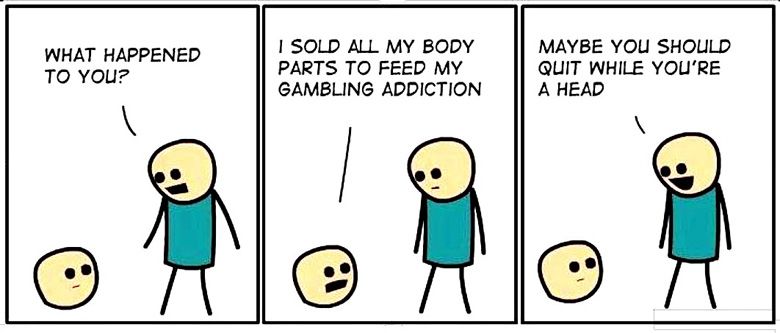

Most people who are buying during the Excitement, Thrill and Euphoria stages are gamblers. Casino's Operate within that range 24/7. Gamblers of money are no different than drug addicts - both sharing the same internal lust for excitement and momentary pleasure - even if it means long term pain or loss.

But aside from setting up roadblocks for yourself (i.e. - hardware wallet) to prevent emotional decisions from being made, one has to develop a reverse emotional reaction to the market direction. It requires a mindset of doubt and healthy skepticism, like your government telling you the economy is rock solid before everything collapses two days later. Were they lying about everything being rock solid, or just trying to delay something from happening? But then you have to ask "how did they know?"

The answer to that question is simple: collectively, people make increasingly dumber and riskier decisions as a market is reaching its peak. In an economy, just look for people racking up credit card debt, or taking out a second mortgage to buy stocks. The simple truth is a government controls the money being pushed into the economy, and therefore a government knows when things are becoming unstable.

The emotions that cause a market to over-extend in the first place is partly the Fear of Missing Out (FOMO), and high risk behavior that comes with being involved with a large crowd. Because there are lots of people talking about a soaring market, this makes one feel more confident in buying, and they don't want to miss out on any gains that can be had. Justifications are made, like "if I invest a thousand and the market drops to zero, I'm out a thousand. But if the market keeps going up, I could double my money!" Or another one that goes "I could get hit by a bus tomorrow and taking a chance now would mean nothing!"

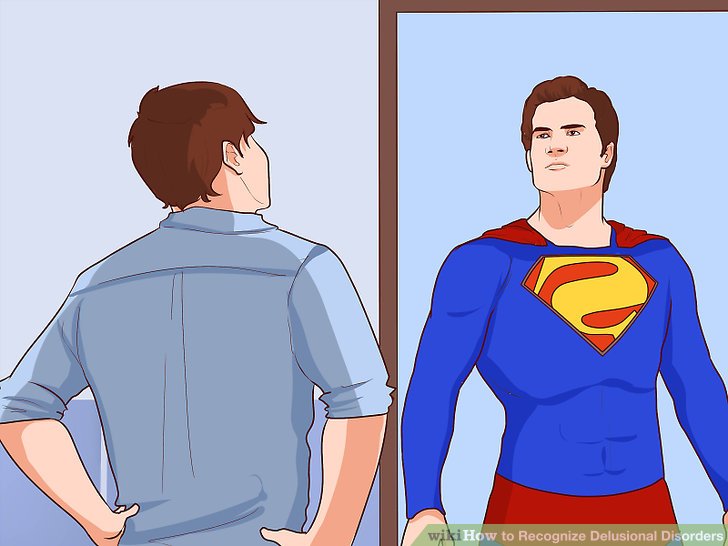

This is just delusional behavior though, spurned on by the drive for excitement and risk that makes us feel more alive, at least momentarily.

I believe the key to success is educating one's self in the systems at play, and learning to know what way the wind is blowing. If you were to show a gambling addict exactly how a casino works behind the scenes, the emotions that drive them to visit a casino would likely change. Instead of going for excitement, they might suddenly want to play the system if possible.

Speculative markets are no different. The more your understand about how prices rise and fall, and the more you research what you are investing into, the more you will feel confident in every move you make, even if sometimes it backfires.

A gambler always loses because they are confined to the rules of the game, while the casino always wins because they are not confined to the rules. While I'm not advocating unethical behavior, I'm simply pointing out that in a market - like with Bitcoin speculation - there are large whales that literally move markets. They play by their own set of rules. The whales also move around in patterns that are mathematically predictable in the long term.

I will give an example of predicting a market. Below is a chart for Steem to USD. I sold some Steem for USD when it hit 4 dollars yesterday, knowing that it would probably drop soon. How did I know? Because the price had reached the trend line, even doing so repeatedly in a short time period.

Bitcoin had a similar appearance. With larger markets like that, you may often see a first spike that hits the trend line, then what looks like a correction, then a second peak before dropping sharply. You can see this clearly with today's massive drop in price across the whole market.

While it can be argued that it is Christmas time and that's why the prices fell, You didn't need to know it was Christmas to see that a correction was coming for bitcoin. I could post countless charts of different coins and many would look similar.

At the end of the day, it's important to be in control of your emotions, and not to be controlled by them, especially when your money is at stake. While it may seem that there are some people who are just better at being in control and making good decisions; most that are better are merely using any means they can to prevent themselves from acting irrationally. When Bitcoin drops 30 percent and they feel like selling, they can't because their hardware wallet is not readily accessible.

The smarter thing to do is when you see the prices crashing, is to already have planned for it and have money aside to buy more coins at a discount price. You make your money when you buy in. If you buy in at the peak of the market, you just lost money in the short term and potentially the long term if you face a considerable bear market.

Briggsy, I was so happy when I saw the dump, i was able to get a little bitcoin cash at bargain prices :)

I like your honest outlook it's good conversation to have thanks for not just posting a screenshot but actually sharing the thoughts.

Great post man very informative upvote, resteem, comment done✌✌✌