A Dose OF Realism - Auckland #2 - Bankruptcy

Bankruptcy is normally attached to businesses but people can also go bankrupt also but how is it possible for a business or a person to go bankrupt as the stigma around the word bankrupt people look at you like you have done something really bad to go bankrupt.

So lets add A Dose OF Realism to Bankruptcy

Business Bankruptcy

Peeling back what it takes to run a business, the expenses, where some links in the chain can go wrong to cause bankruptcy.

- You might need to get a loan to start or expand your business idea

- Rental space/Office/warehouse

- Employees

- Power, Water, Sewage, Internet - depending on what area your in depends on amenities to pay for

- Cleaning supplies, coffee/tea/sugar/milk etc

- Computers - Electronics/office supplies -stationary/safe/tills etc

- Capital

This is just to get a business started, then you need to have a product

- Suppliers

- Manufacturers

- Shipping/freight charges

- Marketing/Advertising/Website/SEO/Email Newsletters/Blog Content/Social Media

- Customers

- Travel to making surer the right product is getting done

- Custom taxes

- Sale taxes

- Tax

Any Business can go bankrupt at any time, what are some of the causes to a business going bankrupt

- Not making enough profits to cover expenses/high over heads

- Costs going higher - rent, power, employee costs

- Competition - same or similar product or service being sold cheaper or your service is not as good as somewhere else.

- Natural disasters/Financial crisis

- Not keeping up with changes - Advertising/Marketing ways, Technology

- Out dated products or ideas

- Employees - unhelpful staff to customers, or that are just their to get paid but don't really do anything

- Taxes

Business ideas change all the time, it's picking and choosing what will work with your business to keep it a float.

Depends where you get your products from, as the mark up from going from middle man to middle man, you may have paid for five middle men before it's reached your door then you need to charge your customers - cutting middlemen going direct to manufacturers helps with the profits.

What happens if your an employee of a company that's going bankrupt

- If the assessors have come in your wages will not be paid out straight away

- If you do get paid, the bank can go in and take that money out of your bank account and say that money doesn't belong to you - which the money does, but because the assessors are involved their services get paid first, you get anything that is left over

- Go to the Benefit straight away they will start helping you, stand down is a week or so not the 28 week stand down - so that you can have your bills covered while your looking for a job, as it can take up to 6 months or longer to get your last payment if you get one and it maybe scattered payments also

Personal Bankruptcy

How can people go bankrupt very easily credit cards, loans, bank fees, fees/bills, tax, mortgage/rent, - spending more than what is being made.

Everywhere we look, listen - TV, Radio, Social Media, Billboards living large, having nice things, keep up with the Jones (keeping up with celebrity, neighbors, others, etc).

Products aren't made like they used to be quality wise - 20 plus years ago you could buy a TV that would still be going today, while buying TV's ten years ago are already not working.

We are in a consumer era where the quality isn't as what it used to be so we keep buy as we have the mentality that we need everything - where we don't.

The biggest consumers and businesses target market is kids - the latest trend was the fidget spinners, sticks and cubes if you didn't have one you weren't like everyone else, parent's don't like their kids missing out or feeling left out, so they buy it, the kids are happy, they play with it for five seconds then it's he next new shiny toy that's the new must have.

Kids don't need everything and neither do we.

What happens to all the bills if the bread winner has an accident, falls ill, or loses their job, bills don't stop coming in but wages do.

With jobs becoming harder and harder to get, everyday items cost going higher, living costs going higher, where do you turn for extra income....

What do you do when you can't pay your bills, the debt collectors are coming taking things, trying to find a cheaper area to live (if you have children that are in school that is extra costs in new books, activity fees, uniforms etc, moving costs, if renting - letting fees, bond etc, buying - lawyer fees, land rates etc)

Being in a financial disarray can cause depression which can feel like your world is caving in on you, if you can't pay your bills or find a way to lower them, or borrow money, to get them under control going bankrupt may be the only option.

What options do you have for going bankrupt in New Zealand

- If your debt is less than $47,000 you have two options

* You can do an (SIO) Summary Instalment Order - where Creditors give you the option to pay all or some of the debt back installments over a three year or up to a five year period depending on your situation and your debtors.

Your credit rating can be affected up to seven years.

The (SIO) option may allow you to keep your belongings

* Or if you have no assets you could do a (NAP) No Asset Procedure - to do an NAP you must have no assets, not done an NAP or gone Bankrupt before, it's a procedure that declares to the people/companies know that you have borrowed money from that you can no longer pay them and have no assets to sell to pay them either.

Creditors can still come and take any of your property that has value.

The bank can close all accounts you hold with them also, you will be on the registry for four years, your credit can be affected for up to seven years, during the procedure you can only borrow up to the maximum of $1,000. - Declaring Bankruptcy

Your name and that you are bankrupt will appear in the local paper, your details will also be on the registry website, you will remain bankrupt for at least three years, your credit rating can be affect up to seven years - but some companies may not lead you money at all if you have been bankrupt.

You can't own or run a company until you are discharged from bankruptcy.

How does going bankrupt affect your life

Pros

- Financial freedom from not owing any one

- Less stress from not being able to cover what was just wiped

Cons

- Having no credit cards or financial back up - living week to week

- You may get your bank account closed - the only bank that may take you might be the Kiwi Bank - where you will only be allowed a debit card - where you can only spend your money you have in that bank account.

- If you a owner or director of a business you will have to stand down

- You'll need to hand over your assets to the creditors, they will sell them for what ever they want - at a low price - not what you paid for them.

What your not told:-

- If you are getting a rental property agency's wont rent to you - there time line keeps changing was 7, then was 9 years - you'll need to find a private rental, flatmates, housing NZ, caravan, tiny home or another option.

- Credit ratings are checked for some jobs and property rental

- You may not be able to get a job that does credit rating checks - admin, data processing, director, anything that handles money - that does credit checks - was up to seven years but that can be with you forever

- You'll need to change the way you shop and your lifestyle so you can stay within your means.

When you take control of your finances where they aren't controlling you, you are controlling them you get a sense of empowerment.

You might find yourself doing things you would of never looked at before and enjoying yourself more.

Living within your means doesn't make you poor it makes you smart, your living the way you can afford, you'll be more happier when you feel more complete, and not worrying about finances, living more simpler and more sustainable and self efficient.

You don't need everything, look at everything you would like to buy - is it a need or a want.

- Need

- a car - do you need a car could you walk, or maybe buy a push bike to get you where you need to go

- If you need a car buy a car where it is reliable, common car with lots of available parts - like Toyota, Nissan, Mazda etc, you don't want any V6, V8 - any petrol eaters just a simple run about.

- Clothes/Accessories - you only need a few sets of clothes, buy classic not fashionable seasons items

- Wholesale shop - buy direct from wholesalers, factory's where you can

- Don't buy on full price wait till a discount

- A need is that you can't live with out it - like shelter, food and warmth etc - Want

- you would like a new pair of shoes but you have two good pairs at home

- a want is you don't really need it but would like it - either to make yourself feel filled or happy, or plain simple just to show off, that you have something nice, that you can keep up with everyone else.

You don't need a lawyer to file for bankruptcy, (that's just an extra unneeded cost) you can go to citizen advice bureau - website here

you can get free advice on what to do and where to go, and fill in the form yourself, if you have any trouble with the form there is a number to ring on the form.

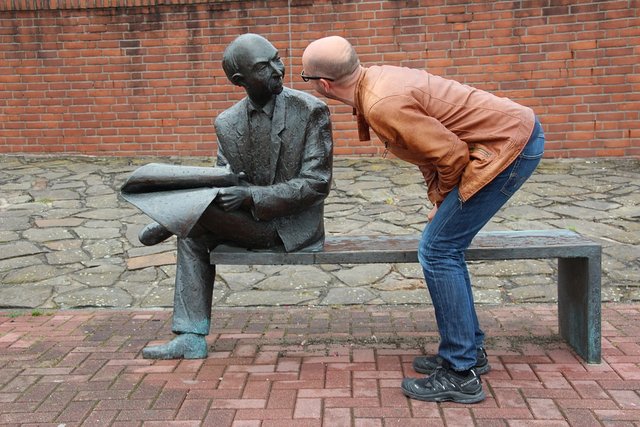

Picture Source 1st picture

Hope this was helpful for anyone that is looking at this avenue

If you missed our first A Dose OF Realism - Auckland Series here it is!

Another helpful post you may of missed is - A Guide to Surviving the School Holidays in Auckland Here!

Thanks for stopping by, have a Fabulous Day/Evening!

Congratulations @biglipsmama! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here

Great Analysis, your post deserves a steemit oscar ..

Thank you so much Cryptocharts, took about three hours to write this post, seeing your comment made me really happy Thank you so much.