When I was growing up a mobile phone was seen as a luxury. Something only businessmen owned to make important calls overseas. Over the years the line between a phone and a computer has become increasingly blurred as new and exciting features have become the norm. We now have more processing power and information in our pockets than the president of United States did 20 years ago. We have access to a vast library of human knowledge as well as billions of hours of entertainment in audio, visual or text form. There are people who decry technology as evil but technology is just a tool and like any tool it facilitates your actions (whether positive or negative) into the world. You don't have to look far to see traditional industries such as advertising, journalism and photography being disrupted by technology. And banking is next.

The strength of banks has always been trust but over the last few decades their carefully crafted facade has started to slip. These corporations have been caught laundering money for Mexican cartels, rigging Libor rates and playing a major role in the 2008 financial crisis. It's safe to say the public trust in these institutions is at an all time low. Do any of us really know how our money is used once it enters the chaotic financial system? If money is information then why do we pay exuberant fees and wait days to send it abroad when a WhatsApp message gets delivered instantly? Technological evolution forces companies to take on an 'adapt or die' mentality with falling costs due to increased competition and economies of scale. Over the last few years companies have sprung up around the world with the aim of displacing the incumbents and I wanted to highlight a few of them here.

[separator type="thin"]

When I was growing up a mobile phone was seen as a luxury. Something only businessmen owned to make important calls overseas. Over the years the line between a phone and a computer has become increasingly blurred as new and exciting features have become the norm. We now have more processing power and information in our pockets than the president of United States did 20 years ago. We have access to a vast library of human knowledge as well as billions of hours of entertainment in audio, visual or text form. There are people who decry technology as evil but technology is just a tool and like any tool it facilitates your actions (whether positive or negative) into the world. You don't have to look far to see traditional industries such as advertising, journalism and photography being disrupted by technology. And banking is next.

The strength of banks has always been trust but over the last few decades their carefully crafted facade has started to slip. These corporations have been caught laundering money for Mexican cartels, rigging Libor rates and playing a major role in the 2008 financial crisis. It's safe to say the public trust in these institutions is at an all time low. Do any of us really know how our money is used once it enters the chaotic financial system? If money is information then why do we pay exuberant fees and wait days to send it abroad when a WhatsApp message gets delivered instantly? Technological evolution forces companies to take on an 'adapt or die' mentality with falling costs due to increased competition and economies of scale. Over the last few years companies have sprung up around the world with the aim of displacing the incumbents and I wanted to highlight a few of them here.

[separator type="thin"]

The Contenders

Countries such as China have started to adopt a 'mobile first' approach to payments which allows its citizens to pay bills and order taxis all within one universal app. Authoritarian implications aside, the ease of use and mass adoption of this idea means Europe is not far behind. Here are 3 companies that I've used in the last few years that are poised to make an impact in the European banking scene.

[separator type="thin"]

[columns_row width="third"]

[column]

LOOT

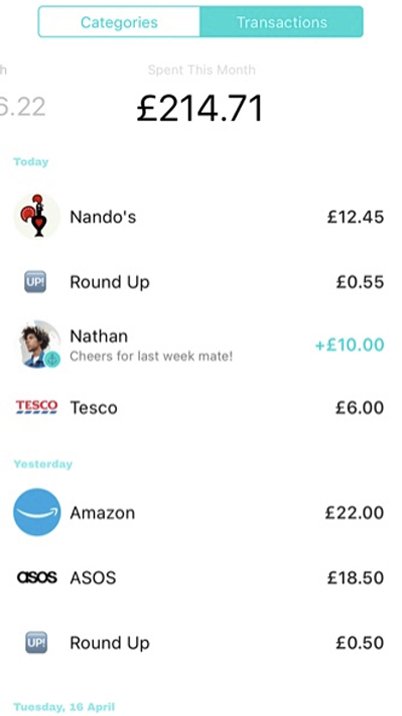

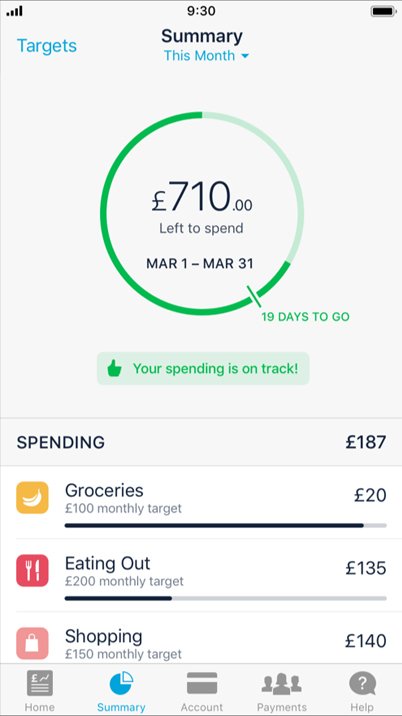

Loot is a challenger bank offering personalised features to keep track of your finances. Loot aims to ensure you never have to ‘miss out’, whether you’re working towards a trip around the world or dinner with friends.

[/column]

[column]

REVOLUT

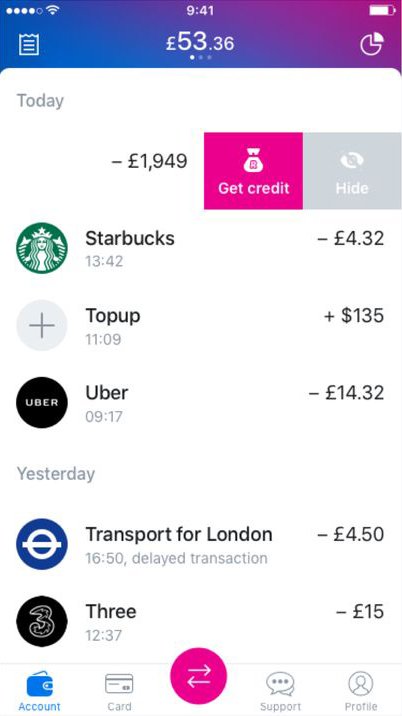

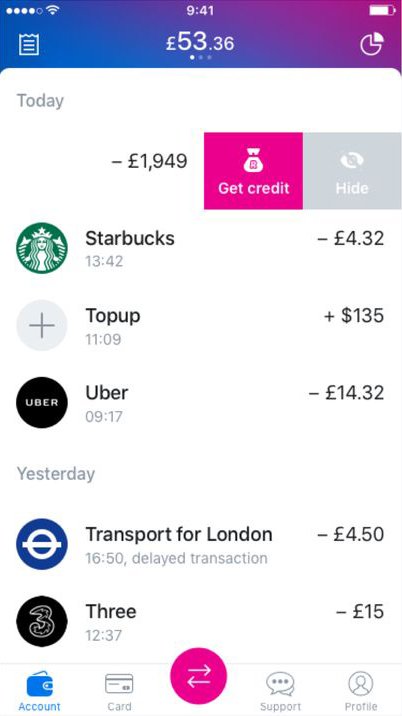

A digital-only company that sets itself apart by offering the ability to hold a number of different currencies and cryptocurrencies. It’s aimed at the millennial traveller, offering competitive exchange rates and international money transfers with no hidden fees.

[/column]

[column]

MONZO

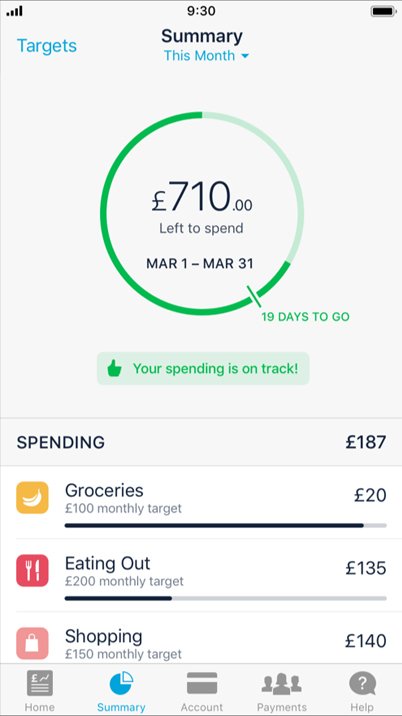

Monzo is one of the biggest names among challenger banks in the UK. It’s a digital, mobile-only bank that offers a current account with a well designed app and a contactless Mastercard that works without a hitch abroad.

[/column]

[/columns_row]

[separator type="thin"]

[separator type="thin"]

User Experience + Design

[separator type="thin"]

My auntie is the least tech literate person I know so to make this a fair and unbiased test I decided to use her as my UX test subject. I asked her to give me a mark out of 10 for initial setup, ease of use (features such as topping up, sending payments and setting up a savings pot), overall look and feel and ability to get help within the app. I will also add points for any additional features these companies provide.

[columns_row width="third"]

[column]

LOOT

Initial Setup: 9/10

Ease of Use: 8/10

Look & Feel: 7/10

Help: 7/10

Additional Features: 5/10

Overall: 36/50

Although the Loot app is the only one that provides a web alternative it also means logging in with a password every single time instead of a PIN. The 'Help' section was difficult to find as it only appears as a small icon on one of the categories. It also offers very few additional features compared to its competitors such as cryptocurrencies, overdrafts or the ability to have your salary paid in directly.

[/column]

[column]

REVOLUT

Initial Setup: 8/10

Ease of Use: 8/10

Look & Feel: 8/10

Help: 8/10

Additional Features: 9/10

Overall: 41/50

Revolut is the card I tend to use the most during my travels. You can spend in over 150 currencies or exchange FIAT for cryptocurrencies such as Bitcoin/Ethereum at very competitive rates . You get a free Euro IBAN account for international payments, set budgets and monitor spending habits. The app is very easy to navigate and offers many additional features for a low monthly payment.

[/column]

[column]

MONZO

Initial Setup: 8/10

Ease of Use: 8/10

Look & Feel: 8/10

Help: 9/10

Additional Features: 8/10

Overall: 41/50

Very similar to Revolut but aimed more towards the UK market. Monzo offers a full UK Current Account – you can receive salary, make direct debit payments, bank transfers or even open overdraft. Help was very easy to find and the design is geared towards great user experience. Thoughtful touches such as monthly spending reports help you keep your finances in check. The only downside I found is the 3% ATM withdrawal charge when you're abroad.

[/column]

[/columns_row]

Overall all 3 apps came out with a solid rating with Loot slightly behind due to its lack of features. Monzo is a perfect alternative to traditional UK Current Accounts while a wide range of currencies and competitive exchange rates means Revolut is the ideal companion when travelling abroad. Compared to the mess that banking apps such as Natwest or Nationwide provide, using Monzo and Revolut abroad was like a breath of fresh air. Spending breakdowns allow for tighter control of your finances and the ability to freeze your card or instantly pay contacts are features that are very handy in day to day life. (If you're interested follow this link to find out more).

The next step for mobile technology is giving everyone in the world the ability to manage their own money and freely exchange it for goods and services. The unbanked in developing countries in Africa, South America and Asia will leapfrog banks just as they leapfrogged landlines with mobile phones. Cryptocurrencies are a step in the right direction but there are still major hurdles to overcome before they're accepted as a stable form of money. For the time being all we can do is vote with our wallets and I commend companies such as Loot, Monzo and Revolut for embracing the inevitable change we're going to experience in our lifetime.

[separator type="thin"]

[separator type="thin"]

Thanks for taking the time to read my latest article. If you wish to support my work please give it a share using the links below and follow my social channels. If you wish to collaborate with me please send an email to [email protected]

[separator type="thin"]

INSTAGRAM | TWITTER | FACEBOOK | PINTEREST

Posted from my blog with SteemPress : http://www.thestyledivision.com/mobile-banking-revolut-monzo-loot