SECURITIES REGULATION IN 2047

SECURITIES REGULATION IN 2047

The year 2047, the year in which Hong Kong will fully rejoin China, is a long way in the future. It would be easy to say that this is too far in the future to make any sort of reasonable prediction about what securities regulation is going to look like. By comparison, thirty years ago the impact of the commercial personal computer was still nascent and few people would have even been aware of the technology that would become the internet. In 1987 we were still living in a relative stone age regarding access to information, rapidity of data exchange and processing power. Many people had difficulty believing in a time when computers would be better than humans at chess and nobody would have conceived of putting their money into a decentralised autonomous organisation to manage their investments, as happened last year with the Ethereum DAO to disappointing results.

With no heed to our poor predictive abilities, the rate of technological improvement is accelerating and, as Barney Frank elucidated in the following video for Big Think, regulators are not becoming any more able to predict how markets and financial behaviors will be affected by emerging technologies.

Nonetheless, despite our very limited capacity to make predictions about fields heavily impacted by technology, there are macro-economic and geopolitical trends which are easier to identify and relevant in considering a broad framework for anticipating future change. If these macro-trends are consistent, they will interact with more current and emerging trends. Together they will shape our medium-to-long-term future, and might enable some guesses at securities regulation 30 years from now.

So what might we consider as macro-level trends or patterns? I would suggest the following are likely to be sustained:

- Urbanization – the ongoing trend of human populations to gather in increasingly dense urban spaces, which simultaneously give rise to increasing wealth and innovation. Populations around the world are also experiencing a massive urban migration. Perusing the UN’s statistics on urban-to-rural population distribution by country, there is a clear trend across the world towards urbanization, and by 2047 the number of countries in which populations are not predicted to be dominantly urban are few.

- Regional economic disparity – while tremendous advances result from innovation, the benefits resulting from them tend to be experienced first in areas of highest economic standards and are slowly dispersed to those areas with lower economic conditions.

- Technological innovation and complexity – once a useful technology is out of the box, it does not go back in and ultimately participates in compounding increases in complexity.

- Power of resource control –influence is gained through controlling access to limited and valued resources.

Regardless of how dramatic changes are in the next 30 years, I believe these four patterns are robust enough to be sustained. My reason for naming these four is that I see each of these as either fundamental expressions of our species level behavior or virtually tautological descriptions of relationships between events. I will use them to provide context for interpreting the direction of current trends developing into the nearer future. With these in mind, I will consider our current conditions and emerging short/medium-term trends.

Where are we now?

Frankly, we’re in very exciting and dynamic times. One hundred years ago blood transfusions were the cutting edge of medical science and Einstein had yet to become recognized for enabling our understanding of general relativity. Now, brain-computer interfaces, genomics and robotic prostheses are redefining human biology and general relativity is taken for granted in every use of the mobile electronic devices in our pockets.

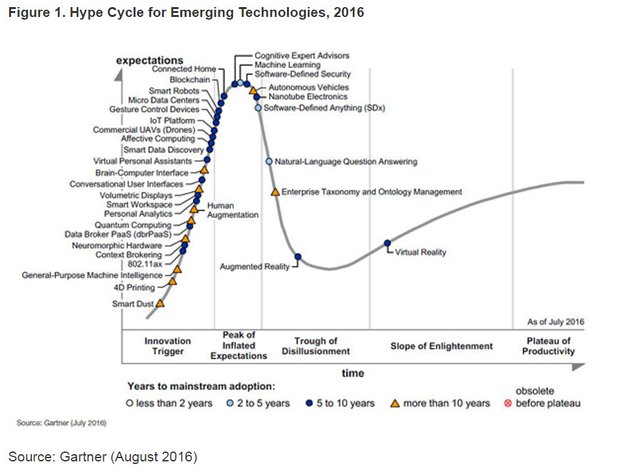

Seriously, it is worth comparing a Google search of "1917 technology" with a Gartner Hype Cycle for 2017 to appreciate how much has changed.

Our technologies, and the networks of systems underpinning them, have become exponentially more complex over the last century. Fortunately, the advances we already live with provide both a much greater capacity to record and interpret data than ever before as well as tremendously open and convenient access to this data. At least for those of us in the 44% of the world population living with internet access. As a result, there is a growing literature surrounding currently emerging trends in technology. Sites such as Singularity Hub have been openly collecting these stories for the better part of a decade and there have been many ideas brought into a more public consciousness through individual speakers at TED conferences. In the last couple of years, I have also noticed a significant increase in recognition of exponential technologies by international entities, government and mainstream publications and media.

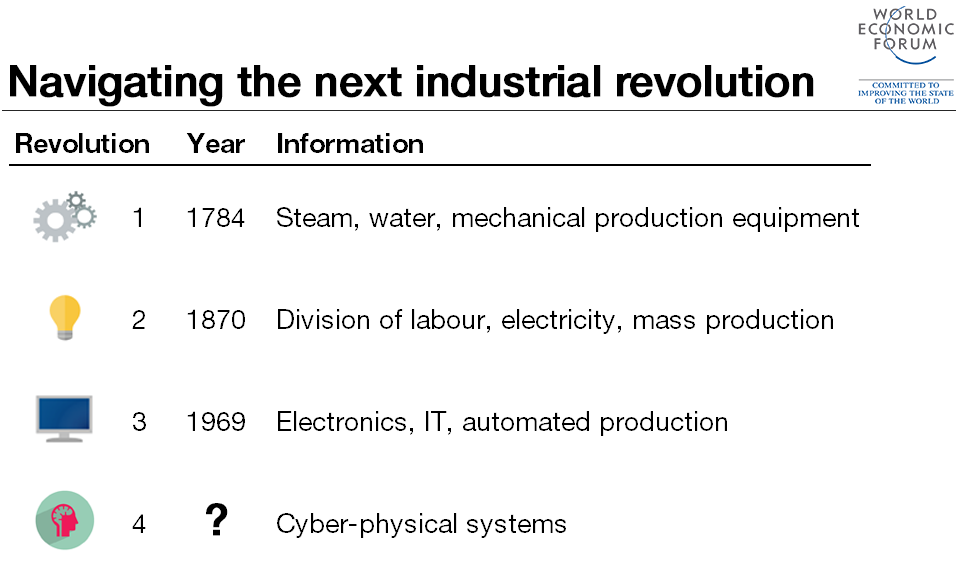

Among the noise and hype of emerging technologies there is naturally plenty of hype about FinTech. Of course, FinTech is exciting and relevant to thinking about the future of securities regulation, but it's only one piece of a larger puzzle. A more comprehensive idea getting attention is that of the fourth industrial revolution, which the hype would have us believe we are in the early stages of. This article from the World Economic Forum gives a good introduction to it if you're wondering when you missed the second and third industrial revolutions.

As described in the WEF article, a critical idea of the fourth industrial revolution is that it will transform "entire systems of production, management and governance". Focusing just on FinTech in considering the future of securities and failing to take account of changes to the broader context would be limiting. Regulations in financial industries are bound to be influenced by the broad economic, social and geopolitical changes that will take place around them.

I'll pick just a few emerging technologies off the Gartner Hype Cycle that are expected to feature in the fourth industrial revolution to discuss in a little more detail:

Blockchain

The hype surrounding blockchain applications right now is really building, especially in financial circles. This hype may prove to be overblown, but the applications of blockchain that are still in early stages are exciting. Distributed ledger systems and smart contracts have the potential to disintermediate the world of finance in the same way that the world of media and information sharing experienced disintermediation through the development of the worldwide web by allowing financial transactions to be occur at close to zero marginal cost.

Furthermore, while cryptocurrencies have their origin as a response to the world financial crisis and a desire to cut the major financial institutions out of person-to-person value exchange, financial institutions themselves are also now working on blockchain applications. They are doing this in recognition of the potential of the blockchain model to erase back office work and reduce associated costs (costs associated with employing costly professionals in finance and in law). Even more, blockchain tech promises to increase trust and security in financial transactions through the elimination of human actors who can manipulate and corrupt processes and through the potential for highly secure and highly public records of transactions. These transaction records which are central to blockchain technology will provide both assurances of untampered records as well as facilitate audit of those records and tracking of wealth.

Beyond these applications, innovations in smart contracts that will be able to identify when terms of an agreement have been met and execute the transactions necessary to complete the deal will disintermediate other fields and simplify transactions between willing parties around the world. They will also further enable the development of decentralised autonomous organisations (DAOs) which at early stages promise the creation of entities similar to corporations but which are entirely regulated by code and do not need any human actors.

It's difficult to see where exactly blockchain is going, but if it meets half of what's projected there is potential for massive impact upon financial regulations.

Internet of Things (IoT)

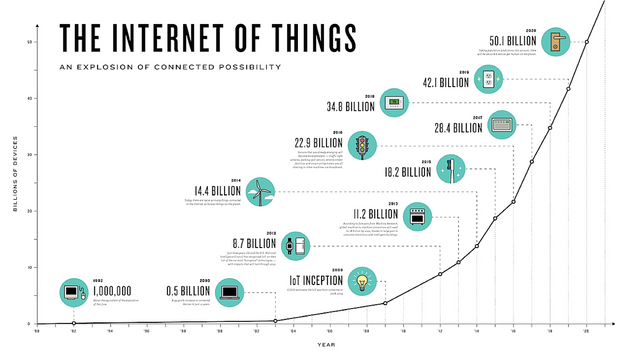

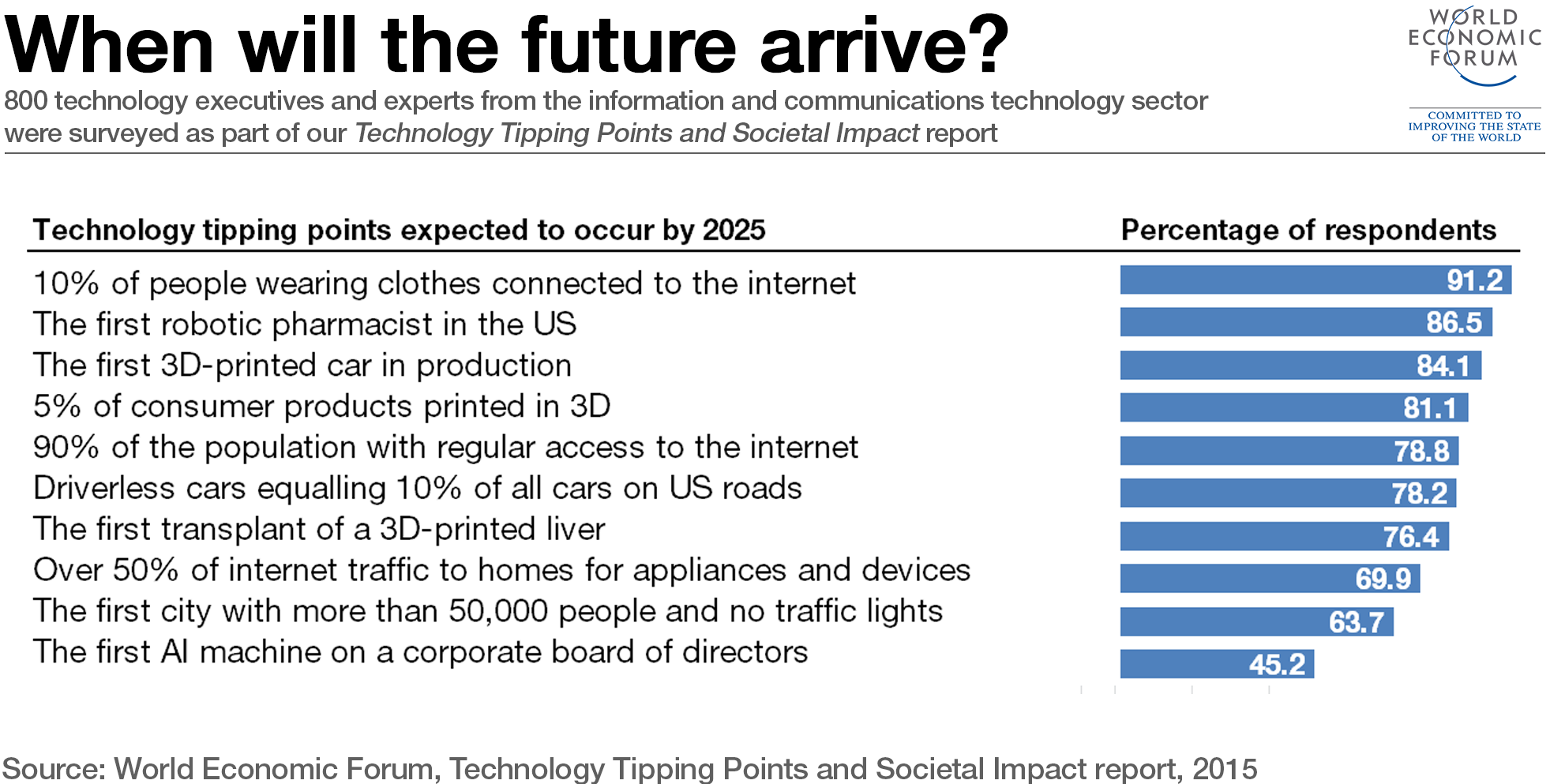

The internet of things is another major subject of hype with real underlying potential. In 2016 it's estimated that there are 13 billion sensors around the world connecting objects to the web and each other. This number is expected to rise to 30 billion by the year 2020 and up to 100 trillion by the year 2030. These sensors will be used for tracking and quantifying interactions between all sorts of objects as well as people. Not only are they projected to be standard in smart clothing but they are projected to be in all other sorts of objects of daily use. This will not only deeply impact supply chain management but could allow transactions to take place between people and objects, via objects and between sets of objects without human intermediaries.

Essentially, many of the things in our lives will become connected to each other in the same way that people have become connected to each other through the web, generating even more enormous amounts of data about all aspects of our lives and businesses than is generated now.

In combination with blockchain, the IoT will also enable reductions in fraud by enabling secure records of transaction across the entire lifetimes of valuable objects in our lives. Current examples of this practice such as Everledger and Chronicled are in beta stages of demonstrating the effectiveness of these combined technologies through authenticated identity tracking of diamonds and sneakers with unique digital identities that buyers, sellers and insurers can trust. By 2047, with hundreds of trillions of cheap sensors available, will instances of fraud such as Sino Forest still be possible? Will regulators require the tracking of physical assets with sensors connecting them to the IoT?

Artificial Intelligence

AI is possibly the most powerful singular force of change among all of these technologies. Despite the apprehensions of thought leaders like Stephen Hawkings and Elon Musk, increases in the power of at least narrow AI seem as though they will be necessary in managing the exponentially increasing amounts of data that will be available as the remaining 50%+ of the world population and trillions of our physical objects come online in the time between now and 2047. The speed at which data will be collected and need processing have already well outstripped human capacity without the aid of powerful computing systems. As volumes of data continue to increase, a race for more powerful AI to interpret data in ways that turn it into competitive advantages seems likely. This race to employ AI will likely also include regulators themselves.

Increases in the power of even narrow AI are also bound to have significant impact on employment rates around the world. Not only does AI seem likely to replace large numbers of jobs, both at the lower end and the higher end of the spectrum, but in combination with the IoT and blockchain, AI will likely facilitate increases in the development of DAOs that further marginalise human participation in generation of wealth and economic value. While jobs such as taxi drivers may be the first on the chopping block, any position which depends upon systematised information processing or which could be made to work through systematised information processing may become vulnerable to replacement. Lawyers and other professional roles will not be invulnerable to displacement by AI.

Cloud Computing

Although cloud computing may seem mundane to those of us who just imagine DropBox or iTunes music when we hear the term, the real power of cloud computing is in how it will combine with powerful AI and cognitive computers to free each personal device that we use from the limitations of its own hardware and give users access to supercomputer AI in the same way that we now access services as ubiquitous as Google Maps. A current example of this is how IBM is enabling doctors to leverage Watson's incredible computational power to leverage the results of millions of medical research papers in providing rapid diagnoses based on interpretations of volumes of data that a human brain in a human doctor simply could not provide.

Just as IBM is currently opening this technology through the cloud to assist with medical needs, it seems likely that in future cloud-based applications of cognitive computing AI will expand to offering support to areas such as finance and action in securities markets. Well before 2047 it may be the case that the average retail investor in any part of the world can benefit from the application of supercomputers to assist in making financial decisions via their personal device.

Quantum Computing

No doubt Watson is impressive for now, but classical computing is still expected to struggle with problems that quantum computing (which we may see the first real implementations of in 2017) is expected to thrive on. These problems include working with truly massive data sets. While beating the world's best Go player is an accomplishment for classical computing that came ahead of its expected time, it pales in comparison to the task of interpreting the data of global financial transactions to develop deeply powerful predictive models used in real-time decisions or answer detailed cause and effect questions. This exponential increase in complexity is the type of demand that quantum computers are expected to be much better suited to dealing with.

In combination with the boom in global sensor count of the IoT and records keeping of blockchain technologies, advances in quantum computing may have the capacity to provide new models of financial systems that are far more powerful those we currently possess. This should provide insights that we have no capacity to anticipate now.

Human Augmentation

Certain aspects of human augmentation will likely be improvements by matter of degree, while others will be more radical. Either way, the tools and structures we use both enable and structure the frameworks of our thought and action. While these tools, such as our current mobile devices, have become essential devices to us, they are still external to our bodies. This will change. The first implanted mobile phone devices are projected to be commercially available by the year 2025. Other human augmentations will likely be diverse combinations of prosthetic and genetic modifications by 2047, thought the implementation, certainly of genetic modifications, are likely to have longer adoption periods and, like other tech, will not be distributed equally. Nonetheless, they may result in acute pressures to keep up through self-modification and these changes may be expected to reshape the framework within which we form our thoughts, values and decisions.

Current Non-Tech Trends

Of course, not every trend worth considering is technological. These coincide with critical geopolitical, environmental and macroeconomic trends in defining a broader context for our future and the future of securities regulation. In 2015 the top ten global trends affecting international development identified at the World Economic Forum included income inequality, growth in joblessness, intensifying nationalism, weakening of representative democracy and increasing geostrategic competition.

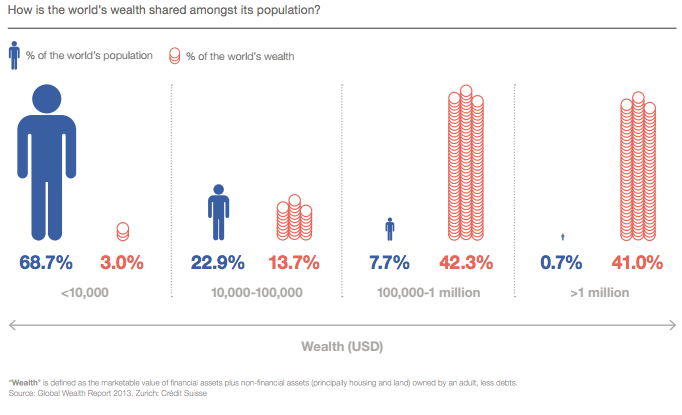

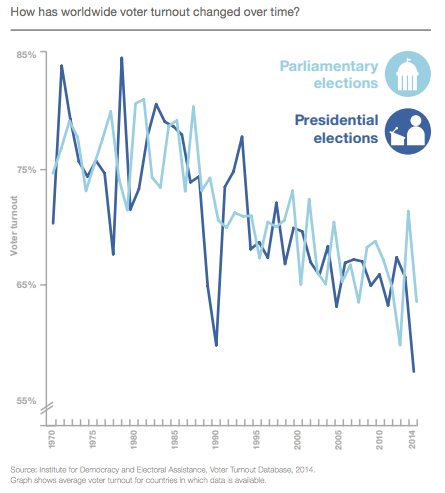

Income inequality is a global issue with acute pain points in both the developed and the developing worlds. As income and wealth disparity increases, young people feel increasingly disenfranchised by their current economic and political systems. At the same time many countries are struggling with joblessness growth. This puts pressure on both populations and governments as people, particularly the young, become more restless and disillusioned. Countries governed by representative democracies are experiencing lower than ever average voter turnout and concerns over loss of faith in democratically elected representatives.

Simultaneously, as populations are facing a growing wealth gap, increasing joblessness and loss of engagement in representative democratic processes they are experiencing an increase in nationalistic spirit. This is unsurprising given that those same people who are faced with drear economic prospects are being affected by systems-level changes upon which they have little feeling of being able to influence. Furthermore, while these nations turn inward with nationalist sentiment there is increasing geostrategic competition and an unsettled balance of global power as China rises.

All of these trends will contribute to defining the context within which regulators are required to act in the years leading up to 2047.

So, how are these different trends going to fit together?

I expect to see an increase in the power of capital and a disintermediation of traditional powers resulting from these converging trends. The increase in the power of capital will be the result of the erosion of labor markets due to increased automation, AI and disintermediating tech such as distributed ledgers, DAO and smart contracts. This disintermediation should also assist capital flows to become increasingly fluid at the same time that employment-based means of generating wealth are destabilised and eroded.

In less developed regions, the forces of automation will not replace jobs so rapidly as these regions will need people to first develop the necessary infrastructures upon which more advanced technologies will depend. These regions may expect to first see increases in their standard of living and employment during the urbanisation of their currently rural and agrarian populations while also generating extreme wealth for a small minority who are in positions to extract value from the development process. This would be fairly consistent with what we see in developing nations now.

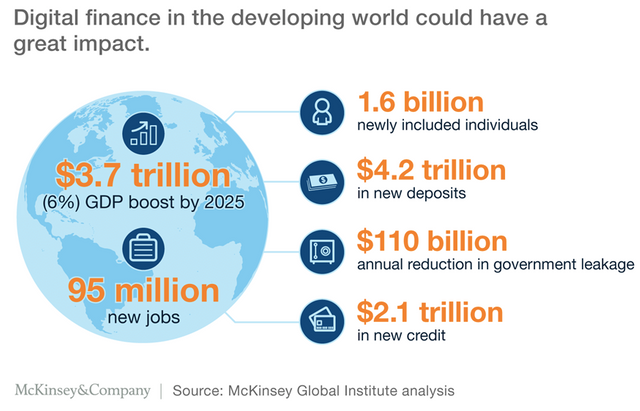

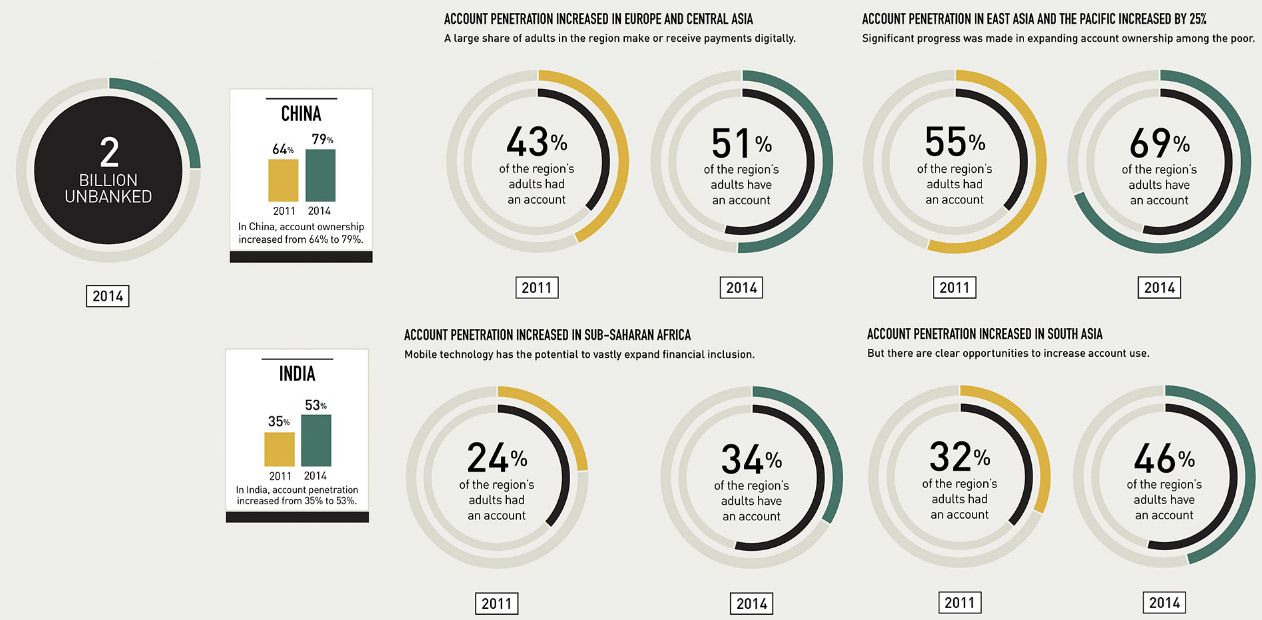

A more distinctive feature of what we might expect to see in the coming 30 years is the speed at which this development takes place. Just as many in developing nations of the last decade effectively leap-frogged over use of hard-lined telephones directly to mobile handheld devices, we may expect that the 56% of the world population that has yet to come online and the billions of people who are unbanked and living in wholly cash economies may leap directly to use of decentralised financial services, access to supercomputer artificial intelligence for managing financial processes through the cloud and incentives to accept human augmentation. While this will bring incredible new capacities to these populations, it will likely also shorten the development cycle and shorten the corresponding period of middle and working class wealth development in these regions. These populations may accelerate rapidly from agrarian lifestyles through to use of and replacement by the most advanced technologies of the developed world. All else being equal, each successive population that undergoes modernisation may expect a shorter period of economic enrichment resulting from the transition.

Taking into consideration the robust pattern that control over limited and valuable resources results in concentration of power, I expect that in 2047 control over capital and valued physical resources will become increasingly important and influential while even skilled and professional labor becomes increasingly commodotised. In generations up to now, there have been measurable economic benefits offered to those working people who had skills and knowledge to exchange for capital. Further development of these skills still results in measurable increases in compensation. The rise of AI and increasing disintermediation however, threaten to commodotise even professional levels of skill and knowledge, thereby reducing their value to no more than the cost of accessing the hardware and software necessary to perform the job equally well or better. On a relative basis, this would then result globally in an increasing concentration of power in control over large quantities of capital and limited resources.

At the same time, the value of those who can find ways to generate wealth from the exploitation of capital or those who can offer low-cost solutions to problems experienced by massive populations will have opportunities to increase their wealth to the levels of our Zuckerbergs and Gates' through entrepreneurial activities and these people are likely to find increased access to financing through the ever-more connected and fluid financial markets of the future.

Financial institutions and regulators will also face pressures and experience benefits as a result of these converging trends. Blockchain technologies will improve efficiencies for financial institutions while also increasing effectiveness of records-keeping. Costs will be greatly reduced through elimination of back office staff and services. Combining blockchain tech with IoT for records keeping and audit purposes will offer greater assurances of security and trust within systems of exchange and the provision of unique digital identities for all sorts of valuable assets may also lead to new forms of exchange and investment as rights to any digitised asset may be divided and exchanged.

Quantum computing and powerful AI will lead to massively more advanced modelling of market activity. If it is proven with financial exchanges, as is expected it will be with self-driving cars, that putting control in the hands of artificial intelligence results in demonstrably lower numbers of serious accidents and failures in judgment, there will be strong incentives for financial institutions to turn over more of their activities to non-human intelligences. Taking this to an extreme, it is quite conceivable that financial markets will feature virtually non-existent human workforces from the back office up to the boardroom.

Of course, all of this turmoil will result in enormous pressure upon governments that will struggle over issues of unemployment, disenfranchisement and nationalism. These forces are likely to drive nations, especially democratic nations, to be strongly internally focused despite facing increased global regulatory and ongoing geostrategic challenges. This, again, should reinforce the power of capital as there will be difficulty coming to any international consensus over shared regulatory procedures.

What will this potentially mean for securities regulation 30 years from now?

Presently, regulators struggle to keep up with innovations in the financial markets. In the future, the pressures to keep up will be even more extreme. As applications of powerful narrow AI, blockchain and distributed ledgers begin to be adopted, regulators will face tremendous pressure to employ similar tools to ensure stability in the financial markets. As these technologies become proven, financial regulators may even reasonably move to require the use of artificial intelligence in the securities markets instead of having statistically inferior human actors.

At the same time, the governments which oversee regulators will face increasing pressures as a result of the rise of automation and artificial intelligence. If resulting unemployment leads to disenfranchisement and nationalistic sentiment, it will be challenging for government bodies to act collaboratively in forming multilateral agreements to deal with problems in integrated financial markets. This, again, will increase the power and influence of parties with concentrated capital and control over resources.

Regulators themselves, while becoming more dependent upon artificial intelligence and quantum computing in developing financial models, will also need to grapple more with how to instruct AIs in regulative decision making and grapple with issues of whether the purpose of financial regulation should be to increase or distribute wealth. However, this may be undermined by the influence of high capital parties who can exert stronger-than-ever influence over the shaping of those regulations.The arms race in applications of AI and other technologies to financial markets and their regulations is also likely to lead to more and more rapid cycles of significant economic change as both innovators and regulatory responders increase the speed of their analysis and response.

Take away

Fundamentally, I believe it is way too difficult to make any accurate predictions about 30 years into the future. Nonetheless, I hope this thought experiment written out reveals some important trends and topics worth thinking about.

This was a great read but please source all of your images if you want to get some good upvotes from SteemSTEM!

The fourth industrial revolution is a controversial idea, though. Some say its already happened... Not sure where I stand on it