Robinhood could get a US banking license

Robinhood is in talks with US regulators to provide banking services to its 4 million users.

Robinhood plans to provide banking services

Robinhood was strongly encouraged by the immeasurable success of its application with free fees for cryptocurrency trading, available on Smartphone. One million users joined the company's big family when it announced the addition of Bitcoin (BTC) and Ethereum (ETH) to its platform last January.

Just one month after taking over the two largest virtual currencies in terms of market capitalization, the application breaks the $ 5.6 billion valuation mark. At the time, she described herself as "the most dynamic brokerage firm to date. "

The company is considering becoming a full-fledged bank. On the other hand, if it were able to offer savings services, significant changes in the traditional banking sector would occur.

The free trading app needs the support of the OCC

The banking laws of the United States are an obstacle for Robinhood at the moment.

"The company is in preliminary discussions with regulators to begin offering bank-type services through different licenses or partnerships," Bloomberg says.." The Office of the Comptroller of the Currency (OCC), which charters and regulates all national banks and the federal savings associations is in full negotiation with Robinhood. "

The company should work in collaboration with existing institutions if its request is accepted. However, it is not the first company operating in the cryptocurrency sector to have had the idea of providing banking services.Goldman Sachs and Coinbase are also in the running. They began discussions with the OCC for a federal banking license earlier this month.

What do you think of Robinhood's ambitions to become a full-fledged bank? Let us know in the comments section below.

Upvote this: https://steemit.com/free/@bible.com/4qcr2i

Love it! Ive been using robinhood since 2015 and have enjoyed its UX changes. Bring on the bank.

You got a 100.00% upvote from @botcoin courtesy of @infoslink!

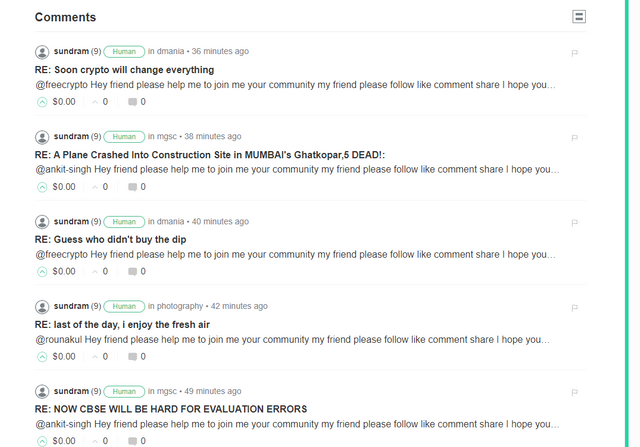

@infoslink Hey please help me to join me your community my friend please follow like comment share I hope you like my content plz support me.

Sorry I dont support spam...

.png)