Why We Should Have A Gold Standard

By: Devon Sparks

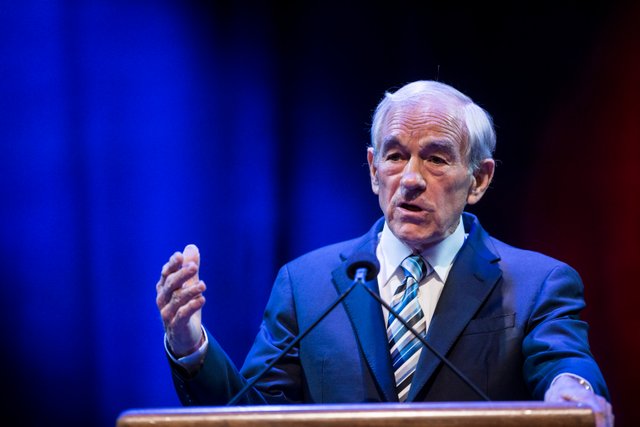

Ron Paul once said, “The gold standard would keep you from printing money and destroying the middle class. Every country where you have runaway inflation, there’s no middle class. Mexico, there’s no middle class, you have a huge poor class, and a lot of wealthy people. Today we have a growing poor class, and we have more billionaires than ever before. So we’re moving into third world status.”(“10 Ron Paul Quote”.) Ron Paul is an American politician and economic genius. Our society has a failing middle class: there is the poor and the rich. Our country is suffering from a disease, and it’s not medical. The disease is called meaningless money. When the world no longer recognizes America’s money as the world currency is when America is going to fall. The bindings of our debt is too strong. We are being constricted by countries that own us because of our debt. America needs to switch back to the Gold Standard because it helps keep the economy of the United States stronger, stabilizes inflation, and stops the Fed from printing money that has no meaning.

From 1792-1971 America was on a form of metallic or gold standard, which means our societies money has had some sort of backing. Whether it was silver or gold our currency had actual value. Our nations’ economy averagely grew 3.9% a year( Should The United States.) When Nixon decided to no longer utilize the Gold Standard in 1971 our economic growth dropped to an average of 2.8%, which means that our economy under fiat money declined. Fiat moneys definition is “Convertible paper money made legal tender by a government decree.” (“Fiat Money.”) Fiat money has no real value. It is based on Americas’ economy as a whole. Americans shouldn’t have to worry if their hard-earned money is worth its’ value based on if their economy is stable. Ron Paul has warned the public of the United States by saying “The way you live, work, travel, retire, and invest in America… everything is going to change. Some of it in ways most people do not expect. This period is going to be particularly rough on seniors and anyone relying on a fixed income, or money from the government.”(“Developing Story.”) Ron Paul goes on to say “Trouble is coming-please make sure you, your family, and anyone you care about are prepared.” (“Developing Story.”) Paul says everyone in America should buy and collect gold because whether America wants it or not, our country will have to fall back on gold. Our economic decrease should be a warning to us, as Americans that our country needs gold so that we do not fall in to the grip of the people who we owe so much money to.

Through out the history of the United States that used some sort of gold standard has had lower levels of inflation. From 1880-1913 the average inflation was 1.6% per year, but when Nixon took America off of a gold standard in 1971 the inflation of the United States was 3.3%. “Inflation is defined as a sustained increase in the general level of prices for goods and services. It is measured as annual percentage increase. As inflation rises, every dollar you own buys a smaller percentage of a good of service. The value of a dollar does not stay constant where there is inflation.” (“Inflation: What is Inflation?”). Inflation was stable and not rising as drastically as it was on the gold standard. People cannot grasp the concept that the gold standard is the best possible solution to our economic distress, money with a backing will prevail.

Fed is short for the Federal Reserve. The Fed prints currency such as the dollar. The dollar is a federal reserve note. They are meaningless because we do not have the gold or anything of value to back them up. The dollar has been degraded and is no longer worth anything. If we, as a nation switch to a gold standard we will stop the Fed from printing money that we just do not have the resources to back it up. It would stop the Fed from Increasing our national debt as well. From 1971 to 2003 our national debt went from $406 Million dollars to $6.8 Trillion dollars, an increase of 1,600%.(“Should the United States Return to a Gold Standard.”). A gold standard could also prevent government from overprinting money to bail out big corporations. For example, Bear Stearns was bailed out for $29 billion dollars. AIG was bailed out for $129 billion dollars as well. Dec. of 2008 the yearly growth rate of the Fed’s balance sheets went from 2.6% to 152.8%.( Should The United States). Balance sheets are government bonds that companies can buy to get money and then repay them over a period of time. (“Inflation: What is Inflation?”).

We need the gold standard to give our money value. A gold standard will stop the Fed and government from printing meaningless money. Many people say it will be hard but getting out of several trillion dollars of debt will not be a walk in the park. Ron Paul was correct when he said America was becoming a Third-World country, we have devalued our money, made an extremely big poverty flourished lower class, and completely destroyed our middle class. Many people trust in Ron and his economics, he has sent his warning and it is up to America to listen.

Sparks 4

Work Cited

“Fiat Money” InvestorWords. WebFinance, Inc. Web. 4, May. 2016

Gsbtc “10 Ron Paul Quotes On Gold, Silver, And The Market.” Goldsilverbitcoin. SiteOrigin.com 22, Sept. 2014. Web. 2, May. 2016.

“Inflation: What is Inflation?” Investopedia. 2016, Investopedia,LLC. Web. 4,May. 2016.

Palmer, Mike. “Developing Story: Dr. Ron Paul Reveals #1 Step to Prepare for America’s Next Big Crisis.” The Crux. Stansberry & Associates Investment Research. 19, Apr. 2016. Web. 4, May. 2016.

“Should the United Return To A Gold Standard?” ProCon. Org. 2016 ProCon.Org. 19, Aug. 2014. Web. 27, Apr. 2016.

Federal Reserve as an institution already dead and I think future unfortunately unfold right now right front of our eyes and international monetary fund will become the issue or currency issue of digital currency for whole entire Globe that's what it's mean Global government however America supposed to go to the Constitution and and the US Treasury must issue of money to maintain their sovereignty unfortunately 99.9% of Americans have zero knowledge or information about finances and fall of the money that's the key of success of every human being on the planet if you don't understand finances you clueless about everything😩

I have mixed feelings about the gold standard. But I disagree with Paul concerning the middle class. America still has a robust middle class. We have filthy rich people, sure, but it's not like our middle class is disappearing.

We do need to focus on creating sectors and training people to insure that remains the case.

Congratulations @liberty.news! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP