LEXIT: INCORPORATING BLOCKCHAIN TECHNOLOGY INTO MERGING AND ACQUISITION PROCESS

In the fast changing business world, companies have to strive hard to achieve quality and excellence in their fields of operation. Every company has the prime objective to grow profitably. The profitable growth for the companies can be possible internally as well as externally. The internal growth can be achieved either through the process of introducing or developing new products or by expanding or by enlarging the capacity of existing products or sustained improvement in sales. External growth can be achieved by merger and acquisition of existing business firms, hence, mergers and acquisitions (M&A) are quite important forms of external growth. In today’s globalized economy, mergers and acquisitions are being increasingly used as a strategy for achieving a larger asset base, for entering new markets, generating greater market shares/additional manufacturing capacities, and gaining complementary strengths and competencies, to become more competitive in the marketplace. Mergers and Acquisitions (M&A) are an extensive worldwide phenomenon and have emerged as the natural process of business restructuring throughout the world. The last two decades have witnessed extensive mergers and acquisitions as a strategic means for achieving sustainable competitive advantage in the corporate world. Mergers and Acquisitions (M&A) have become the major force in the changing environment. The policy of liberalization, decontrol and globalization of the economy has exposed the corporate sector to domestic and global competition. Mergers and Acquisitions (M&A) have also emerged as one of the most effective methods of corporate structuring, and have therefore, become an integral part of the long-term business strategy of corporate sector all over the world. However, the merging and acquiring of companies comes with a lot of challenges and hitches such as finding the appropriate buyer that would offer to buy the seller company for a reasonable price, high cost of transaction, lengthy period of transactions, to mention a few. As a result, it is evident that the entire process of traditional merging and acquisition needs a total overhaul, hence the birth of a platform named LEXIT.

WHAT IS LEXIT

LEXIT is a platform which leverages on blockchain technology to provide a decentralized market for corporate entities to carry out the process of merging and acquisition in a revolutionized way. Lexit aims to make merging and acquisition process hitch free and uncomplicated as compared to the way it is in the present world of today.

CHALLENGES IN TRADITIONAL MERGING AND ACQUISITION PROCESS

• Finding the right buyer: the challenge of finding the right buyer for a company could be very stressful and overwhelming and it requires a whole lot of time and patience. The search requires an extensive review of potential candidates before finding one that fits into the company’s strategic need both financially and in terms of buyer’s existing reputation.

• Lengthy transaction completion period: the process of buying and selling of a corporate entity is usually a long one and may take as long as 2-3 years. The purchase of a business presents itself as a great means of entry into a new market or to strengthen a competitive position. Therefore, buyers are more careful and tend to conduct researches before finally consenting to the purchase of company, thus slowing down the entire transaction process. Also buyers tend to approach the situation in a manner that allows them to avoid being cheated. It is not out of place to take one’s time in buying a delicate property such as a company as once a company is acquired, the purchasing company takes on not only the profits but also its contingencies and possible losses. Hence, the reason why buyers take their time to buy well, thus elongating the length of transaction period.

• Pricing: this is very important in the process of carrying our merging and acquisition deals. Reaching a consensus between the two parties is usually not a pleasant phase in the M&A process. The buyer tries to avoid being cheated while the seller wants to sell at a reasonable price to minimize or totally avoid losses

• High Transaction costs: The cost of acquiring and merging companies are very high and small companies or startup businesses even when they seem interested may not have the financial capability to go through with the process, considering that they have to hire the service of lawyers, accountants and other professional experts which on its own comes with very high costs.

LEXIT SOLUTIONS

Lexit aims to proffer solutions to the above highlighted challenges by incorporating blockchain technology into the process of Merging and Acquisition. Lexit will create a platform that connects buyers, sellers, professional experts and all stakeholders in the corporate world involved in Merging and acquisition process together in the same environment.

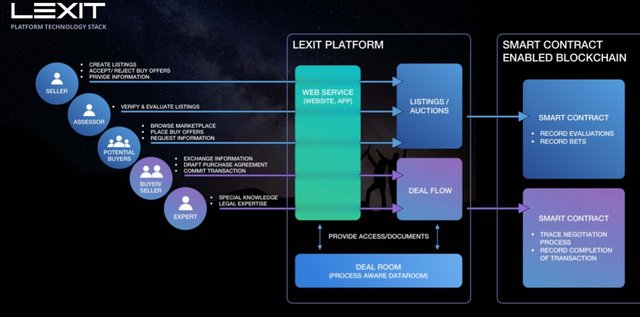

HOW LEXIT WORKS

• Sellers would provide an auction lists for the companies and intellectual properties on the platform at an affordable listing fee for each of the listing

• Buyers browse through these lists which includes detailed information about each company such as location, type of industry etc. after which they carefully select the company of interest and bid for it

• Seller decides whether or not to accept the bid and communicates further negotiations directly with buyers. Buyers also requests for further information regarding the company of choice from seller directly on the platform.

• After a seller accepts to buy a listing, the deal is moved to the deal room where terms are negotiated, agreements are signed and transactions are finalized. The deal room is a highly secured environment and would only be made accessible to the relevant buyer, seller and professional expert such as lawyers, accountants, auditors etc.

• On Lexit platform, merging and acquisition deals could be initiated and completed in the space of 12weeks compared to the present day M&A process which could take up to 2-3 years.

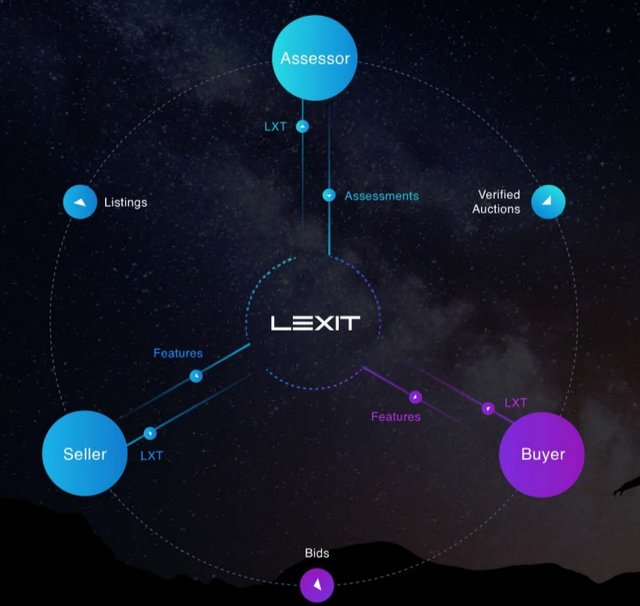

PARTICIPANTS ON LEXIT ECOSYSTEM

• Buyers and Sellers: Buyers are companies or investors who wish to purchase companies and assets for the purpose of investment while sellers are those who wish to sell companies and assets. Sellers are required to provide adequate information about listed items and also to make themselves available for negotiations and interactions with buyers

• Assessors: These are experts who give personal views on listing and transaction on the platform. They must have been approved before they can participate as assessors on the lexit platform. After every review made by assessors, they get rewarded with LXT tokens.

• Anti-Fraud detection team: They are directly employed by Lexit and their role is to monitor listings and filter out unauthentic ones before they appear on the platform.

Other participants on the ecosystem include:

• Outside service providers

• Lexit global partners

• External partners

TOKEN

The token to be used on the platform is LXT token. It powers the lexit ecosystem and is used as a means of transaction on the platform. Buyers, sellers will be charged in LXT while assessors will also be compensated in LXT tokens.

TOKEN INFORMATION

Token Ticker: LXT

Maximum Supply: 160,000,000

Hard Cap: 30,000 ETH

Price: 1 ETH = 1200 LXT

Token sale: Tier 1-3: Ended

Tier 4 token sale: July 12th-18th 2018

Tier 5 token sale: July 19th-25th 2018

For more information about lexit, kindly visit:

Website: https://www.lexit.co/

Whitepaper: https://uploads-ssl.webflow.com/59f21153ffa06300013c0c6d/5b21365c35f5520dee397dfc_LEXIT_White_Paper.pdf

Telegram: https://t.me/LEXITco/

Facebook: https://www.facebook.com/LEXITco/

Twitter: https://twitter.com/LEXITco

Ann Thread: https://bitcointalk.org/index.php?topic=2494585.0

Writer’s email: [email protected]