Learn With Steem - Learn How to Calculate the Cost of Capital in Capital Structure

Introduction

.jpeg)

Link

It's important to note that a firm while deciding on investment criteria must combine it with financial decisions. For example, An organization seeking to buy new cars or a lessor to lease to them must look for a way to pay for the cars.

Capital Structure

The term capital structure is used to represent the comparative relationship between the cost of equity and the cost of debt.

%20(2).jpeg)

Link

It focuses on how investment decisions are sourced and some of these decisions to be made under financing are:

Whether to invest for long-term or short-term purposes.

Where and whom to meet to finance the intending project.

Cost of equity, Cost of debt, or both. Disadvantages and advantages of using either equity or both.

Proper proportion in mixing equity and debt in a business.

Classification of Capital Structure

%20(1).jpeg)

Link

Capital structures are internally or externally generated by the companies. The monetary gains from these sources are used to start the business.

A. Internally Generated Capital Structure

- Shareholders Funds

- Retained Earnings

It's better and easier to pay back what you owe shareholders than to pay back loans and as such firms choose to rely heavily on internal sources of capital.

B. Externally Generated Capital Structure

- Bonds

- Stocks

- Loans

- Advance

It's worthy to note that, internally generated capital is referred to as equity financing while externally generated capital is debt financing.

Measures of Capital Structure

- Debt Equity Ratio

- Debt Ratio

- Interest Coverage

Theories Associated With Capital Structure

- Traditional Method

- Net Operating Income Method

- Net Income Method

Traditional Method

This method or theory opines that the cost of capital of a firm is a function of the capital structure. It is believed that the firm has an optimal capital structure.

Optimal Capital Structure means that at a ratio of debt to equity, the cost of capital is less and the value of the firm is high.

Net Operating Income Method

Durand instigated this theory which states that "the Weighted Average Cost of Capital remains as it is (constant), the market values an organization as a whole and discounts it to determine its present value using a particular rate.

This rate has no relationship to whether the organization adopts debt to equity ratio and does not pay taxes.

Net Income Method

This is the opposite of the net operating income method and was still propounded by one of the founding fathers of economics, David Durand.

He stated that "an increase or decrease in the financial leverage of a firm will ultimately lead to a change in its cost of capital.

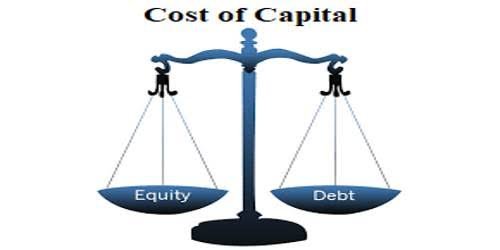

Cost of Capital

%20(3).jpeg)

Link

The cost of capital is the opportunity cost of financing a project or the project's cost of capital for discounting cash flows. Its the minimum acceptable rate of return on funds committed to the project.

The cost of capital in project evaluation is always represented in the form of the letter k. The formula carries k as a constant factor in project computations. Some elements constitute the make-up of a firm's actual or derived cost of capital which is outlined and explained below.

Elements of Cost of Capital

A. A Risk-free Rate of Return

This is the compensation given for the time of waiting for the investment to mature. This means that investing for an investment to ripe.

B. A Premium for Business Risk

This is the risk that is associated with uncertainty about the future and what it holds in the running of the business at hand.

B. A Premium for Financial Risk

Under this, the risks faced are associated with introducing debt and borrowed funds into the capital structure of the business.

Computations of Cost of Capital

- Cost of Debt

- Cost of Preferred Stock

- Cost of Equity

Cost of Debt

%20(4).jpeg)

Link

This is the rate of return set by the lenders of the funds and is usually stated with the period under review. Under this cost of debt, we also have;

Debt issued at Par; This is before the tax cost of debt which is expected by the lenders and it's mathematically represented as;

kd = Int/Po

Where:

kd - Before Tax Cost of Debt

Int - Interest

Po - Issuing Price of Debt

Illustration 1

An agricultural Industry wishes to sell new issues of 3 years, 10% bond of 1000 each at par. You're required to calculate the before-tax cost of debt.

Solution

kd = Int/Po =

100/1000 = 0.1×100

Therefore kd = 10%

Debt issued at a Premium/Discount; A debt issued at is premium or discount is calculated differently.

A bond may be issued at a premium when the maturity value of the bond is higher than the face value.

A bond may be issued at a discount when the maturity value of the bond is given out at a price lesser than its original face value.

To calculate the cost of debt here, the formula is denoted as kdt = kd (1-T)

Illustration 2

A firm issues debt of #2,000 with an interest rate of 5%, and the corporate tax is 40%. You're required to calculate the cost of debt.

Solution

kdt = kd (1-T)

kd = Int/Po

kd =100/2000 = 0.05

kdt = 0.05(1- 0.40) =

0.05(0.6) =

0.03×100 = 3%

Therefore kdt = 3%

It's worthy to note that cost of debt is always represented in percentages that's why we multiply by 100% to get the percentage value of the bond issued.

Cost of Preferred Stock

%20(5).jpeg)

Link

This is a function of the expected dividend. Organizations issue preferred stock instead of paying back the intended dividend.

Preferred stock has no date set for maturity and its cost may be stated and represented mathematically as follows: kp = Pdvi/Po

Where:

kp - Cost of Preferred Stock

Pdvi - Expected Preferred Dividend

Po - Issuing Price of Preferred Dividend

Illustration 3

Assuming a preferred issue is perpetuity that sells for #100 a share and pays an annual dividend of #8. Calculate the Cost of Preferred Stock.

Solution

kp = Pdvi/Po

kpn= 8/100 = 0.08×100 = 8%

Therefore KP = 8%

Cost of Equity

%20(7).jpeg)

Link

Under this cost of equity, we have internal and external equity which are sourced differently and they are:

Cost of Retained Earnings; the opportunity cost of retained earnings is that the rate of return required by shareholders in dividend is forgone.

Cost of retained is mathematically represented as; **ke = [(Div1/Po) + g]

Where;

Ke - Cost of Equity

Div1 - Initial Dividend

Po - Market Price of Ordinary Shares

g - Dividend Growth Rate

Illustration 4

Supposing that the current price of a company share is #150 and the expected dividend per share next year is #7.50kobo. If the dividend is to grow at a constant rate of 10%. Calculate the Cost of Retained Earnings.

Solution

ke = [(7.50/150) + 0.10]

0.05 + 0.10 = 0.15

0.15 × 100 = 15%

Cost of New Issues; This is an externally generated cost of equity and it's gotten my issuing new stock and make it available for the public to buy therefore raising funds and increasing shareholders.

This cost of new issues can be mathematically represented as: me = [Di/Po(I-F)] + g

Illustration 5

Whitestallion Nig Ltd has a stock it wishes to sell to complete its already existing shares. The firm has an expected dividend of #1/share and the price of the stick is #20. The floatation rate is 10% while the dividend growth rate is 5%. Calculate the cost of new issues.

Solution

ke = 1/20(1-0.10) + 0.05 =

0.06 + 0.05 =

0.11 × 100 = 11%

Therefore ke = 11%

Conclusion

Firms can raise their equity or debt internally or externally. The role of equity holders is to set their required rate of return.

Thank you for contributing to #LearnWithSteem theme. This post has been upvoted by @Reminiscence01 using @steemcurator09 account. We encourage you to keep publishing quality and original content in the Steemit ecosystem to earn support for your content.

Regards,

Team #Sevengers