Why Safaricom needs to reinvent itself to maintain its stellar growth

Safaricom (NSE: SCOM) is the largest company in East Africa with a market capitalization of KES 1.52 trillion. Currently trading at KES 37.55, Safaricom shares are up about 11% year-to-date. On Thursday, February 11th, Safaricom announced an interim dividend of KES 0.45 per share totaling KES 18.029 billion in dividend payments. The company is now worth 63% of the entire Nairobi Stock Exchange (NSE) which is valued at KES 2.4 trillion.

Key Points

• Technology companies need to reinvent themselves by adopting new technologies to avoid the Nokia Effect

• Elon Musk’s Starlink is a major threat to internet service providers globally

• Implementing 5G infrastructure may help Safaricom maintain the lead as a technology leader in the region

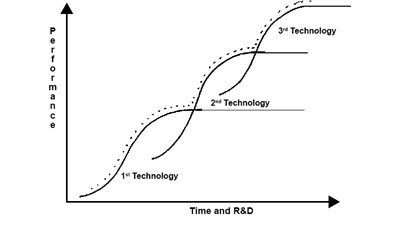

Safaricom’s success has been technology-based. This includes its mobile money transfer segment dubbed M-Pesa, mobile data services, Safaricom Home Fiber, and voice & SMS. All technology-based companies tend to follow the technology curve where time corrodes technology over time. If firms don’t invest in research & development to advance their technology and products, they become obsolete and die.

For instance, the “Nokia Effect”, which refers to how Nokia tumbled from the most dominant mobile phone manufacturer down to a shell of its former self, is a clear illustration of how failure to adapt may crush technology companies. For a technology company to survive the technology s-curve, they must reinvent themselves over time by doing research & development as well as adopting new technologies rapidly.

The one distinguishing factor that has made Safaricom so successful is its M-Pesa product. However, new technologies are coming up and the firm needs to adapt. This implies embracing the new technologies and using them to advance their products.

Global companies are adapting by entering into mergers & acquisitions with companies that come up with new technologies. For instance, Facebook is developing a cryptocurrency named Libra, Nvidia is acquiring Arm, Volkswagen is looking to produce electric vehicles in direct competition with Tesla, and Fiat Chrysler merged with Group PSA (Peugeot) to form Stellantis.

Can Safaricom offer cryptocurrencies?

Governments and corporations across the world are embracing blockchain technology and promoting the trading of Bitcoin and other cryptos. For instance, Tesla has invested $1.5 billion in Bitcoin and is looking to accept Bitcoin as payment for its products. However, the Kenyan central bank banned the trading of cryptocurrencies in Kenya and that makes it difficult for Safaricom to offer such a product.

If CBK softens its stance on cryptocurrencies, Safaricom can leverage the technology to make local and cross-border payments faster and cheaper. This would then expand Safaricom’s revenue streams and market reach.

Square Inc., an American company, developed a product that is similar to M-Pesa in the US market. The product is named Cash App and is a peer-to-peer (P2P) payment service application. Americans can simply download the app, sign up and start transacting immediately. Square then added Bitcoin transaction capability which expanded their revenues. In 2020, Square raked $4.57 billion in Bitcoin revenue and $97 million in profit from Bitcoin transactions.

Is Starlink a threat to Safaricom?

Starlink is an American company that has launched over 1000 satellites in low-earth orbit and is looking to cover the whole world with a network of 42,000 satellites. These satellites are providing internet connectivity to any location in the world. Currently, at the Beta testing level, users in the UK are averaging 50-150 Mbps at a latency of 20-40 microseconds.

The internet is set to cost about KES 10,000 per month with a one-time installation cost of KES 50,000. Organizations may find this to be cheaper compared to Safaricom’s rates and opt for this option. To address this, Safaricom needs to offer a data service that Starlink cannot offer. This may include higher speeds, quality customer service, and 5G connectivity. Safaricom home fiber platinum package is currently priced at KES 11,499 and is supplying 100 Mbps speeds but with a fair usage policy capped at 1000 GB. The installation cost is about KES 50,000.

The youthful population of Kenya is increasingly subscribing to online gaming services as well as video streaming services. These services need low latency for them to give a seamless experience. Starlink latency rates are better than Kenyan internet service providers especially when accessing European servers which gives it a competitive advantage.

Does Safaricom need to introduce 5G infrastructure?

5G stands for fifth-generation technology standard for broadband cellular networks. This technology allows people to transfer data at much higher speeds compared to 4G. A recent test by Verizon in the US showed speeds of up to 1.13Gbps.

Smartphone producers are now manufacturing phones that support 5G networks. This includes Apple, Samsung, OnePlus, Motorola, Oppo, and Lenovo. For these phones to use 5G networks, the internet service providers need to upgrade their network devices for 5G compatibility. 5G networks are already in place in Eurozone countries, the US, UK, China, South Korea, and Japan.

5G has improved connectivity, data transfer and processing, online gaming, and video streaming services. Kenyans are already purchasing 5G capable devices and the 5G infrastructure vacuum is growing each day.

If Safaricom does not take the lead and implement this technology now, other firms may take the opportunity and grab a big chunk of Safaricom’s data service market share. Adopting 5G technology could improve Safaricom’s revenue as users make the internet of things (IoT) a reality. This involves connecting more devices to the internet using the 5G network.

Is Safaricom’s market saturated?

With an estimated 99% market share in mobile transactions and over 65% in mobile subscriptions in Kenya, Safaricom’s prospects for growth within Kenya are getting smaller and smaller. This has forced the firm to consider operations in other countries such as Uganda, Tanzania, and Ethiopia.

When markets get saturated, other telecommunication firms in the rest of the world usually engage in value addition to their existing services. For instance, Safaricom is in a prime position to offer financial services such as banking, lending, e-commerce, parcel logistics, insurance, financial markets investment, and money markets investment. This could be achieved by acquiring existing firms.

Safaricom has always thrived by leading in technology adoption while reinventing itself over time. In 2021, telecommunication and financial technology are growing fast and Safaricom needs to catch up. This involves adding value to existing services while exploring other revenue streams that take advantage of its existing infrastructure.

Serving in a country where over 75% of the people are under 35 years, Safaricom needs to accelerate the transition from 4G to 5G while considering blockchain technology to lower M-Pesa transaction costs for its clients. This will give it the necessary lead to become a blue-chip company in the future rather than falling for the Nokia Effect.

Rufas Kamau

Research & Markets Analyst

Great insight there on Safaricom adopting cryptocurrency as a value add to its products. Sadly, its majority shareholders who would determine its direction are best served with the current setup (traditional finance).

If anything, the ideal application of cryptocurrency payments would mean less revenue for them since their role as a middleman is greatly diminished.

But, in the same way big companies rubbished the internet in its early years, then eventually adopted it after realizing its potential, the same case is to current corporate entities with crypto. But all in all, eventual adoption is imminent.

When merchants start accepting Bitcoin via the lightning network, Safaricom will be forced to start looking for crypto developers. By then, it will be too late.