JACS | Just Another Communications Stack

Fintech has been the ordinary natural development of the financial area in social orders with high rates of banked economies. In different economies where innovation, particularly versatile media communications, grown a lot snappier than banking, distributed money and miniature financial matters assumed a gigantic function to halfway change these social orders into credit only exchanges. Versatile wallets and e-installment arrangements accomplished a lot in public monetary consideration, particularly in provincial regions inside unbanked populaces.

The change in perspective from money dealings, upheld by affordable hazards, discovered the ideal arrangement in e-cash. Monetary standards have consistently been a way to trade esteem whether in their banknote designs or advanced ones. Digital currencies essentially presented the idea of decentralization and made the answer for sidestep the centralization of power inside public national banks. For worldwide administrative selection, the issue of focal guideline remains the principal predicament that nations have begun to work with. The idea of public blockchains and dependence on a broad agreement for approval of exchanges in squares of a blockchain kept up by unknown people must be overseen through an instrument that gives the necessary public security.

Computerized monetary standards are as yet favored over crypto as governments trust in the control of liquidity and cash gracefully whether paper or advanced, the main contrast computerized will consistently be in the framework and observed, while the paper is esteemed to resign. Notwithstanding, if the open rivalry issue presented by digital forms of money is controlled, public stores can ordinarily be moved to crypto.

Then again, there are set up economies, a considerable lot of them in underdeveloped nations, have understood the advantage of embracing Fintech methodologies to get up to speed with the race of banking their social orders. In any case, would Blockchain-based Fintech orders permit them to do as such?

It is, with no uncertainty, understood that the advancement of a Fintech environment is fundamental because of numerous drivers:

I. REQUEST

People, SMEs, and budgetary establishments will profit by consistent monetary administration methods gave by innovation. In nations where public assets are determined by unfamiliar direct ventures (FDI), settlement and administrations, as opposed to industry and nearby creation expecting to become provincial business centers depending on their purchaser market size driven by the immense populace, will zero in on need zones identified with installments, miniature loaning, and framework enablement.

II. FINANCING

In those nations, craving for Fintech financing is restricted because of need or crude legitimate and administrative orders. The requirement for delivering a public technique and impact on investments to put resources into Fintech new businesses is basic.

III. GUIDELINE

Water can be tried with little advances, beginning from portable wallets, e-KYC, computerized loaning, and web-based business. For a permitting system to be created it needs to rise out of genuine use cases. To empower this to occur, the idea of Sandboxes utilizing genuine test clients inside a controlled climate is the path forward to build up the ideal fit procedure establishing the frameworks fitting the market needs and following the means affirmed by different pioneers in the race.

Sandboxes fundamentally intend to help advancement while looking after control, securing buyers, creating a trust for financial specialists, and giving intends to a coordinated effort.

IV. ABILITY

HR profiting by a populace of youthful instructed worldwide residents upheld by the public bearing of innovation training is critical. Work openings and consolation of SMEs just as offering supporting proficient types of assistance is a significant mainstay of the Fintech procedure, as quickening agents and hatching centers.

V. ADMINISTRATION

All supporting elements work together to help the system from lawful structures to media transmission administrative bodies just as monetary controllers and against tax evasion specialists.

To accomplish all the abovementioned while utilizing the advantages of Blockchain and still keep up the required control, a devoted framework can give a truly reasonable goal.

JACS.tech, a decentralized foundation for Web 3.0 administrations and application, could assume the required part of the worldwide stage completely appropriate for the rise of the aimed Fintech environment of the nations pointing driving functions in the money related innovation long-distance race. Not just that public blockchain component will guarantee possible worldwide arrive voluntarily be accomplished however the idea of utilizing early adopters as empowering agents inside right around a close live sandbox environment will normally come set up.

The network will be boosted to spread the take-up of the applications sent over the JACS framework while application engineers will zero in on their administrations while leaving the correspondence foundation to be taken care of consistently over the JACS public chain.

JACS grows the arrive at not exclusively to dynamic Web clients, yet additionally to things and machines needing to intercommunicate over the worldwide organization utilizing its bountiful genuine location space.

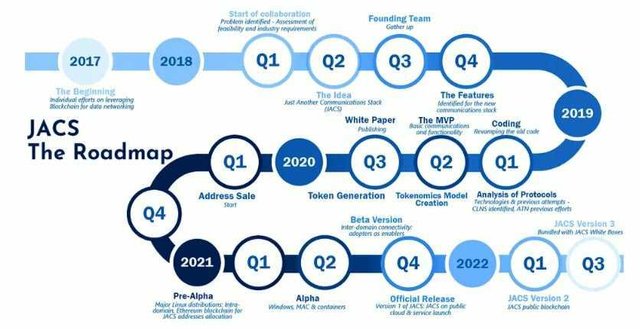

ROADMAP

USEFUL LINK:

Website: https://www.jacs.tech/

Twitter: https://www.twitter.com/Moustafaamin77

Telegram: https://t.me/jacstech

Bitcointalk: https://bitcointalk.org/index.php?topic=5279310.0

LinkedIn: https://www.linkedin.com/company/viablock

Whitepaper: https://www.jacs.tech/white-paper

Bitcointalk username: Lizzysneh1

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=2451642;