The Big Long – Update on Collapse in Bitcoin Dominance – 11/14/17

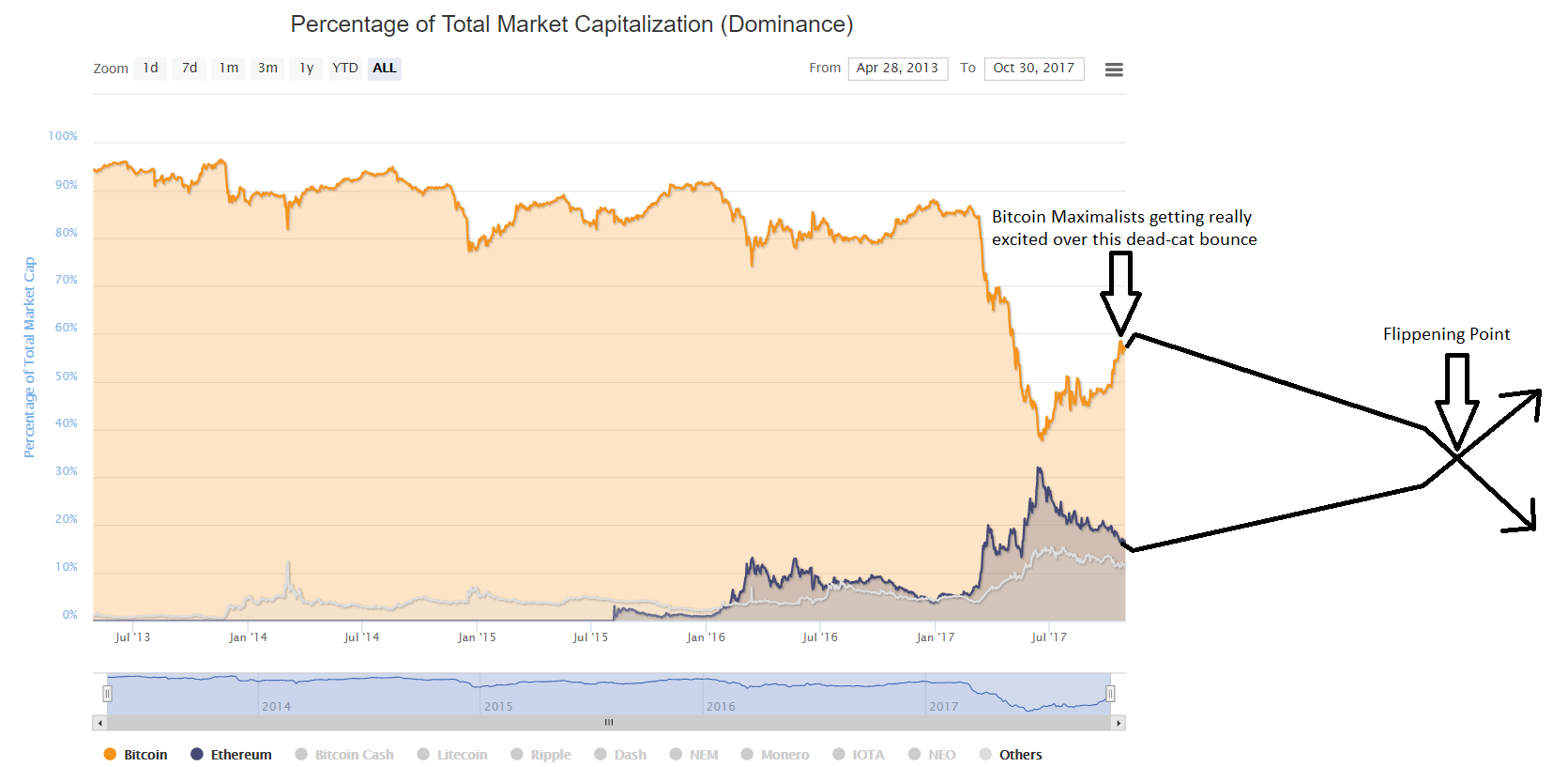

A few weeks ago, I posted the following image:

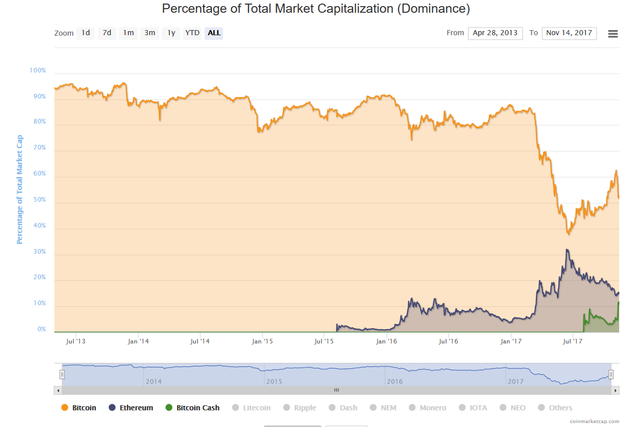

Here is what has happened, as predicted. So far, so good.

Bitcoin’s share of the overall crypto market should continue to decline with another leg down in the coming months. The network has split twice effectively, resulting in bitcoin, bitcoin cash, and bitcoin gold. I was surprised that bitcoin cash did not capture a larger share of the market initially, although it has recently eaten away at bitcoin’s dominance. Bitcoin Cash would have probably done better with segwit enabled in conjunction with the 8 mb block size limit. Perhaps a new fork will emerge with segwit and 8mb blocks combined as a final fork of the bitcoin network during this cycle.

I am aware of all arguments for leaving the 1mb block size limit in place, but have yet to see a convincing, realistic argument for doing so, although proponents of the 1mb block size limit have strong conviction in their arguments. Perhaps they will be proven right over time and the big blockers will be proven wrong. We shall see.

Personally, I think a block size of 1 mb is a joke at this stage. Suppose bitcoin sees full adoption of segwit and tx limits increase to roughly 12 tx/sec max. That allows each person on earth 1 bitcoin tx approximately once every 20 years, which will not fly for a global reserve currency. Sure, people can use the lightning network, side chains, or some other off-chain scaling solution, but the core security properties of bitcoin are lost when not using the main chain. Also, I was glad to see 2x cancelled because a 2 mb block size limit is also a joke. Bitcoin Cash’s 8 mb limit is a step in the right direction, as long as the roadmap calls for much larger blocks over time. In my opinion, Monero’s dynamic block size limit is probably the best solution out right now, and any bitcoin fork would be better suited to use it.

I am not opposed to secondary scaling solutions, I just believe everyone should have a right to the core security properties of the main chain, if only for large transactions, or else the system doesn't work as intended for all of humanity.

I imagine this will work very similar to the way people use fiat today. For instance, say I have $100,000. I may put $90,000 in a savings account, $9,900 in a checking account, and $100 in my wallet in my back pocket for everyday spending. The bank accounts are the most secure and the back pocket is the least secure. If I lose the $100 in my back pocket, I may not be too happy about it, but it won’t ruin my life. If I lose the $99,900 in my bank account, I am devastated. The eventual dominant chain should provide tx limits at rates that will easily allow every person on earth at least 1 tx per month, which roughly equates to around 3000 tx/sec or segwit enabled 250 mb blocks. This rate is generally consistent with the rates at which people transfer large sums of money from their savings account to spending accounts. Once a month, a person can transfer a few thousand dollars’ worth of digital currency from the main chain to an account for monthly expenditures and from there they can transfer a hundred bucks or so to a not-so-extremely-secure wallet on their phone for daily expenditures, or vice-versa. This way people can take advantage of the core security properties of the main chain while having the flexibility and ease-of-use inherent with a typical personal wallet. For all intents and purposes, the $100 back pocket wallet could be a centralized solution.

This is how I see this technology eventually maturing. However, I think Proof-of-Work is in the process of being obsoleted and a superior consensus mechanism will emerge as dominant. Ethereum’s Casper design is the front runner. In fact, Ethereum is the most likely candidate to be the internet of value at this point because of Casper and scaling solutions including sharding, plasma, and raiden networks. These scaling solutions should provide the 1tx-per-person-per-month on-chain settlement that I outlined above, along with other secondary use cases in subsequent layers.

Most likely, the winner will capture 80%+ of crypto market share, while the rest will have combined less than 20%, consistent with the pareto principle. It is very difficult to predict exactly how this will play out and it almost certainly will not evolve exactly as anyone foresees, but it is very exciting to watch and participate in. Good luck to everyone involved.

Disclaimer: None of this is advice of any kind.

https://steemit.com/steem/@helikopterben/crypto-commentary-altcoin-breakout-bitcoin-dominance-in-jeopardy-02-15-17

You were right about Bitcoin dominance.

Thanks. At least I got something right.

Thank you for posting helikopterben.

Appreciated the well written article and graphs.......your idea of the wallet and ease of use.....is right around the corner......after a greater percentage of acceptance of bitcoins in general....it will be amazing to watch all the supporting players in cryptospace have their day in the sun.

In the meantime....enjoy the quiet whilst we can. Cheers.

Nice article as @bleujay pointed out.

I am not a big fans of the different bitcoins neither.

What projects do you like?

My favorites are EOS, ETH, XRP, Steem, BTS, LTC and Augur. Do you have doubts about one of the following?

Take care.

Thank you vlemon.....If you do not mind bleujay answering your query regarding your favourites with an opinion.....

Could not have better coins.....however XRP...Ripple is tied to the banking industry and when it begins to flounder....perhaps May18 or sooner....Ripple will have problems as well. Also the privacy coins are good to have in ones portfolio...ie....Monero, Zcash etc.

Would appreciate hearing helikopterben's take as well.

Cheers.

Hello @Bleujay, Of course I do not mind.

I know for XRP, I see it from an equity perspective. I believe it could be the one showing mainstream adoption (I understant it is not decentralized and is king of a closed loop). Nevertheless, if as a customer I can transfer 5k€ to China in 10 sec for 1€ using my usual bank account and having no clue they use Ripple. I still think Banks will love it as they retain control over their customers.

Yes I used to own Monero. Which one would you pick between XMR and Zcash? and for what main reason?

Cheers,

Thank you for your reply.

Oh yes...you are correct about Ripple....bleujay actually has some as well.

Between Monero and Zcash.....oh dear...lets say Monero as it is a bit of a sleeper at the moment....however the thinking is that it will shed its less than stellar reputation....and will be the one to watch...so for the possibility of growth...Monero.

Both will do well in bleujay's opinion.....certainly as governments catch on.

Cheers.

Actually, Ripple is somewhat decentralized, but is prone to censorship because new nodes generally have a set Unique Node List (UNL) that is controlled by ripple labs. However, node operators can change their trusted nodes at any time if they wish, so ripple has a chance to be much more decentralized as time goes on if a diverse set of nodes and validators emerge.

Besides, the bulk of security comes from digital signatures (which ripple has) and the constant ability for users to hard fork the system through open source code (which ripple has). So far, I am not aware of any major attack on ripple consensus, so the naysayers have some proving to do.

Contrary to popular belief, some fiat currencies are somewhat decentralized. For example, monetary policy for the US dollar is set by the federal reserve, the head of which is elected by the president, who is elected by the populous. However, the dollar has suffered massive attack (bailouts, qe, inflation) primarily because users don't have digital signatures and they can't fork at will. Imagine if a faction of US dollar users could have forked the US dollar at the point of the first bailout in 2008. I would have traded all bailout dollars for real dollars myself.

Thank you helikopterben for this information regarding Ripple.

Always appreciate learning more about cryptocurrency and the money system in general.

Cheers.

News out today about Ripple and AMEX:

https://ripple.com/insights/american-express-joins-ripplenet-giving-visibility-and-speed-to-global-commercial-payments/

Dear @helikopterben,

I fully agree with you, the decline of BITCOIN dominance is the near horizon if the DEVs do not work against...

You talked about MONERO and ETHEREUM as the most probable candidates, what do you think about BITSHARES? it is nowadays the fastest coin in the cryptoworld...

cheers

I used to be a big fan of bitshares, but several problems exist IMO. Namely, no real incentive for market makers exists. Perhaps this has changed. I haven't looked into bitshares in a while, especially after dan larimer moved on. I think EOS has a chance to host a bitshares-type platform that will work.

Decentralized exchanges are coming, make no mistake. I like the idea of performing all operations off-chain except for settlement, which some exchanges, especially ethereum-based exchanges, are attempting. I think idex is one that is trying to do this. This will allow a user experience most closely resembling that of a traditional exchange, with the blockchain-based security properties for user funds.

I need to dig into decentralized exchanges more because that is one of the biggest killer apps of this technology.

Bitcoin cash will never have segwit, they forked the network not to implement segwit, it would also be asic resistant so why should Bitmain allow this? The block size is not a definitive scaling solution, you can’t deal with hundreds of millions of transactions daily just increasing the block size...nobody would ever be able to run a full node with so much data to record, the fact that bitcoin cash works today is because still a niche of enthusiasts know about cryptocurrencies and who does barely knows the difference between Ethereum and btc, but from this to go mainstream in people’s everyday life is a big difference...and in my opinion, if you really want big blocks then just use Dash which has 45mb blocks, using bitcoin brand on a coin that without its name would be out of the top 50 is just an attempt to destroy bitcoin and spread FUD on the markets.

There is no attempt to destroy bitcoin because hard forks are a free market solution. Several hard forks have been tried before on bitcoin with no effect. Bitcoin cash has taken market share because bitcoin has failed to upgrade, IMO. While secondary scaling solutions are necessary, 1 mb is still a joke. Bitcoin market share should continue to decline.

Agreed on the decline of BTC. I heavily believe in protocol level improvements. A tree with strong roots can withstand a storm. You can read from the founder of Dash Evan Duffield on the topic of on-chain scaling with 400MB blocks :https://medium.com/@eduffield222/how-to-enabling-on-chain-scaling-2ffab5997f8b

I truly believe in Dash Evolution and Dash is currently my biggest crypto position. I also wrote a semi-parody post on Bitcoin scaling comparing it to better products: https://steemit.com/cryptocurrency/@vimukthi/bitcoin-fees-triple-under-a-week-while-dash-makes-itself-10-times-cheaper-my-discovery-of-a-secret-device-to-store-the-entire

halo man i read your article! im about to invest 10 k in bitconect tomorrow! what should i do! you dont mention bitconect in this article! i realy need your advice!

Bitconnect is a ponzi scheme don't do it.

I run a company (http://criptonetwork.com) that assess and educate cripto-investors or investors who want to invest in cryptocurrencies...Bitconnect is about to collapse, it has been declared scam by the British authorities and it has two months to show the opposite...I wouldn't like to lose 10k in 2 months to be honest ;)

scam coin