The Big Long – Revisiting Helikopter Ben’s Top 10 Predictions for 2017 – 12/27/17

It is always interesting to look back at the beginning of the year and see how technology and markets have evolved, usually in very unexpected ways. It has been a banner year for crypto, which I mostly forecast. Here is the list of predictions from last year and how they fared:

- A major breakthrough in consensus protocols will be achieved and a POC for this technology will be released. Most likely this will come from the ethereum team as significant research has gone into this field of study. It won’t be clear at first, but over time and, with enough testing, this system will be deemed superior to POW, DPOS, and any other competing protocols. Significant trolling will accompany the release of this system. This breakthrough could possibly come from another source.

I indicated that I thought the proposed Casper protocol in ethereum would make major breakthroughs this year with respect to consensus protocols. While significant progress has been made, the final version is not out yet, but could come in 2018. Both Vitalik Buterin and Vlad Zamfir are working on different implementations and the initial production version will most likely incorporate work from both individuals. As I said, time will be needed for the realization to set in that another consensus mechanism is superior. It won’t happen overnight.

One interesting ‘breakthrough’ is Komodo’s delayed POW, which uses the bitcoin blockchain to notarize its data, allowing for bitcoin-level security without the need for mining operations on its own. This could allow even the smallest of blockchain-based systems to be highly secure, potentially alleviating some of the scaling bottlenecks associated with digital asset systems.

2 A large faction from the traditional financial system (think goldman-sachs, JP Morgan, Bank of America, ect.) will defect, form their own company with ample funding, and begin building an ethereum-based derivatives network - futures contracts, options contracts, contract-for-difference, ect. This network will be built on top of the ethereum public chain and will also work with rootstock. This action will futher reduce the legitimacy of private chains. However, it will also become clear that the base layer of ethereum needs years more work to get to the point where these two networks can be used reliably. POS and sharding will be difficult to get right on many different levels, but will be done eventually, just not in 2017.

Some pretty detailed predictions here. **The Ethereum Enterprise Alliance (EEA) did form in February**, after being announced in January, and has about 300 members, including JP Morgan. This entity was formed to integrate existing enterprise with the public ethereum blockchain.

While an ethereum-based derivatives network could emerge from this, it looks like the entrepreneurial community is making the most progress. As usual, the financial incumbents are dragging their feet. The 0x protocol is being built for decentralized exchange. Another interesting decentralized exchange project is Idex, which performs all trading functions off-chain for users and only uses the main ethereum chain for settlement. I imagine this could be abstracted one level further to only have dispute resolution occur on-chain.

3 bitcoin - Segwit will not be activated in its current form. The 95% threshold needed to achieve activation will not be reached. Currently, miner activation levels have stagnated around the 25% level and segwit enable nodes have yet to reach 50%. However, an agreement will be negotiated that accommodates a block-size increase in conjunction with segwit and a lower threshold for activation, which will be done as a hard fork. This hard fork will not take place in 2017.

Indeed, an agreement was reached to incorporate both segwit and a 1mb block-size increase. This arrangement, dubbed the new york agreement, was cancelled after it was deemed that sufficient consensus had not been reached for this change.

However, segwit was required to be enabled before the hardfork to 2mb blocks. The agreement was canceled only after the segwit portion of the agreement was fulfilled. A bit of a bait and switch if you ask me.

Also, bitcoin cash forked from the bitcoin core chain to produce a chain without segwit and with an 8mb block size limit. This chain has consistently retained roughly 10% of the adoption level that bitcoin has experienced, based on most metrics such as hash rate and market capitalization.

4 Bitcoin will reach a price of $6,000 and then crash spectacularly. Tx rates will increase dramatically during this run-up and, as a result, the rise will be exacerbated as users won’t be able to send coins to exchanges to sell. This will highlight the main problem with bitcoin – onchain scaling – and miners will finally be motivated to do something about it: see prediction #1.

Any time you forecast a 600%+ increase in price in one calendar year for an asset, and get it right, you have done spectacular. Bitcoin surpassed $6,000 and looks to end the year around the $15,000 mark.

Typical transaction fees have gone from about $0.35 at the beginning of the year to around $45.00 now, pricing out the vast majority of users. In my opinion, this is a ticking time bomb.

5 ETH will see a price of $100 and remain somewhat stable near that price.

Another correct prediction. This time for a 1,235% gain in price. Although ethereum did not stabalize near $100, I will consider this a correct prediction. ETH price has gone from $8.10 to $740.00 this year, for a gain of 9,135%.

6 Steem will reach a market cap of $400 million again but won't surpass it. Fears of stakeholder centralization will be prevalent throughout the year.

Another 1000% gain correctly identified. Steem began the year at a $40 million market cap and is currently just under $800 million. Although it is finishing the year at well above $400 million, it pulled back significantly from July until December, and has only very recently surpassed that $400 million mark.

7 An unforeseen use case for Steem will emerge.

Smart media Tokens (SMTs) were introduced in 2017 to further enable monetization of content creation through the Steem blockchain.

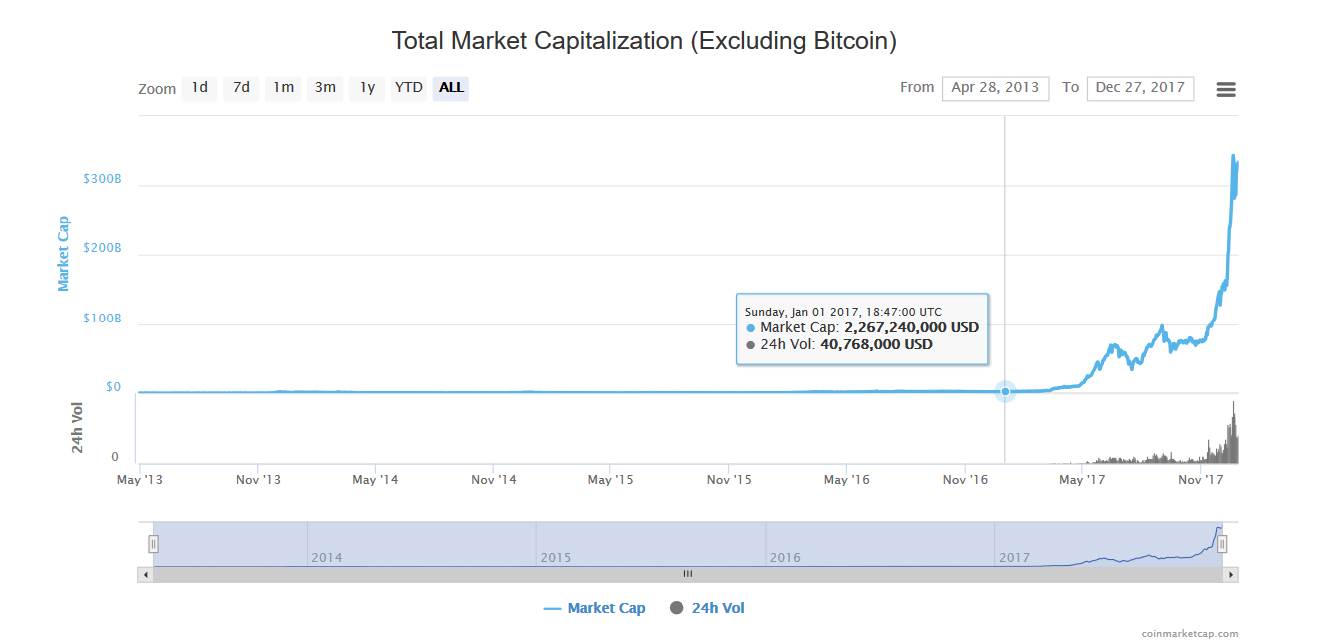

8 A brief buying frenzy will occur in most altcoins. Only the strong will survive. combined altcoin market cap will hit $10 billion.

A 450% gain correctly predicted, although the final tally will be more along the lines of 14,475%. This year has been a once in a lifetime opportunity in the crypto markets. You won’t see this again.

9 The Euro will experience further decline vs the dollar. Interest rates will rise in US dollars (specifically the 10 yr treasury note) and at least one fiat currency will hyperinflate.

Several predictions in one here. The first one was wrong. The Euro gained a bit over 13% against the dollar.

The 10 yr treasury note is down to 2.41% from 2.47% at the end of last year. I still could be technically right on this one, but probably not. Interest rates have done a round-trip this year, falling as low as 2.03 on the 10 yr before recovering to nearly flat on the year.

Venezuela was the big hyperinflationary story this year with the currency hyperinflating at an annual rate of 2,000% in November. Nailed that one.

10 The US stock market (S&P 500) will decline this year, which will begin a multi-year downturn and possibly a multi-decade drop in stock prices.

I am going to stop calling tops in the US stock market. It seems to be an exercise in futility. By many metrics, the markets are overvalued. However, I suppose the mantra of “don’t fight the fed” rings true more than ever.

Bonus: At least one more member of the European Union will leave.

Italeave, Frexit, Czech-out, or any other slang term for a country leaving the European Union – did not happen in 2017.

I will be posting predictions for 2018 in the next few days. Stay tuned.

Disclaimer: None of this is advice of any kind.

resteemed - great thoughts, will keep an eye on your work :)

Congratulations!

You did much better than Goldman Sachs with their recommendations:

"Six out of eight trades were stopped. Now we all get things wrong, but this should warn us to avoid copying analyst trade recommendations for 2018."

https://seekingalpha.com/article/4126510-goldman-sachs-top-trades-fades-2018

Nice prediction...thanks for guding me...i like your post god bless u dear...and tha ks for sharng

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly – Featured Posts are voted every 2.4hrs

Join the Curation Team Here

https://steemit.com/contest/@trophy-token/classy-content-awards-3-nominate-a-post-for-a-trophy-token

I had to nominate this post.

Congratulations! You were nominated for a TROPHY TOKEN award HERE Please comment your Bitshares address to receive your reward! You can also contact us on Discord @Trophy-Token. Thank you for being a great Steemian!