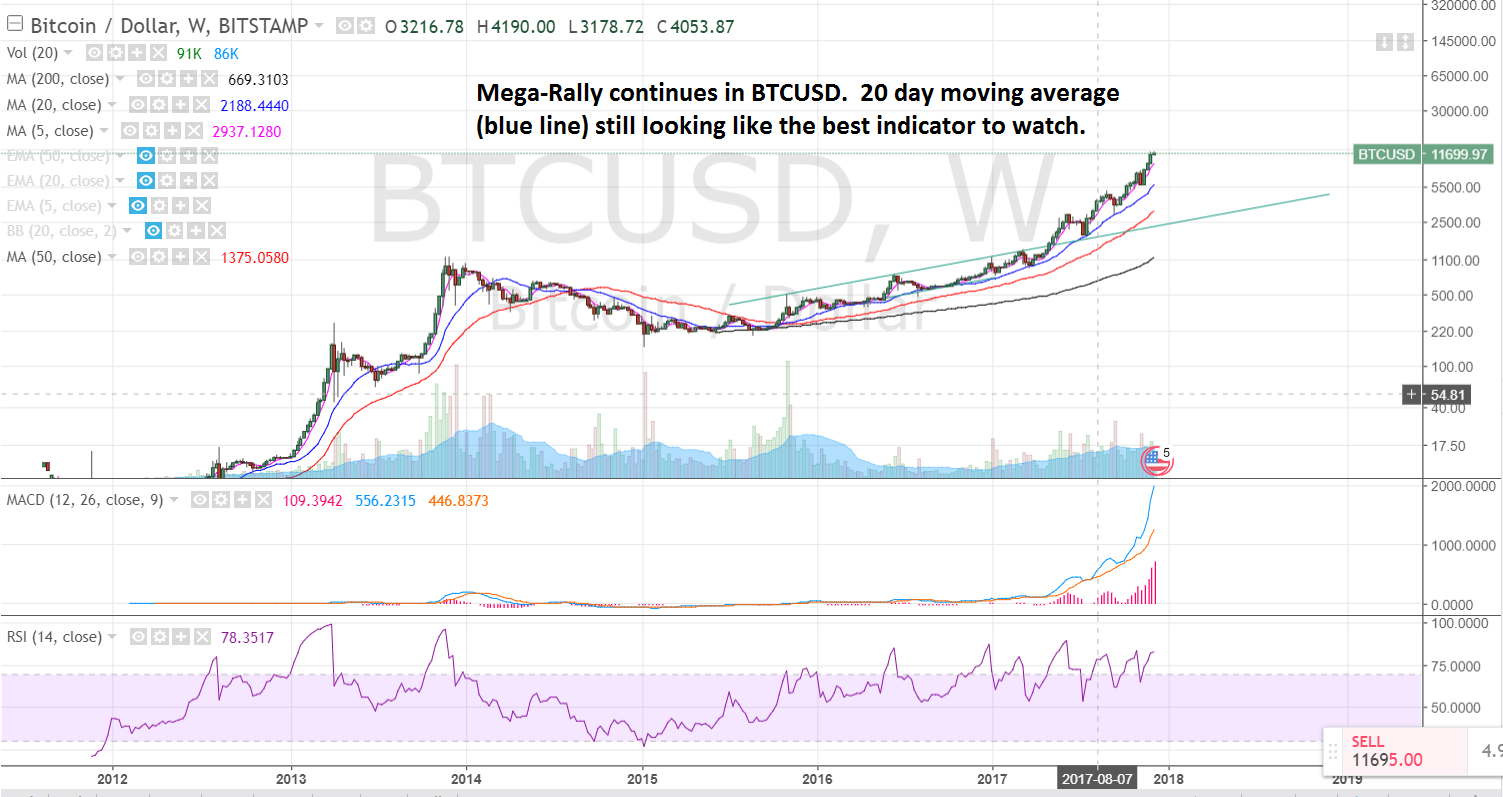

The Big Long – Bitcoin Mega-Rally Continues as Futures Begin Trading – 12/05/17

BTCUSD is up roughly 50% since I posted this article, highlighting the similarities between bitcoin now and silver in 1980. I suspect we haven’t seen the top yet. To negate this view, we need to see a completed weekly bar (open, low, high, close) below the 20 week moving average.

The CBOE will begin bitcoin futures trading on Sunday, Dec. 10th and the CME will begin bitcoin futures trading on Monday, December 18th, soon to be followed by the Nasdaq. I predict the onset of futures trading will lead initially to a short, but powerful, sell-the-news spike lower. This will kick off the final, strongest leg of the rally as the big boys who are giddy to short bitcoin in a regulated environment are forced to cover their shorts during a meteoric rise. After that, we can start taking about a bear market.

Hello @helikopterben,

I totally agree with you, I see the trading of Bitcoin Futures as a BAD news.

Bitcoin's purpose is to be a store of value based on scarcity. By allowing bn of $ to poor in and opening the derative Bitcoin market, we are bringing the wolf.

If I was a bank or a government, I would just put some money to short BTC until it loses 50-70% of its value in order to scare crypto-investors away... You would just need 30-40bn$ to control the price (as you can leverage to X5/X10 with futures.

Then by a cascade effect, all the Ponzi Schemes (Bitconnect and co) will fall giving a Scam label to the entire ecosystem and preventing the adoption of this technology.

As with Gold ownership we will soon see a 100 people "owning" the same exact Bitcoin which will defeat the purpose of this crypto...

Take care.

those are some good informations and i agree taht we didnt see the top of it

hope u make bunch of money

We are going according to the plan.

You wrote:

"The CBOE will begin bitcoin futures trading on Sunday, Dec. 10th and the CME will begin bitcoin futures trading on Monday, December 18th, soon to be followed by the Nasdaq. I predict the onset of futures trading will lead initially to a short, but powerful, sell-the-news spike lower. This will kick off the final, strongest leg of the rally as the big boys who are giddy to short bitcoin in a regulated environment are forced to cover their shorts during a meteoric rise."