Should investors focus on the commodity sector?

Should investors focus on the commodity sector?

The commodity sector has not had it easy in recent years. Compared to "normal" shares, most commodity shares have even delivered a dramatic performance. Nevertheless, a trend shift may soon take place within this hard-punished sector.

The commodity sector has become more or less in the "forgotten corner" in recent years. Only a handful of investors are still interested in commodities today. And that is not surprising, because this sector has not had it easy in recent years. Yet that dramatic time can be over.

Commodities were rarely this cheap

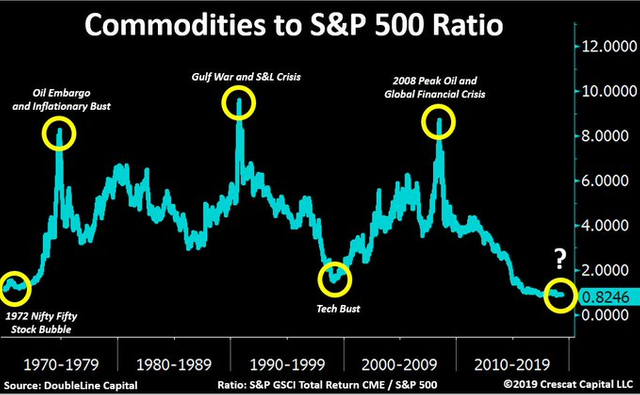

The graph above, from Crescat Capital LLC, shows that the S&P GSCI / S&P 500 index ratio has reached a level that we last saw during the 1970s. In other words, ordinary shares have outperformed the commodity sector in recent years.

However, this graph also shows that such low levels often offer enormous opportunities. In fact, in the past 50 years, investors have had such a unique opportunity to invest "cheaply" in commodities only twice before.