Keep an Eye on Bitcoin as the Next Financial Crisis Starts

Crypto-Currencies could be an investment of a lifetime given the volatility and uncertainty we could see soon. The next financial crisis might be coming.

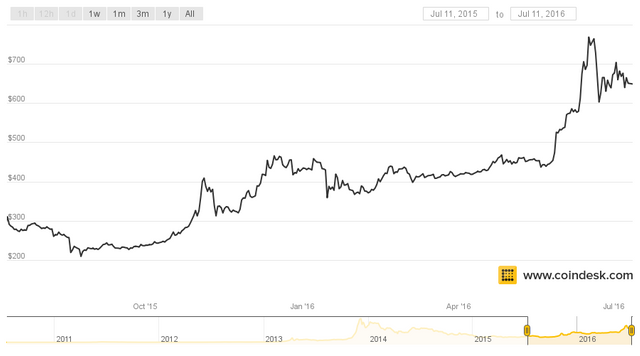

Bitcoin is on a huge streak. Its performance over the last year has been outstanding and it has outperformed most asset classes, by a wide margin. It's probably the only asset class which beats out both gold and silver, in 2016. Why is it shooting into outer space?

People look at alternate asset classes when their confidence in traditional assets fades. Since the beginning of the year, both the stock and the commodity markets have been on a roller coaster ride while catching both the bulls and the bears on the wrong side.

The macroeconomic situation of the world does not give confidence to astute investors. This is evident by the return of the legendary George Soros, who has come out of retirement to short the overblown markets. Similarly, other hedge fund managers are stocking up on gold, which supports the view that a financial crisis is right around the corner.

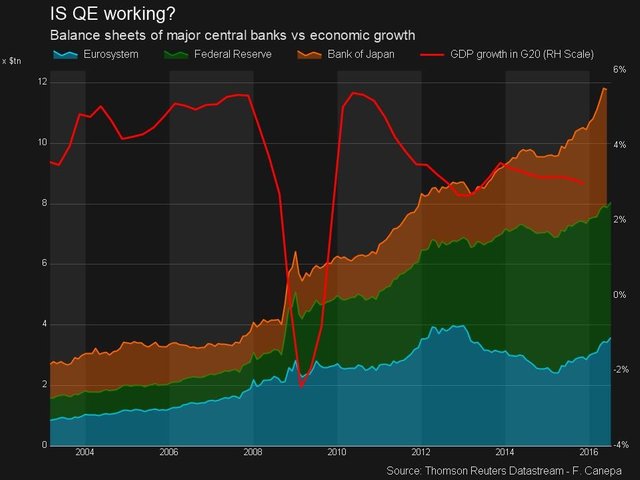

The Brexit results have also opened up a possibility of another round of easing by the central banks, around the world. The Bank of England will most likely resort to an easing schedule during the next meeting and that will be followed by the European Central Bank and the U.S. Federal Reserve. Following his victory in the recent elections, the Japanese Prime Minister Shinzo Abe is likely to push the Bank of Japan to announce another round of easing.

Since the last financial crisis, the combined central banks have pumped massive amounts of money into the system and they continue to do so at a rapid pace. Nonetheless, the world is closer to a financial crisis than ever before.

The Fed's money printing policy had led the commodity Guru Jim Rogers to remark: "The Fed will continue to print money until there are no trees left in America."

Bitcoin Is Doing the Opposite of Central Banks

Compare this with the cryptocurrency Bitcoin. Unlike the traditional currencies, the Bitcoin has an upper limit of 21 million coins, after which no more Bitcoins can be mined. It's tightening.

Every subsequent mining will become difficult and will reduce the reward associated with mining each block. Satoshi Nakamoto programmed that after mining of 210,000 blocks, the rewards will be halved. Initially, the reward was 50 Bitcoins for every block, which was halved by the end of 2012, at which time the reward was reduced to 25 Bitcoins per block. The next round of halving took place last week, when the rewards were reduced to 12.5 Bitcoins per block.

While the central banks have been on a printing spree, the Bitcoin is on a tightening route which boosts its price, as is visible in its sharp rise this year.

A few miners will find it difficult to continue mining at the halved rewards, which is likely to slow down new mining as halving will continue, in the future.

"The block halving will dramatically decrease the bitcoin being added as we approach 75% of all bitcoin issued. People understand that in this world of ever expanding assets and printing of money, we have something that's fixed and limited in issuance. It gives a decent alternative for people who want to hold assets that can have sustained purchasing power," said Bobby Lee, chief executive of China-based BTCC, which is one of the largest Bitcoin exchanges in the world.

Bitcoin and digital currencies and are changing the world, financial systems, and lives in huge way, and this is only the beginning.

Bitcoin's volatility has dropped dramatically over the past few years with the lowest linear level of volatility seen since is this asset class started. It has become easier to use for trading and purchasing.

I would also recommend researching digital wallet solutions where you can purchase many up-and-coming digital currencies on one place as I've been doing. Why? Because I firmly believe the masses will slowly migrate their money into various digital currencies as a safe-haven store of wealth and for ease of use. Payments can be made with your mobile phone to anyone, anywhere in the world and for any amount with no fees or costs, -- and in many cases it cannot be traced.

I agree that BTC with boom when the next recession hits. That is when it will shoot past the 2013 highs in my mind. Please consider upvoting my post. I just upvoted you! I just posted steemit's first pool meeting where I talk about my initial thoughts about it. Check it out! https://steemit.com/steem/@brianphobos/first-pool-meeting-on-steemit-initial-thoughts-and-advice-from-someone-who-has-made-money-online-since-2008