This stock almost tripled in last 6 months… Do you have this multibagger stock in your portfolio?

This stock was trading at 490 rs on exchanges on 2 Jan 2017, and now trading at 1400 rs levels.

This phenomenal stock in none other than the small cap wonder stock AVANTI FEEDS.

Avanti Feeds is the leading manufacturer of prawn and fish feeds and shrimp processor and exporter from India.

Avanti Feeds has, to its credit pioneering effort and service for over two decades in development of prawn culture, processing and exports with its state-of-art shrimp and fish feeds and processing plants.

Hallmark of Avanti is constant upgradation of aquaculture technology bringing latest developments in the field to the doorstep of the Indian aquaculture farmer.

Avanti Feeds Limited stands as a leading provider of high quality feed, best technical support to the farmer and caters to the quality standards of global shrimp customers. It has a long list of loyal customers from USA, Europe, Japan, Australia & Middle East.

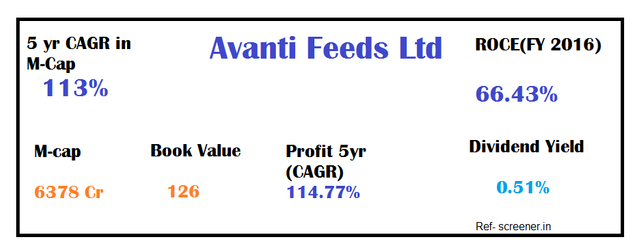

Today, Avanti Feeds has a market share of 50 percent from 25 percent in 2008. Over the last five years, the company has grown by 45 percent annually against an industry growth of 15 percent. In FY16, its revenue stood at Rs 2,018 crore, with net profits of Rs 155 crore. Almost 80 percent of its revenue comes from feeds, while the rest comes from export of processed shrimps to the US and Europe. The company has a return on capital employed of 66 percent.

The cultivation of whiteleg shrimp has met with such success in India that its production is expected to touch 4.5 lakh tonnes in 2017, from 10,000 tonnes in 2010, according to the Marine Products Exports Development Authority. This, while the production of black tiger shrimps, which was at 50,000 tonnes in 2009, was eventually stopped by 2015. According to industry publication Aquaculture, India has become the second largest whiteleg shrimp producer in the world, second only to the US, with Andhra Pradesh accounting for the bulk of the production.

Avanti Feeds’ role in this phenomenal growth has been to help farmers feed and breed as many shrimps possible within the same area, as well as reducing the feed conversion ratio (the amount of feed given to the shrimps compared to their increase in weight). At present, 1.5 kg of feed generates 1 kg of shrimps; the company is trying to generate the same amount of shrimp with 1.2 kg of feed. But achieving this target is easier imagined than done, with the feed being a well-researched and finely balanced mix of dried fish powder, deoiled soya cake and white flour. Thai Union is involved in the formulation of this feed.

Q4FY17 results

Avanti Feeds had posted a consolidated net profit at Rs 90 crore in Q4FY17 against profit of Rs 32 crore in the same quarter of last fiscal. It had profit of Rs 46 crore in December 2016 quarter.

Total net income from operations of the company during the quarter under review increased 50% to Rs 704 crore over the previous year quarter.

Looking at the full year numbers, we see that Revenue jumped by 35% to reach Rs.2732.66 crore while EBITDA rose by 43% to 329.7 crore.Company reported net profit of Rs.214 crore, up 36% yoy.