Investing on Dollar-Denominated Securities in the Philippine Stock Exchange (100% Original Post)

The Philippine Stock Exchange will now be offering dollar-denominated securities for both traders and investors in the stock market.

Here are the answers to the most frequently asked questions about this new type of financial instrument, as provided to me by the PSE press.

What are Dollar-Denominated Securities?

Dollar-Denominated Securities (DDS) are securities listed, traded, and settled in US dollar (USD). The introduction of DDS aims to provide issuers and investors more instruments to meet their specific requirements.

It can provide issuers with dollar-denominated requirements an opportunity to raise capital at the Exchange without incurring foreign exchange risks.

In the same manner, the product can also reduce the currency risk exposure of foreign investors who trade PSE-listed securities.

Moreover, DDS offers local investors an alternative investment option for their USD currency holdings.

When will DDS be available?

The PSE Rules on DDS were approved by the Securities and Exchange Commission on November 10, 2016.

The first DDS listing shall be on April 7, 2017 with Del Monte Pacific Limited. DMPL intends to issue up to $360 million in US Dollar Denominated Series A-1 Preference Shares in the Philippine capital market.

Information on new listings may be viewed from the Listing Notices published in the EDGE website.

Who can trade DDS?

Both local and foreign investors may trade DDS as long as they have a foreign currency deposit unit (FCDU) account with any bank.

An FCDU account is needed for a more efficient settlement process. Dollar-denominated dividends, if any, shall also be paid through the FCDU account.

How do you trade DDS?

DDS is traded like any other stock in the PSE during trading hours. However, an investor must trade through an Eligible Broker.

Who are the Eligible Brokers?

Trading of DDS is restricted to Eligible Brokers. Eligible Brokers are trading participants which complied with the Exchange’s requirements to ensure their operational readiness to trade DDS.

As of March 24, 2017, there are eight eligible brokers which can trade DDS: (1) Armstrong Securities, Inc.; (2) Astra Securities Corporation; (3) BA Securities, Inc.; (4) BDO Securities Corporation; (5) Philippine Equity Partners, Inc.; (6) The First Resources Management and Securities Corporation; (7) Venture Securities, Inc.; and (8) Wealth Securities, Inc.

Are the mechanics for trading DDS the same as trading peso stocks?

Other than the difference in currency denomination, the mechanics for trading DDS is the same as trading peso stocks.

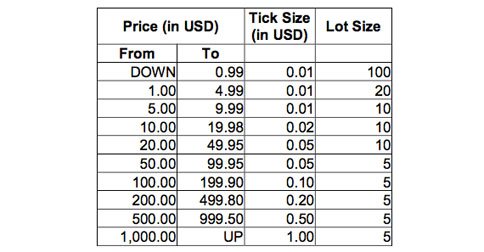

It follows the board lot or round lot system which determines the minimum number of shares an investor can buy or sell at a specific price range.

However, the minimum lot sizes for DDS were adjusted from their peso denominated counterpart to make them more affordable to investors. The minimum price fluctuation and board lot for DDS listed in the Exchange are the following:

DDS also follows the same settlement cycle of any other security at the PSE, which is at T+3. This means that the delivery or payment for DDS transaction should be made before the settlement date of three working days after the transaction date.

Do I need to have USD to buy DDS?

Yes, an investor must have ready USD in his FCDU account to trade DDS. Settlement for purchases of DDS shall be is USD.

Investors may purchase USD from banks to invest in DDS, based on Section 44 of the Amendments to Foreign Exchange Regulations issued by the BSP.

Who is the appointed settlement bank for DDS?

The Securities Clearing Corporation of the Philippines (SCCP) has appointed BDO Unibank, Inc. as the designated settlement bank for the launch of DDS.

This means that Eligible Brokers must have an FCDU settlement account with BDO. The SCCP may appoint more than one settlement bank.

However, the FCDU accounts of DDS investors may be with any bank.

What are the transaction fees involved in trading DDS?

Trading DDS will involve the same transaction fees as peso-denominated stocks such as SEC fee, PSE transaction fee, clearing fee. Selling investors will also need to pay stock transaction tax equivalent to 0.5% of the transaction value.

These fees are payable in Philippine pesos (Php) converted using the PDEx closing USD exchange rate on transaction date.

Broker’s commission on the other hand, varies depending on the value of transaction with a maximum allowable commission rate of 1.5%. Such commission may be payable in either Php or USD.

Where can I find more information about DDS?

For more information on DDS, please visit the Dollar Denominated Securities section of the PSE website under Products & Services. DDS transactions shall also be included in the End-of-Day report generated by the Exchange.

You can also see this blog on my website: https://fitzvillafuerte.com/investing-dollar-denominated-securities-philippine-stock-exchange.html

Entrepreneur. Blogger. Dreamer.

Entrepreneur. Blogger. Dreamer.

Entrepreneur. Blogger. Dreamer.

Entrepreneur. Blogger. Dreamer. My Websites:

Facebook

ReadyToBeRich

THANKS FOR READING! :-)

ReadyToBeRich

THANKS FOR READING! :-)

Follow

Thank's man. Will follow you back