The great crypto-currency deflation + my predictions

By now many of you have noticed the trend in crypto markets, most if not all tokens have been declining five to ten percent in value per day each of the previous three days. I'm sure if you are like me you saw this coming and didn't have much of anything in BITcoin or digital coins in general other than steem. I hope you didn't hold too much but if you are trying to hold it out and sweating you might want to read this anyway.

This economic trend is not exclusive to crypto economies. Many of the world's financial markets have experienced downturns this week. The reality check appears to be sweeping the world at large. The big players that influence markets with their decisions appear to be gaming the digital markets like they have with the stock market for generations. Time will tell if they are successful here as well.

In the days when we were all seeking the top of the pyramid to be established we trusted in the power of the pyramid itself to bring us value. The days of this trust often exhibited by the hold meme and its propagators, has been lost along with the days of peak BITcoin.

Fortunately for uncertain traders and economists, the top of the pyramid was established in late 2017. Since the peak value of $19,843 was established in December, the currency has lost over half of it's value from that time. In fact, holders of the currency have lost over $70 Billion collectively so far this year, and we are barely even one month into 2018, this year will be one for economic history books and economists to remember.

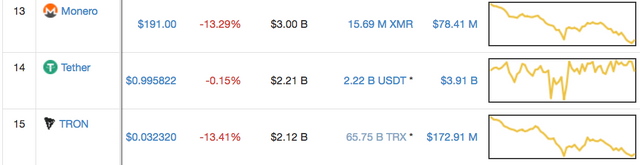

Since all tokens are more or less declining together the playing field is being leveled regarding crypto to crypto trading as more investment is tempted to join into the digital/crypto economy. While outside investment has been minimal in the past month this can change any moment a big player moves all of their capital to one currency. For us speculators what to keep an eye on is the proportions between cryptos and if they are narrowing or widening in time. The only relative benchmark for the market other than these proportions which seem to have been established based on the currency consumption habits of digital consumers is the USDT.

USDT is below $1 indicating there is more demand to trade out of the digital economy than people willing to trade in. This rule does not function perfectly but is a good indicator of urgency and outlook. When people were saying to hold BITcoin at $18K this token was trading between 1.01-1.03 constantly.

Predictions

- BTC at $4,500 by April

- $1,200 BTC by the end of 2018

- $600 ETH by April

- $1.00 Steem & SBD by the end of 2018

- USDT his a record low in the 80¢ range due to a panic sometime this year.

- $100 Monero (XMR) by October

- BITcoin and XMR parity by 2024.

These are my predictions for what will happen during this year and beyond in crypto markets with the data so far this year and to the best of my market analyzing ability as of now. In 2010 I predicted BITcoin would get to over $1,000 and was proven right within five years, It was trading at $8.00 at that time.

The great deflation will continue

It may have been greed or fear but regardless of the reason one can easily see that many big players (people owning more than 1% of total capital in an economy) bought into BITcoin believing the hype that it would come to be accepted worldwide as legal tender.

One can see that these big players repeatedly crash markets in order to make a profit selling and later rebuying the same volume at a lower price. This gaming of markets has been around as long as markets have been but it is only now all participants can see with their own eyes this type of absurdity and also clearly see who is responsible and profiting from the market volatility.

I believe the big players bought in early last year so their baseline is somewhere between 2-4k.

The losses were are now seeing is from an excess demand these big players are creating by selling their supply. They are not concerned with its actual value because these people already have enough money to retire not including this speculation of Billions they are making over 100% on (declining everyday until base line).

We may see a spike when BITcoin gets down to about the five thousand dollar mark but after this short lived event of a week or so I would expect BITcoin to linger in the three to four thousand dollar range before finding somewhat of a floor around twelve hundred dollars later this year.

Summery

I hope I am proven wrong with my predictions so I can learn more about the economics of this exciting new industry, but I stand by the predictions made in this post to be accurate. I have entered and won many prediction contests on steemit, but my predictions here more represent the time frame I am interested in documenting. Feel free to comment on them or provide your own predictions below. Thanks for reading and steem on friends!

Also SBD will be more valuable than Steem again by March

I think you're right about some of the coins running even lower although I think clif high is right, there will be new highs too, especially towards the end of the year. This is one of the first years where a lot of the coins actually represent functioning businesses and ideas that can be used by businesses so as the tech gets adopted the market will climb again.

i honestly hope you're wrong as well. let's not forget how some of the coins tend to brek free from following bitcoin and that the marketcap dropped with two thirds comparing to early 18 and still grow bigger!

have you read this article? it raises some interesting points

https://www.coindesk.com/coindesk-releases-2018-bitcoin-blockchain-industry-report/

I have not seen this yet, I will check it out Thanks for sharing! Like I said in the post, value is not as important as trading proportions I will read the link with this in mind.

yeah i see your point

You got a 7.69% upvote as a Recovery Shot from @isotonic, currently working as a funding tool, courtesy of @digitalsecurity!

@isotonic is the Bid Bot of the @runningproject community.

Earnings obtained by this bot, after paying to the delegators, are fully used to increase the SP of the @runningproject from which all affiliated members are benefited.

Check @runningproject posts in order to know further about.