Bankera: Banking for the Block Chain Era - ICO review Team & Road Map - Part 4/4

In my previous article we have reviewed Spectrocoin as an exchange and e-wallet provider. We also saw the steps on how to register, deposit, purchase tokens and withdraw Ethereum that is received as part of the merits of holding BNK token (See article 2 for details on Merits).

In this article we will finalize the review on Bankera by looking into the Team and the Roadmap.

Team

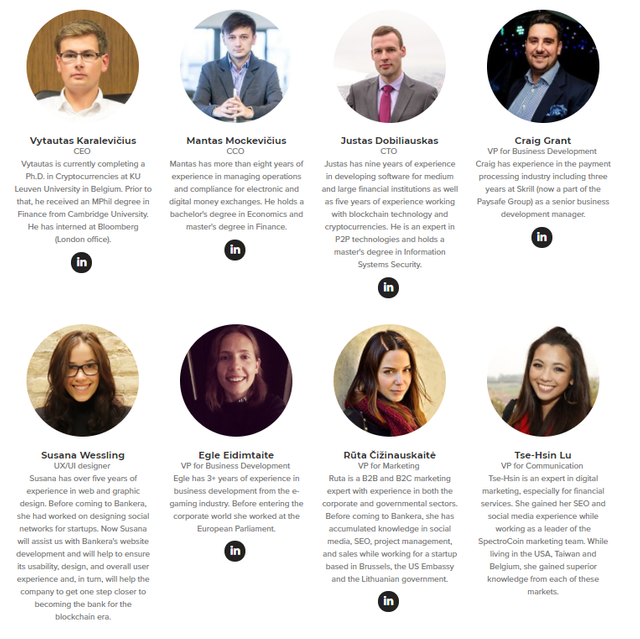

The team behind the Bankera project consists of the following members.

CEO and CCO

Similarly to Spectrocoin, the team of Bankera is also surrounded by several negative comments on the net.

Vytautas Karalevičius is the co-founder and the CEO of Spectrocoin. On Bitcoinforum there are accusations in regards to him and his CCO partner Mantas Mockevičius, who is also the co-founder of the Spectrocoin platform, of being scam artists.

Usually I would stay out of any ICOs with scam alerts. However, what made me to look into the Bankera ICO, is actually the advisers. So instead of viewing each team member individually, I have decided to look at the big picture by studying the whole team at once, including the potential influence of advisers, and by viewing the accusations against them from a neutral perspective.

Advisors

The advisors of Bankera are the following people:

Point 1

The first person to be noticed is Lon Wong. As many of you may know, Wong has a very reputable background as the president and founder of NEM.io and is a strong leader in the NEM blockchain.

In order to show that he is supporting the Bankera ICO, Wong has posted on Twitter about it:

Point 2

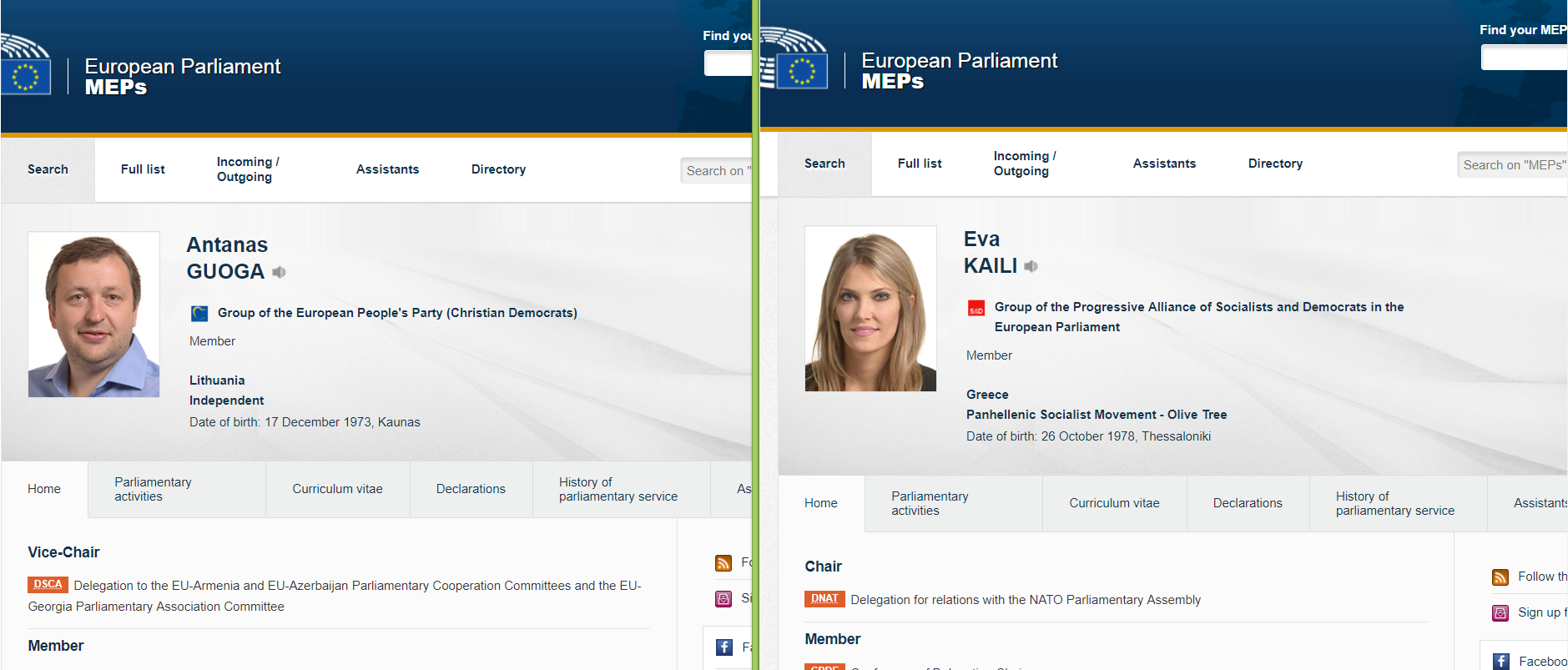

Another noteworthy point is that there are two members of European Parliament among the Advisors: Antanas Guoga and Eva Kaili. Both of them are listed on the European Parliament’s official website. Politics and finance have always been in a complicated relationship. However we can all agree that it has never been a good idea for a politicians to link themselves to such project if it was deemed fraudulent.

Here are their profiles on the European Parliament’s official website.

Point 3

Another advisor, Audrius Žiugžda, has an extensive experience in the finance industry. He is well known as a long-term director of Skandinaviska Enskilda Banken (Lithuania) and top executive in Šiaulių Bank. As you may remember, in the previous part of this ICO review we have covered Bank of Lithuania's opposing view of cryptocurrencies. Their position hasn’t changed since 2014 and Bankera/Spectrocoin have been planning their project with this position in mind. In other words, it gives them an advantage on a global level while having less competitors to worry about. And as they aim to become a global bank for the blockchain era and are working on obtaining licensing in other jurisdictions, we should consider the strong support Bankera has of their team such as Audrius Žiugžda who has an extensive experience and expertise in the financial industry and who might fuel positive impacts for the Bankera's strategy and its upcoming performances.

What to consider from a team perspective

As we have seen, Bankera has several advisors that are influential to the market. Also Bankera openly conducts interviews of their team members, publicly shows their faces, accomplishments and challenges they come across during the projects, all of which is appealing to the public as a very honest business.

While there are indeed strong accusations against the CEO and CCO, one must admit that such accusations could be untrue as there are respected and influential individuals involved in and supporting this project.

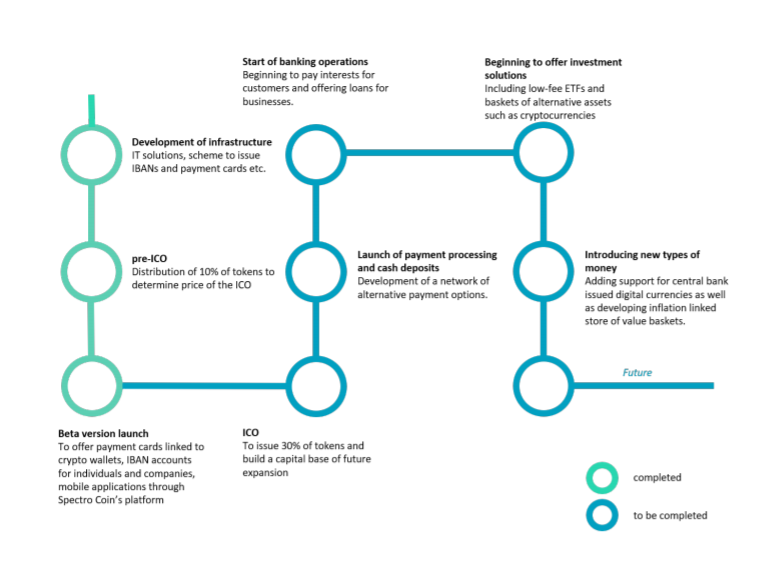

Timeline

Now that we have seen the team, let’s have a look at the roadmap.

By end of Aug 2017: Pre-ICO

By end of Oct 2017: Launch of the viable product with working IBAN and payment cards support

By end of Sep 2017: Preparation for ICO

By end of Feb 2018: End of ICO

By summer 2018: Payment processing solution

By Autumn 2018: Application for a banking license

By End of 2019: Obtaining Banking License in EU.

By Mid 2019: Starting of deposit and lending business (Initially from Bankera's capital)

A summary of achievements can be seen here:

Indeed, Bankera is keeping their promises made to the investors.

Finalizing Bankera ICO review

1st article

In my 1st article, I have reviewed the concept of Bankera:

Bankera aims to become the First Bank for the blockchain era, which allows individuals to invest and grow their assets and provides a payment solution for corporations while benefiting the economic scale growth enjoyed by traditional financial institution.

This point is best described in the white paper as following:

"In the future, Bankera will start offering various investment solutions for individual clients as well as businesses. Initially, low-cost exchange traded funds will be offered for customers; later the offer will expand by adding trading, advisory, brokerage, custody, wealth management and other services. Most of the services, such as advisory or wealth management solutions, will be developed in house based on using the most advanced artificial intelligence (AI) technologies.

For corporates, Bankera initially will offer treasury services, which will expand to cover most investment banking services required by corporate clients including deal financing”

Furthermore Bankera shares the following plans of activities and services that are to be established upon a successful ICO, which demonstrates their potential banking solutions and financial investment products and services:

"Upon a successful ICO, Bankera’s operator will establish banking licenses and become an issuing bank for payment cards.

In terms of revenue streams, Bankera will initially focus on core banking activities such as lending and payment processing, following the establishment of an banking license. The next product option that Bankera will introduce will be low-cost investment options for clients via ETFs. Eventually, the bank will offer a full range of investment services including trading, custody and investment banking services for its clients. Bankera will also offer robo-advisory based wealth management services for its clients."

2nd article

In my 2nd article I have reviewed the merits of BNK tokens.

One of the key merits of Bankera token is that 20% of net transaction revenue will be distributed among BNK holders. The amount that can be earned depends on how much BNK tokens an investor holds and the amount of transaction revenue earned during each week. The transaction revenue commission will be paid out to Spectrocoin wallets of the BNK holders. An individual can receive the rewards in ETH or in NEM.

We have seen that the amount of ETH or NEM an individual receives will decrease as more and more tokens are being sold, however at the same time, if the value of ETH and NEM increases, even for a small amount, the return can become an attractive one.

We have also speculated a possibility that Bankera may lower its margin. It may happen in order for Bankera to stay competitive in the fierce financial market. The lower the margin, however also means the lower amount of net transaction revenue BNK holder may receive. While there is a negative view on lowered margin, there is also a potential for the community of Spectrocoin to grow due to the lower margin, resulting into a larger transaction revenue due to an increased usage of their services.

Another important merits we should consider are:

1st: the potential impact of Bankera’s own exchange platform. Via such exchange platform the volume of transactions will increase which in turn should result in the increased transaction revenue.

2nd: the potential increase of value of BNK tokens from a ICO structure perspective. Though mathematical analysis, we have seen several scenarios: the potential increase of token values when it reaches to SCO and the profit BNK holders will receive if tokens are unsold (as it will be redistributed among the token holders).

3rd article

In my 3rd article I have reviewed the overall process of registering with Spectrocoin, depositing funds, purchasing of BNK tokens and withdrawing ETH received as part of 20% of net transaction revenue distributed among the BNK holders.

By going through the whole process we have concluded that Spectrocoin provides a fair and functional e-wallet and exchange services with the benefit of p2p free cost transfer among Spectrocoin users.

4th article

In my 4th current article we have seen individuals involved in the Bankera project. As we have reviewed the team and advisors profiles, we can presume that the accusations against Bankera and some members of their team are likely to be untrue. Bankra often conducts marketing activity to the public, and including they have been featured on Bloomberg.

Bankera has recently purchased a bank which was openly announced to the public via subscription Email.

At the Interview hosted in “analysisinchainspodcast (#57)” it was discussed in depth their reasons of purchasing a bank, functionality and risk management of SCO.

Conclusion

As it is the case for many nowadays ICOs, it is hard to predict how it will perform in the future, partially because the success of an ICO does not necessary lie only in the hard work of the team behind it, but it also largely depends on the support that the project (in this case – Bankera) receives from the cryptocommunity.

Just because an ICO doesn’t perform well in terms of ROI, it doesn't mean it is fake and fraudulent. The key point to ask yourself is: "Are they delivering on their promises?”. And as of today we can see that Bankera has indeed been accomplishing the goals that they set up before themselves and delivering the promised benefits to the investors. And in return has been growing and supported by many members of the crypto-community.

In essence, we can review Bankera as an opportunity to manage cryptoportfolio and it certainly has the potential of becoming world’s 1st bank for the blockchain era.

Again, I am not a professional financial adviser, however if you find this ICO interesting enough to participate, please participate on your own risk and decision. I am not responsible for any damages or loss incurred by your participation. Make sure to participate in ICO in moderation and never invest in more than you can afford.

Hope you enjoyed this post and please feel free to comment openly.

Below you can find more information.

Bankera Site: https://bankera.com/

Bankera White Paper: https://bankera.com/Bankera_whitepaper.pdf

Bankera Blog: https://blog.bankera.com

Spectrocoin: https://spectrocoin.com